Page 287 - Profile's Unit Trusts & Collective Investments - September 2025

P. 287

Domestic funds Camissa Stable Fund

Camissa Stable Fund

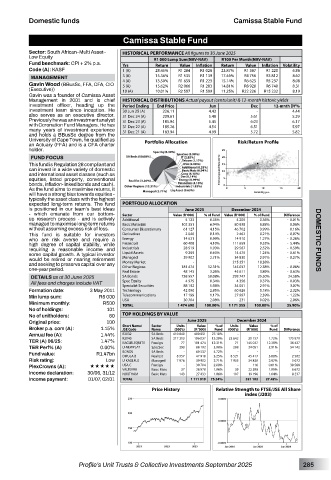

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Low Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: CPI + 2% p.a. Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): KASF 1 (A) 28.45% R1 284 R1 028 23.87% R1 367 R1 220 6.86

3 (A) 15.36% R1 535 R1 139 17.46% R4 756 R3 812 8.62

MANAGEMENT

Gavin Wood (BBusSc, FFA, CFA, CIO 4 (A) 13.50% R1 659 R1 223 15.14% R6 625 R5 237 8.08

R6 740

14.81%

8.31

5 (A)

R1 283

15.62%

R8 920

R2 066

(Executive)) 10 (A) 10.01% R2 597 R1 599 11.25% R22 226 R15 232 8.19

Gavin was a founder of Camissa Asset

Management in 2001 and is chief HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

investment officer, heading up the Period Ending End Price Jun Dec 12-mnth DY%

investment team since inception. He 30 Jun 25 (A) 226.11 4.43 - 4.44

also serves as an executive director. 31 Dec 24 (A) 209.61 5.48 5.61 5.29

Previously he was an investment analyst 31 Dec 23 (A) 185.94 5.45 6.03 6.17

with Coronation Fund Managers. He has 31 Dec 22 (A) 185.26 4.54 6.51 5.97

many years of investment experience 31 Dec 21 (A) 183.94 4.99 5.72 5.82

and holds a BBusSc degree from the

University of Cape Town, he qualified as Portfolio Allocation Risk/Return Profile

an Actuary (FFA) and is a CFA charter

holder.

FUND FOCUS

This fund is Regulation 28 compliant and

can invest in a wide variety of domestic

and international asset classes (such as

equities, listed property, conventional

bonds, inflation-linked bonds and cash).

As the fund aims to maximise returns, it

will have a strong bias towards equities -

typically the asset class with the highest

expected long-term returns. The fund PORTFOLIO ALLOCATION

is positioned in our team’s best ideas June 2025 December 2024

- which emanate from our bottom- Sector Value (R ‘000) % of Fund Value (R ‘000) % of Fund Difference

up research process - and is actively Additional 5 123 0.35% 4 205 0.36% - 0.01%

managed to maximise long-term returns Basic Materials 102 351 6.94% 80 638 6.88% 0.06%

without assuming excess risk of loss. Consumer Discretionary 61 127 4.15% 46 702 3.99% 0.16%

This fund is suitable for investors Derivatives 2 046 0.14% 2 462 0.21% - 0.07%

who are risk averse and require a Energy 14 621 0.99% 14 910 1.27% - 0.28% DOMESTIC FUNDS

high degree of capital stability, while Financials 60 408 4.10% 111 659 9.53% - 5.44%

requiring a reasonable income and Industrials 28 519 1.93% 29 567 2.52% - 0.59%

some capital growth. A typical investor Liquid Assets 9 259 0.63% 14 475 1.24% - 0.61%

would be retired or nearing retirement Managed 39 902 2.71% 34 830 2.97% - 0.27%

and seeking to preserve capital over any Money Market - - 215 251 18.38% -

one-year period. Other Regions 181 474 12.31% 145 037 12.38% - 0.08%

48 143

Real Estate

45 611

- 0.63%

3.89%

3.26%

DETAILS as at 30 June 2025 SA Bonds 738 557 50.08% 298 747 25.50% 24.58%

4 356

4 975

All fees and charges include VAT Spec Equity 88 192 0.34% 34 051 0.37% - 0.03%

2.91%

5.98%

3.07%

Specialist Securities

Formation date: 3 May 2011 Technology 42 090 2.85% 60 626 5.18% - 2.32%

Min lump sum: R5 000 Telecommunications 17 199 1.17% 27 997 2.39% - 1.22%

30 704

2.06%

231

2.08%

0.02%

Minimum monthly: R500 USA 1 474 690 100.00% 1 171 355 100.00% 25.90%

TOTAL

No of holdings: 101

No of unitholders: 60 TOP HOLDINGS BY VALUE

Original price: 100 June 2025 December 2024

Value

% of

Value

% of

Units

Units

Broker p.a. com (A): 1.15% Short Name/ Sector (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Name

JSE Code

Annual fee (A): 1.44% R2032 SA Bnds 410 840 400 851 27.18% - - - -

1.72%

20 157

TER (A) 06/25: 1.47% R2040 SA Bnds 217 313 196 037 13.29% 22 642 145 037 12.38% 175 879

181 474

12.31%

36 437

Foreign

77

71

KAGLBLEQUITY

TER Perf% (A) 0.00% U-NEWPLAT SpecSec 390 88 192 5.98% 208 34 051 2.91% 54 142

Fund value: R1.47bn BONDS SA Bnds 8 957 - 69 537 4.72% 8 521 - 45 417 - 3.88% - 2 502 -

47 918

Real Est

DIPULA B

3.25%

Risk rating: Low U-KAGLFLX Managed 7 976 39 902 2.71% 7 935 34 830 2.97% 5 072

PlexCrowns (A): ««««« USA C Foreign - 30 704 2.08% - 116 0.01% 30 588

39

37

Income declaration: 30/06, 31/12 VALTERRA Basic Mats 143 28 970 1.96% 197 22 299 1.90% 6 672

1.86%

8 237

1.64%

NORTHAM

27 433

19 196

Basic Mats

Income payment: 01/07, 02/01 TOTAL 1 111 019 75.34% 321 102 27.42%

Price History Relative Strength to FTSE/JSE All Share

index (J203)

Profile’s Unit Trusts & Collective Investments September 2025 285