Page 283 - Profile's Unit Trusts & Collective Investments - September 2025

P. 283

Domestic funds Camissa Islamic High Yield Fund

Camissa Islamic High Yield Fund

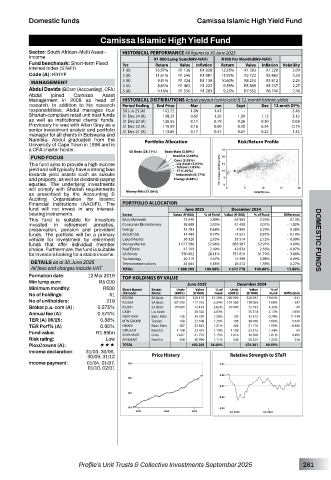

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Income R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: Short-term Fixed Yrs Return Value Inflation Return Value Inflation Volatility

Interest Index (STeFI) 1 (A) 13.57% R1 136 R1 028 12.25% R1 283 R1 220 2.09

Code (A): KIHYF 2 (A) 11.61% R1 246 R1 081 11.93% R2 722 R2 483 2.33

3 (A) 9.81% R1 324 R1 139 10.60% R4 254 R3 812 2.25

MANAGEMENT 4 (A) 8.83% R1 403 R1 223 9.59% R5 869 R5 237 2.27

Abdul Davids (BCom (Accounting), CFA) 5 (A) 9.16% R1 550 R1 283 9.25% R7 652 R6 740 2.46

Abdul joined Camissa Asset

Management in 2008 as head of HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

research. In addition to his research Period Ending End Price Mar Jun Sept Dec 12-mnth DY%

responsibilities, Abdul manages four 30 Jun 25 (A) 143.72 1.08 1.41 - - 3.48

Shariah-compliant retail unit trust funds 31 Dec 24 (A) 138.23 0.60 1.20 1.39 1.12 3.12

as well as institutional clients’ funds. 31 Dec 23 (A) 126.55 0.11 0.19 0.26 0.30 0.69

Previously he was with Allan Gray as a 31 Dec 22 (A) 119.59 0.16 0.09 0.35 0.34 0.79

senior investment analyst and portfolio 31 Dec 21 (A) 113.86 0.17 0.47 0.67 0.22 1.35

manager for all clients in Botswana and

Namibia. Abdul graduated from the Portfolio Allocation Risk/Return Profile

University of Cape Town in 1996 and is

a CFA charter holder.

FUND FOCUS

This fund aims to provide a high income

yield and will typically have a strong bias

towards yield assets such as sukuks

and property, as well as dividend-paying

equities. The underlying investments

will comply with Shariah requirements

as prescribed by the Accounting &

Auditing Organisation for Islamic

Financial Institutions (AAOIFI). The PORTFOLIO ALLOCATION

fund will not invest in any interest- June 2025 December 2024

bearing instruments. Sector Value (R ‘000) % of Fund Value (R ‘000) % of Fund Difference

This fund is suitable for investors Basic Materials 73 540 3.89% 62 963 3.76% 0.13%

invested in retirement annuities, Consumer Discretionary 38 688 2.05% 51 408 3.07% - 1.02%

preservation, pension and provident Energy 12 783 0.68% 4 896 0.29% 0.38%

funds. The portfolio will be a primary Industrials 14 489 0.77% 14 557 0.87% - 0.10%

vehicle for investment by retirement Liquid Assets 38 320 2.03% 35 514 2.12% - 0.09% DOMESTIC FUNDS

funds that offer individual member Money Market 1 077 586 57.06% 885 987 52.97% 4.09%

choice. Furthermore, the fund is suitable Real Estate 47 109 2.49% 42 834 2.56% - 0.07%

for investors looking for a stable income. SA Bonds 530 802 28.11% 531 810 31.79% - 3.68%

DETAILS as at 30 June 2025 Technology 20 219 1.07% 16 398 0.98% 0.09%

0.27%

34 864

1.85%

26 412

1.58%

Telecommunications

All fees and charges include VAT TOTAL 1 888 399 100.00% 1 672 778 100.00% 12.89%

Formation date: 12 Mar 2019 TOP HOLDINGS BY VALUE

Min lump sum: R5 000 June 2025 December 2024

Minimum monthly: R500 Short Name/ Sector Units Value % of Units Value % of

No of holdings: 61 JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

No of unitholders: 219 RS2036 SA Bnds 300 000 328 170 17.38% 300 000 328 782 19.65% - 611

RS2034

7.06%

SA Bnds

107 500

117 763

6.24%

118 059

- 297

107 500

Broker p.a. com (A): 0.575% RS2031 SA Bnds 70 000 72 144 3.82% 70 000 72 193 4.32% - 49

2 806

Annual fee (A): 0.575% CASH Liq Asset 126 - 38 320 2.03% 126 - 35 514 2.12% 11 919

12 312

24 230

1.28%

NORTHAM

Basic Mats

0.74%

TER (A) 06/25: 0.58% MTN GROUP Telcom 168 23 598 1.25% 196 18 058 1.08% 5 540

TER Perf% (A) 0.00% OMNIA Basic Mats 287 22 853 1.21% 406 31 718 1.90% - 8 866

84

Fund value: R1.89bn DIPULA B Real Est 4 198 22 459 1.19% 4 198 22 375 1.34% 4 906

1.15%

Cons

1.01%

16 830

SEAHARVST

21 735

2 016

2 667

Risk rating: Low RESILIENT Real Est 348 20 996 1.11% 348 20 459 1.22% 536

PlexCrowns (A): ««« TOTAL 692 269 36.66% 676 301 40.43%

Income declaration: 31/03, 30/06,

30/09, 31/12 Price History Relative Strength to STeFI

Income payment: 01/04, 01/07,

01/10, 02/01

Profile’s Unit Trusts & Collective Investments September 2025 281