Page 291 - Profile's Unit Trusts & Collective Investments - September 2025

P. 291

Domestic funds Marriott Balanced Fund of Funds

Marriott Balanced Fund of Funds

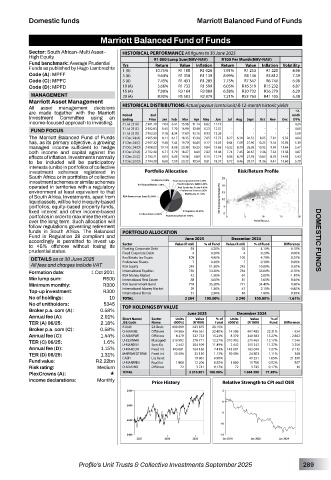

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

High Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: Average Prudential

Value

Value

Funds as published by Hugo Lambrechts Yrs Return R1 108 Inflation Return R1 253 Inflation Volatility

10.75%

1 (A)

R1 220

4.96

R1 028

7.91%

Code (A): MPFF 3 (A) 9.64% R1 318 R1 139 8.99% R4 146 R3 812 7.39

Code (C): MPFC 5 (A) 7.43% R1 431 R1 283 7.75% R7 347 R6 740 6.98

Code (D): MPFD 10 (A) 5.66% R1 733 R1 599 6.05% R16 519 R15 232 6.87

15 (A) 7.98% R3 164 R2 089 6.58% R30 732 R26 279 6.20

MANAGEMENT 20 (A) 8.90% R5 503 R2 879 7.21% R53 763 R41 105 6.38

Marriott Asset Management

All asset management decisions HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

12-

are made together with the Marriott Period End mnth

Investment Committee using an Ending Price Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec DY%

income-focused approach to investing. 31 Jul 25 (A) 2 981.39 7.04 6.41 15.58 11.14 6.82 11.19 - - - - - - 4.24

31 Jul 25 (C) 2 982.83 8.45 7.70 16.99 12.48 8.23 12.57 - - - - - - 4.80

FUND FOCUS 31 Jul 25 (D) 2 983.55 9.16 8.34 17.69 13.16 8.93 13.26 - - - - - - 5.08

The Marriott Balanced Fund of Funds 31 Dec 24 (A) 2 905.90 8.11 6.17 18.35 13.34 7.85 13.72 8.27 6.30 26.53 8.85 7.81 9.52 4.64

has, as its primary objective, a growing 31 Dec 24 (C) 2 907.32 9.46 7.44 19.70 14.61 9.17 15.03 9.64 7.69 27.90 10.25 9.16 10.94 5.19

managed income sufficient to hedge 31 Dec 24 (D) 2 908.02 10.14 8.08 20.38 15.25 9.84 15.68 10.32 8.39 28.58 10.95 9.84 11.64 5.47

both income and capital against the 31 Dec 23 (A) 2 792.36 6.71 5.79 18.27 8.60 7.82 16.46 7.74 7.45 26.67 9.36 7.54 13.58 4.87

effects of inflation. Investments normally 31 Dec 23 (C) 2 793.71 8.03 6.99 19.58 9.89 9.15 17.74 9.06 8.79 27.93 10.63 8.79 14.93 5.42

to be included will be participatory 31 Dec 23 (D) 2 794.38 8.68 7.59 20.23 10.54 9.81 18.37 9.72 9.46 28.57 11.26 9.41 15.60 5.70

interests (units) in portfolios of collective

investment schemes registered in Portfolio Allocation Risk/Return Profile

South Africa or in portfolios of collective

investment schemes or similar schemes

operated in territories with a regulatory

environment at least equivalent to that

of South Africa. Investments, apart from

liquid assets, will be held in equity-based

portfolios, equity-based property funds,

fixed interest and other income-based

portfolios in order to maximise the return

over the long term. Such allocation will

follow regulations governing retirement

funds in South Africa. The Balanced PORTFOLIO ALLOCATION

Fund is Regulation 28 compliant and June 2025 December 2024

accordingly is permitted to invest up DOMESTIC FUNDS

to 45% offshore without losing its Sector Value (R mil) % of Fund Value (R mil) % of Fund Difference

Floating Corporate Debt

92

4.20%

93

4.10%

0.10%

prudential status. Fixed Corporate Debt 4 0.20% 4 0.20% 0.00%

DETAILS as at 30 June 2025 Real Estate Inv Trusts 108 7 4.90% 105 7 4.70% 0.20%

Preference Shares

0.30%

0.30%

0.00%

All fees and charges include VAT RSA Equity 249 11.30% 242 10.80% 0.50%

Formation date: 1 Oct 2001 International Equities 756 34.30% 784 35.00% -0.70%

1.90%

67

42

-1.10%

RSA Money Market

3.00%

Min lump sum: R500 International Real Estate 88 4.00% 81 3.60% 0.40%

Minimum monthly: R300 RSA Government Bond 778 35.30% 771 34.40% 0.90%

Top-up investment: R300 International Money Market 29 1.30% 47 2.10% -0.80%

2.30%

International Bonds

40

51

0.50%

1.80%

No of holdings: 10 TOTAL 2 204 100.00% 2 240 100.00% -1.61%

No of unitholders: 5345 TOP HOLDINGS BY VALUE

Broker p.a. com (A): 0.58% June 2025 December 2024

Annual fee (A): 2.01% Short Name/ Sector Units Value % of Units Value % of

TER (A) 06/25: 2.18% JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Broker p.a. com (C): 0.58% R2040 SA Bnds 690 890 623 875 28.15% 14 586 - 497 485 - 22.31% - - 924 -

22.40%

496 561

14 586

Offshore

O-MARINC

Annual fee (C): 1.44% O-MARFWE Offshore 8 379 337 722 15.24% 8 379 340 583 15.27% - 2 862

TER (C) 06/25: 1.6% U-ESSINMA Managed 310 992 278 711 12.57% 310 992 271 465 12.17% 7 246

2 442

2 442

Annual fee (D): 1.15% U-MARDIVI Spec Eq 143 681 254 599 11.49% 143 681 251 342 11.27% 3 256

Fixed Int

162 044

7.27%

2 112

7.41%

164 156

U-MARCOR

TER (D) 06/25: 1.31% MARRMEDTERMI Fixed Int 30 496 25 150 1.13% 30 496 24 803 1.11% 348

Fund value: R2.22bn CASH Liq Asset 1 800 - 19 861 0.90% 1 800 - 41 251 1.85% - 21 390

507

0.55%

0.52%

11 700

12 206

U-MARPRIN

Real Est

Risk rating: Medium O-MARIND Offshore 72 3 741 0.17% 72 3 725 0.17% 16

PlexCrowns (A): « TOTAL 2 216 581 100.00% 1 604 398 71.95%

Income declarations: Monthly Price History Relative Strength to CPI excl OER

Profile’s Unit Trusts & Collective Investments September 2025 289