Page 295 - Profile's Unit Trusts & Collective Investments - September 2025

P. 295

Domestic funds Marriott First World Equity Feeder Fund

Marriott First World Equity Feeder Fund

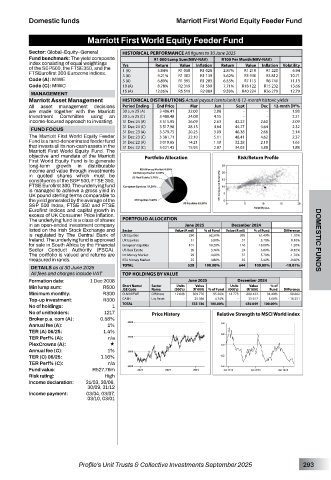

Sector: Global–Equity–General HISTORICAL PERFORMANCE All figures to 30 June 2025

Fund benchmark: The yield composite R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

index consisting of equal weightings

of the S&P500, the FTSE350, and the Yrs Return Value Inflation Return Value Inflation Volatility

6.94

FTSEurofirst 300 Eurozone indices. 1 (A) 5.84% R1 058 R1 028 2.87% R1 219 R1 220 10.71

5.62%

R1 139

R3 812

R1 302

9.21%

3 (A)

R3 930

Code (A): MIWE 5 (A) 6.89% R1 395 R1 283 6.55% R7 115 R6 740 11.13

Code (C): MIWC 10 (A) 8.78% R2 319 R1 599 7.71% R18 122 R15 232 13.66

15 (A) 12.06% R5 519 R2 089 9.59% R40 224 R26 279 12.79

MANAGEMENT

Marriott Asset Management HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

All asset management decisions Period Ending End Price Mar Jun Sept Dec 12-mnth DY%

are made together with the Marriott 30 Jun 25 (A) 3 486.41 22.00 2.08 - - 1.98

Investment Committee using an 30 Jun 25 (C) 3 488.48 24.08 4.15 - - 2.21

income-focused approach to investing. 31 Dec 24 (A) 3 515.95 26.09 2.63 42.22 2.60 2.09

31 Dec 24 (C) 3 517.98 28.15 4.64 44.27 4.64 2.32

FUND FOCUS 31 Dec 23 (A) 3 379.75 20.25 3.09 46.38 2.66 2.14

The Marriott First World Equity Feeder 31 Dec 23 (C) 3 381.71 22.10 5.11 48.41 4.62 2.37

Fund is a rand-denominated feeder fund 31 Dec 22 (A) 3 019.65 14.21 1.19 32.28 2.10 1.65

that invests all its non-cash assets in the 31 Dec 22 (C) 3 021.43 15.93 2.87 34.03 3.88 1.88

Marriott First World Equity Fund. The

objective and mandate of the Marriott Portfolio Allocation Risk/Return Profile

First World Equity Fund is to generate

long-term growth in distributable

income and value through investments

in quoted shares which must be

constituents of the S&P 500, FTSE 350,

FTSE Eurofirst 300. The underlying fund

is managed to achieve a gross yield in

UK pound sterling terms comparable to

the yield generated by the average of the

S&P 500 Index, FTSE 350 and FTSE

Eurofirst indices and capital growth in

excess of UK Consumer Price Inflation.

The underlying fund is a class of shares PORTFOLIO ALLOCATION

in an open-ended investment company June 2025 December 2024

listed on the Irish Stock Exchange and Sector Value (R mil) % of Fund Value (R mil) % of Fund Difference

is regulated by The Central Bank of US Equities 330 62.50% 395 61.40% 1.10%

Ireland. The underlying fund is approved UK Equities 31 5.80% 37 5.70% 0.10% DOMESTIC FUNDS

for sale in South Africa by the Financial European Equities 101 19.20% 116 18.00% 1.20%

Sector Conduct Authority (FSCA). US Real Estate 20 3.70% 24 3.80% -0.10%

The portfolio is valued and returns are Int Money Market 29 4.00% 37 5.70% -1.70%

measured in rands. RSA Money Market 25 4.80% 35 5.40% -0.60%

DETAILS as at 30 June 2025 TOTAL 528 100.00% 644 100.00% -18.01%

All fees and charges include VAT TOP HOLDINGS BY VALUE

Formation date: 1 Dec 2008 June 2025 December 2024

Value

Units

% of

Units

Value

Min lump sum: R500 Short Name/ Sector (000’s) (R ‘000) % of Fund (000’s) (R ‘000) Fund Difference

Name

JSE Code

Minimum monthly: R300 O-MARFWE Offshore 12 648 509 770 95.26% 14 773 600 432 94.40% - 90 662

Top-up investment: R300 CASH Liq Asset - 25 366 4.74% - 35 617 5.60% - 10 251

No of holdings: 1 TOTAL 535 136 100.00% 636 049 100.00%

No of unitholders: 1217 Price History Relative Strength to MSCI World index

Broker p.a. com (A): 0.58%

Annual fee (A): 1%

TER (A) 06/25: 1.4%

TER Perf% (A): n/a

PlexCrowns (A): «

Annual fee (C): 1%

TER (C) 06/25: 1.16%

TER Perf% (C): n/a

Fund value: R527.76m

Risk rating: High

Income declaration: 31/03, 30/06,

30/09, 31/12

Income payment: 03/04, 03/07,

03/10, 03/01

Profile’s Unit Trusts & Collective Investments September 2025 293