Page 294 - Profile's Unit Trusts & Collective Investments - September 2025

P. 294

Marriott Essential Income Fund Domestic funds

Marriott Essential Income Fund

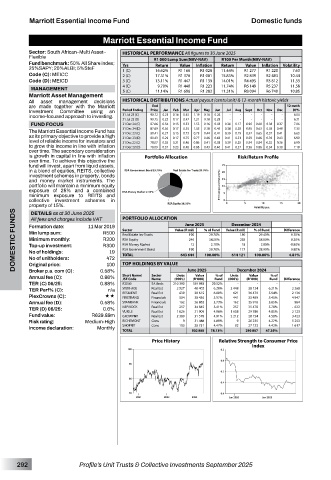

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Flexible R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: 50% All Share index;

Value

Value

25%SAPY; 20%ALBI; 5%SteF Yrs Return R1 166 Inflation Return R1 277 Inflation Volatility

11.44%

R1 028

R1 220

16.62%

1 (C)

7.63

Code (C): MEICC 2 (C) 17.31% R1 376 R1 081 15.83% R2 839 R2 483 10.44

Code (D): MEICD 3 (C) 13.11% R1 447 R1 139 14.01% R4 495 R3 812 11.33

4 (C) 9.70% R1 448 R1 223 11.74% R6 149 R5 237 11.58

MANAGEMENT

5 (C) 11.14% R1 696 R1 283 11.31% R8 094 R6 740 10.85

Marriott Asset Management

All asset management decisions HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

are made together with the Marriott End 12-mnth

Investment Committee using an Period Ending Price Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec DY%

income-focused approach to investing. 31 Jul 25 (C) 90.72 0.21 0.16 0.45 1.19 0.16 0.26 - - - - - - 6.04

31 Jul 25 (D) 90.75 0.23 0.17 0.47 1.21 0.18 0.28 - - - - - - 6.31

FUND FOCUS 31 Dec 24 (C) 87.66 0.54 0.15 0.53 1.53 0.16 0.43 0.36 0.17 0.96 0.60 0.36 0.37 7.06

The Marriott Essential Income Fund has 31 Dec 24 (D) 87.69 0.56 0.17 0.55 1.55 0.18 0.45 0.38 0.20 0.98 0.63 0.38 0.40 7.33

0.41

31 Dec 23 (C)

0.37

0.57

0.44

0.41

0.19

0.39

0.75

0.27

80.41

0.15

0.73

0.65

6.63

as its primary objective to provide a high 31 Dec 23 (D) 80.43 0.29 0.17 0.75 0.77 0.46 0.43 0.41 0.21 0.59 0.66 0.39 0.43 6.90

level of reliable income for investors and 31 Dec 22 (C) 78.07 0.35 0.21 0.46 0.86 0.41 0.38 0.39 0.25 0.54 0.84 0.32 0.36 6.90

to grow this income in line with inflation 31 Dec 22 (D) 78.09 0.37 0.23 0.48 0.88 0.43 0.40 0.41 0.27 0.56 0.86 0.34 0.38 7.19

over time. The secondary consideration

is growth in capital in line with inflation Portfolio Allocation Risk/Return Profile

over time. To achieve this objective the

fund will invest, apart from liquid assets,

in a blend of equities, REITS, collective

investment schemes in property, bonds

and money market instruments. The

portfolio will maintain a minimum equity

exposure of 25% and a combined

minimum exposure to REITS and

collective investment schemes in

property of 15%. PORTFOLIO ALLOCATION

DOMESTIC FUNDS Formation date: 11 Mar 2019 Sector Value (R mil) % of Fund Value (R mil) % of Fund Difference

DETAILS as at 30 June 2025

All fees and charges include VAT

December 2024

June 2025

R500

Min lump sum:

190

180

29.40%

29.70%

0.30%

Real Estate Inv Trusts

R300

Minimum monthly:

38.50%

38.80%

246

RSA Equity

-0.30%

238

Top-up investment:

-0.80%

18

13

R300

2.90%

RSA Money Market

2.10%

190

0.80%

29.70%

177

28.90%

RSA Govenment Bond

No of holdings:

19

614 121

TOTAL

100.00%

4.81%

100.00%

643 644

No of unitholders:

472

Original price:

100

Broker p.a. com (C):

Units

% of

Short Name/

% of

Value

Value

Sector

Annual fee (C): 0.58% TOP HOLDINGS BY VALUE Units June 2025 Fund (000’s) December 2024 Fund Difference

0.86%

JSE Code

Name

(000’s)

(R ‘000)

(R ‘000)

TER (C) 06/25: 0.88% R2040 SA Bnds 210 390 189 983 29.52% - - - -

TER Perf% (C): n/a STOR-AGE Real Est 2 527 40 402 6.28% 2 448 38 134 6.21% 2 268

36 479

2 136

5.94%

38 615

6.00%

639

RESILIENT

Real Est

621

PlexCrowns (C): «« FIRSTRAND Financials 504 38 436 5.97% 441 33 489 5.45% 4 947

Annual fee (D): 0.58% STANBANK Financials 162 36 882 5.73% 162 35 918 5.85% 964

257

257

TER (D) 06/25: 0.6% NEPIROCK Real Est 1 626 34 845 5.41% 1 658 35 478 5.78% - 632

2 123

4.96%

VUKILE

4.85%

29 786

31 909

Real Est

Fund value: R639.89m GROWPNT Real Est 2 380 31 578 4.91% 2 212 28 154 4.58% 3 423

Risk rating: Medium-High RICHEMONT Cons 9 31 488 4.89% 9 26 235 4.27% 5 253

Income declaration: Monthly SHOPRIT Cons 103 28 751 4.47% 92 27 133 4.42% 1 617

TOTAL 502 888 78.13% 290 807 47.35%

Price History Relative Strength to Consumer Price

Index

292 Profile’s Unit Trusts & Collective Investments September 2025