Page 278 - Profile's Unit Trusts & Collective Investments - September 2025

P. 278

Camissa Equity Alpha Fund Domestic funds

Camissa Equity Alpha Fund

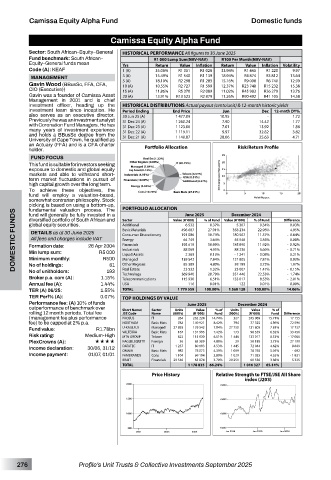

Sector: South African–Equity–General HISTORICAL PERFORMANCE All figures to 30 June 2025

Fund benchmark: South African– R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Equity–General funds mean Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): KEAF 1 (A) 35.06% R1 351 R1 028 33.94% R1 445 R1 220 9.97

3 (A) 15.49% R1 540 R1 139 18.94% R4 874 R3 812 13.64

MANAGEMENT

R9 008

R6 740

Gavin Wood (BBusSc, FFA, CFA, 5 (A) 18.10% R2 298 R1 283 15.16% R23 748 R15 232 12.99

10.55%

R1 599

10 (A)

R2 727

15.38

12.37%

CIO (Executive)) 15 (A) 11.86% R5 370 R2 089 11.02% R45 983 R26 279 13.76

Gavin was a founder of Camissa Asset 20 (A) 13.91% R13 523 R2 879 11.26% R90 492 R41 105 14.58

Management in 2001 and is chief

investment officer, heading up the HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

investment team since inception. He Period Ending End Price Jun Dec 12-mnth DY%

also serves as an executive director. 30 Jun 25 (A) 1 477.09 10.95 - 1.72

Previously he was an investment analyst 31 Dec 24 (A) 1 260.24 7.90 14.42 1.77

with Coronation Fund Managers. He has 31 Dec 23 (A) 1 123.06 7.01 13.92 1.86

many years of investment experience 31 Dec 22 (A) 1 119.11 9.97 32.82 3.82

and holds a BBusSc degree from the 31 Dec 21 (A) 1 140.87 28.06 25.63 4.71

University of Cape Town, he qualified as

an Actuary (FFA) and is a CFA charter

holder. Portfolio Allocation Risk/Return Profile

FUND FOCUS

This fund is suitable for investors seeking

exposure to domestic and global equity

markets and able to withstand short-

term market fluctuations in pursuit of

high capital growth over the long term.

To achieve these objectives, the

fund will employ a valuation-based,

somewhat contrarian philosophy. Stock

picking is based on using a bottom-up, PORTFOLIO ALLOCATION June 2025 % of Fund Value (R ‘000) % of Fund Difference

fundamental valuation process. The

DOMESTIC FUNDS global equity securities. 26 Apr 2004 Additional 496 687 27.91% 358 234 - 0.08% - 0.84%

fund will generally be fully invested in a

December 2024

diversified portfolio of South African and

Value (R ‘000)

Sector

0.37%

0.34%

5 307

0.03%

6 532

22.96%

Basic Materials

4.95%

DETAILS as at 30 June 2025

10.74%

191 086

180 567

Consumer Discretionary

11.57%

All fees and charges include VAT

3.64%

64 749

3.56%

0.08%

55 548

Energy

- 0.92%

10.99%

195 619

11.92%

Formation date:

Financials

185 890

88 236

Industrials

5.66%

4.95%

- 0.71%

88 069

Min lump sum:

R5 000

- 1 241

Liquid Assets

0.13%

2 369

0.21%

R500

Minimum monthly:

7.84%

0.03%

121 805

Managed

139 542

7.81%

61

No of holdings:

1.07%

3.73%

58 189

85 389

4.80%

1.47%

1.32%

23 007

Real Estate

23 532

No of unitholders:

193

Technology

- 1.74%

Broker p.a. com (A): 1.15% Other Regions 369 940 20.79% 351 446 22.53% - 0.15%

Telecommunications

- 2.01%

115 930

6.51%

133 017

8.53%

Annual fee (A): 1.44% USA 116 0.01% 122 0.01% 0.00%

TER (A) 06/25: 1.55% TOTAL 1 779 559 100.00% 1 560 128 100.00% 14.06%

TER Perf% (A): 0.07% TOP HOLDINGS BY VALUE

Performance fee: (A) 10% of funds June 2025 December 2024

outperformance of benchmark over Short Name/ Sector Units Value % of Units Value % of

rolling 12 month periods. Total fee JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

(management fee plus performance PROSUS IT 264 262 224 14.74% 327 245 069 15.71% 17 155

fee) to be capped at 2% p.a. NORTHAM Basic Mats 782 149 921 8.42% 794 77 325 4.96% 72 596

Fund value: R1.78bn U-KAGLFLX Managed 27 893 139 542 7.84% 27 750 121 805 7.81% 17 737

98 539

173

33 456

Risk rating: Medium-High VALTERRA Basic Mats 167 131 995 7.42% 1 446 133 017 6.32% - 17 086

Telcom

6.51%

823

8.53%

MTN GROUP

115 930

PlexCrowns (A): «««« KAGLBLEQUITY Foreign 36 85 389 4.80% 29 58 189 3.73% 27 199

Income declaration: 30/06, 31/12 DATATEC IT Basic Mats 1 237 80 693 4.53% 1 445 72 044 4.62% 8 649

5.05%

982

OMNIA

- 692

78 073

78 765

1 009

4.39%

Income payment: 01/07, 01/01 FAMBRANDS Cons 1 104 69 194 3.89% 1 029 71 025 4.55% - 1 831

BRAIT Financials 29 540 65 874 3.70% 29 251 60 550 3.88% 5 325

TOTAL 1 178 835 66.24% 1 016 327 65.14%

Price History Relative Strength to FTSE/JSE All Share

index (J203)

276 Profile’s Unit Trusts & Collective Investments September 2025