Page 285 - Profile's Unit Trusts & Collective Investments - September 2025

P. 285

Domestic funds Camissa SA Balanced Fund

Camissa SA Balanced Fund

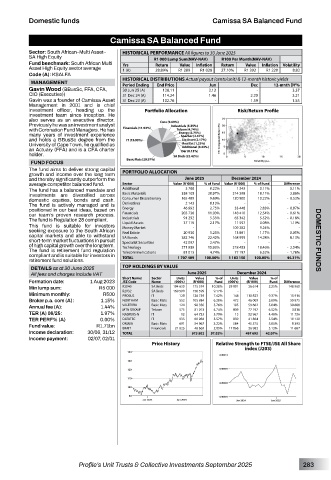

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

SA High Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: South African Multi Yrs Return Value Inflation Return Value Inflation Volatility

Asset High Equity sector average 1 (A) 28.89% R1 289 R1 028 27.10% R1 392 R1 220 8.82

Code (A): KSALFA

HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

MANAGEMENT Period Ending End Price Jun Dec 12-mnth DY%

Gavin Wood (BBusSc, FFA, CFA, 30 Jun 25 (A) 128.11 2.12 - 3.37

CIO (Executive)) 31 Dec 24 (A) 114.24 1.46 2.20 3.21

Gavin was a founder of Camissa Asset 31 Dec 23 (A) 102.76 - 1.59 1.55

Management in 2001 and is chief

investment officer, heading up the Portfolio Allocation Risk/Return Profile

investment team since inception. He

also serves as an executive director.

Previously he was an investment analyst

with Coronation Fund Managers. He has

many years of investment experience

and holds a BBusSc degree from the

University of Cape Town, he qualified as

an Actuary (FFA) and is a CFA charter

holder.

FUND FOCUS

The fund aims to deliver strong capital

growth and income over the long term PORTFOLIO ALLOCATION

and thereby significantly outperform the June 2025 December 2024

average competitor balanced fund. Sector Value (R ‘000) % of Fund Value (R ‘000) % of Fund Difference

The fund has a balanced mandate and Additional 3 788 0.22% 1 343 0.11% 0.11%

investments are diversified across Basic Materials 358 105 20.97% 214 298 18.11% 2.86%

domestic equities, bonds and cash. Consumer Discretionary 165 489 9.69% 120 900 10.22% - 0.53%

The fund is actively managed and is Derivatives 2 143 0.13% - - -

positioned in our best ideas, based on Energy 46 992 2.75% 33 448 2.83% - 0.07%

our team’s proven research process. Financials 203 736 11.93% 148 410 12.54% - 0.61%

The fund is Regulation 28 compliant. Industrials 91 292 5.35% 65 342 5.52% - 0.18%

11 597

This fund is suitable for investors Liquid Assets 37 119 - 2.17% - 109 282 0.98% 1.19% -

Money Market

9.24%

seeking exposure to the South African Real Estate 20 930 1.23% 13 881 1.17% 0.05%

capital markets and able to withstand SA Bonds 382 746 22.42% 168 999 14.28% 8.13%

short-term market fluctuations in pursuit Specialist Securities 42 097 2.47% - - - DOMESTIC FUNDS

of high capital growth over the long term. Technology 271 959 15.93% 218 453 18.46% - 2.54%

The fund is retirement fund regulation Telecommunications 81 013 4.74% 77 197 6.52% - 1.78%

compliant and is suitable for investors in TOTAL 1 707 409 100.00% 1 183 150 100.00% 44.31%

retirement fund solutions.

DETAILS as at 30 June 2025 TOP HOLDINGS BY VALUE

All fees and charges include VAT June 2025 December 2024

% of

Units

Value

Units

Value

% of

Formation date: 1 Aug 2023 Short Name/ Sector (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Name

JSE Code

Min lump sum: R5 000 R2040 SA Bnds 194 630 175 574 10.28% 29 901 - 26 614 - 2.25% - 148 960 -

160 500

9.17%

SA Bnds

156 599

R2032

Minimum monthly: R500 PROSUS IT 128 126 739 7.42% 148 110 823 9.37% 15 916

Broker p.a. com (A): 1.15% NORTHAM Basic Mats 552 105 884 6.20% 472 46 009 3.89% 59 875

Annual fee (A): 1.44% VALTERRA Basic Mats 124 98 350 5.76% 105 59 662 5.04% 38 688

575

77 197

3 816

4.74%

81 013

6.52%

839

Telcom

MTN GROUP

TER (A) 06/25: 1.97% NASPERS-N IT 12 64 723 3.79% 13 52 967 4.48% 11 756

TER PERF% (A) 0.00% DATATEC IT 935 60 984 3.57% 839 41 864 3.54% 19 120

584

Fund value: R1.71bn OMNIA Basic Mats 21 825 54 967 3.22% 17 866 45 575 3.85% 11 687

9 393

691

36 983

3.13%

BRAIT

Financials

48 669

2.85%

Income declaration: 30/06, 31/12 TOTAL 973 502 57.02% 497 693 42.07%

Income payment: 02/07, 02/01

Price History Relative Strength to FTSE/JSE All Share

index (J203)

Profile’s Unit Trusts & Collective Investments September 2025 283