Page 282 - Profile's Unit Trusts & Collective Investments - September 2025

P. 282

Camissa Islamic Global Equity Feeder Fund Domestic funds

Camissa Islamic Global Equity Feeder Fund

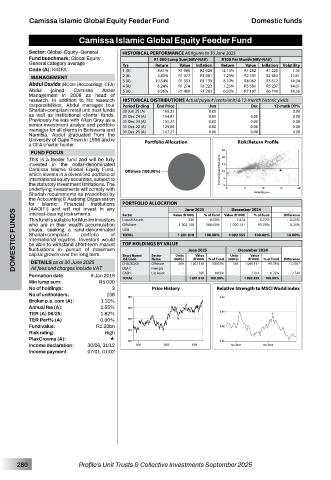

Sector: Global–Equity–General HISTORICAL PERFORMANCE All figures to 30 June 2025

Fund benchmark: Global Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

General category average Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): KIGFA 1 (A) 8.61% R1 086 R1 028 12.13% R1 282 R1 220 7.35

2 (A) 3.80% R1 077 R1 081 7.29% R2 591 R2 483 12.61

MANAGEMENT

Abdul Davids (BCom (Accounting), CFA) 3 (A) 10.54% R1 351 R1 139 8.10% R4 087 R3 812 14.94

R1 274

6.24%

7.23%

R5 581

R1 223

4 (A)

R5 237

14.61

Abdul joined Camissa Asset 5 (A) 6.96% R1 400 R1 283 6.93% R7 187 R6 740 14.36

Management in 2008 as head of

research. In addition to his research HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

responsibilities, Abdul manages four Period Ending End Price Jun Dec 12-mnth DY%

Shariah-compliant retail unit trust funds 30 Jun 25 (A) 169.22 0.00 - 0.00

as well as institutional clients’ funds. 31 Dec 24 (A) 154.81 0.00 0.00 0.00

Previously he was with Allan Gray as a 31 Dec 23 (A) 155.27 0.00 0.00 0.00

senior investment analyst and portfolio 31 Dec 22 (A) 129.86 0.00 0.00 0.00

manager for all clients in Botswana and 31 Dec 21 (A) 147.27 0.00 0.00 0.00

Namibia. Abdul graduated from the

University of Cape Town in 1996 and is Portfolio Allocation Risk/Return Profile

a CFA charter holder.

FUND FOCUS

This is a feeder fund and will be fully

invested in the dollar-denominated

Camissa Islamic Global Equity Fund,

which invests in a diversified portfolio of

international equity securities, subject to

the statutory investment limitations. The

underlying investments will comply with

Shariah requirements as prescribed by

the Accounting & Auditing Organisation

for Islamic Financial Institutions PORTFOLIO ALLOCATION June 2025 % of Fund Value (R ‘000) % of Fund Difference

(AAOIFI) and will not invest in any

December 2024

DOMESTIC FUNDS who are in their wealth accumulation Offshore Sector Units June 2025 100.00% - 1 092 555 - Value 99.78% - 10.00% -

interest-bearing instruments.

Value (R ‘000)

Sector

This fund is suitable for Muslim investors

Liquid Assets

0.22%

- 0.25%

2 414

- 330

- 0.03%

100.03%

1 090 141

1 202 148

0.25%

phase, seeking a rand-denominated

USA

-

Shariah-compliant

portfolio

of

100.00%

1 201 818

TOTAL

international equities. Investors would

be able to withstand short-term market

TOP HOLDINGS BY VALUE

fluctuations in pursuit of maximum

December 2024

capital growth over the long term.

Short Name/

Units

Value

(R ‘000)

(R ‘000)

Name

DETAILS as at 30 June 2025

1 090 141

99.78%

585

100.03%

112 007

1 202 148

590

O-ISGEQKA

All fees and charges include VAT

Foreign

USA C

2 414

CASH

- 330

Liq Asset

- 0.03%

- 2 744

0.22%

Formation date: 9 Jan 2019 JSE Code Offshore (000’s) - - 1 201 818 - % of Fund - (000’s) - - 1 092 555 - % of Fund - Difference -

100.00%

100.00%

TOTAL

Min lump sum: R5 000

No of holdings: 3 Price History Relative Strength to MSCI World index

No of unitholders: 138

Broker p.a. com (A): 1.15%

Annual fee (A): 1.55%

TER (A) 06/25: 1.82%

TER Perf% (A) 0.00%

Fund value: R1.20bn

Risk rating: High

PlexCrowns (A): «

Income declaration: 30/06, 31/12

Income payment: 07/01, 01/02

280 Profile’s Unit Trusts & Collective Investments September 2025