Page 289 - Profile's Unit Trusts & Collective Investments - September 2025

P. 289

Domestic funds Coronation Management Company (RF) (Pty) Ltd.

Coronation Management Company (RF) (Pty) Ltd.

Reg. No. 1973/009318/06

HEAD OFFICE INVESTMENT ADVISORS

Seventh Floor, MontClare Place, cnr Campground and Coronation Asset Management (Pty) Ltd.

Main Roads, Claremont, Cape Town, 7708 AUDITORS

PO Box 44684, Cape Town, 7735 KPMG

Tel: 021-680-2000

Fax: 021-680-2100 DIRECTORS

Tollfree: 0800-221-177 Anton Pillay

Email: clientservice@coronation.com Alexandra Watson (Retired from board 30 September 2024)

Website: http://www.coronation.com Lulama Boyce

Madichaba Nhlumayo

TRUSTEE Mary-Anne Musekiwa

Standard Chartered Bank Cindy Robertson (Appointed 1 October 2024)

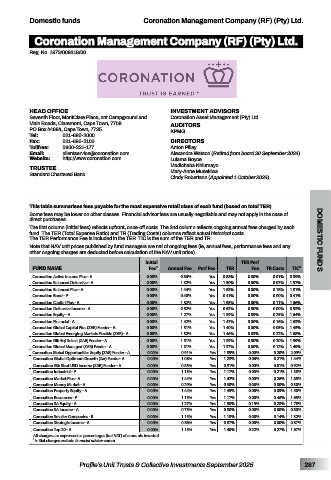

This table summarises fees payable for the most expensive retail class of each fund (based on total TER).

Some fees may be lower on other classes. Financial advisor fees are usually negotiable and may not apply in the case of

direct purchases.

The first column (initial fees) reflects upfront, once-off costs. The 2nd column reflects ongoing annual fees charged by each

fund. The TER (Total Expense Ratio) and TR (Trading Costs) columns reflect actual historical costs.

The TER Performance Fee is included in the TER. TIC is the sum of the TER and TR. DOMESTIC FUNDS

Note that NAV unit prices published by fund managers are net of ongoing fees (ie, annual fees, performance fees and any

other ongoing charges are deducted before calculation of the NAV unit price).

Initial TER Perf

FUND NAME Fee1 Annual Fee Perf Fee TER Fee TR Costs TIC3

Coronation Active Income Plus - A 0.00% 0.86% Yes 0.88% 0.00% 0.01% 0.89%

Coronation Balanced Defensive - A 0.00% 1.32% Yes 1.50% 0.00% 0.07% 1.57%

Coronation Balanced Plus - A 0.00% 1.44% Yes 1.63% 0.00% 0.18% 1.81%

Coronation Bond - P 0.00% 0.40% Yes 0.41% 0.00% 0.00% 0.41%

Coronation Capital Plus - A 0.00% 1.32% Yes 1.55% 0.00% 0.11% 1.66%

Coronation Defensive Income - A 0.00% 0.52% Yes 0.53% 0.00% 0.00% 0.53%

Coronation Equity - A 0.00% 1.27% Yes 1.39% 0.09% 0.25% 1.64%

Coronation Financial - A 0.00% 1.42% Yes 1.47% 0.00% 0.16% 1.63%

Coronation Global Capital Plus (ZAR) Feeder - A 0.00% 1.31% Yes 1.40% 0.00% 0.05% 1.45%

Coronation Global Emerging Markets Flexible (ZAR) - A 0.00% 1.32% Yes 1.46% 0.03% 0.22% 1.68%

Coronation Glb Eqt Select [ZAR] Feeder - A 0.00% 1.31% Yes 1.39% 0.00% 0.20% 1.59%

Coronation Global Managed (ZAR) Feeder - A 0.00% 1.31% Yes 1.37% 0.00% 0.12% 1.49%

Coronation Global Opportunities Equity [ZAR] Feeder - A 0.00% 0.91% Yes 1.89% 0.00% 0.20% 2.09%

Coronation Global Optimum Growth (Zar) Feeder- A 0.00% 1.08% Yes 1.23% 0.06% 0.21% 1.44%

Coronation Glb Strat USD Income [ZAR] Feeder - A 0.00% 0.85% Yes 0.91% 0.00% 0.01% 0.92%

Coronation Industrial - P 0.00% 1.15% Yes 1.17% 0.00% 0.21% 1.38%

Coronation Market Plus - A 0.00% 1.44% Yes 1.62% 0.00% 0.26% 1.88%

Coronation Money Market - A 0.00% 0.29% Yes 0.30% 0.00% 0.00% 0.30%

Coronation Property Equity - A 0.00% 1.44% Yes 1.45% 0.00% 0.05% 1.50%

Coronation Resources - P 0.00% 1.15% Yes 1.17% 0.00% 0.46% 1.63%

Coronation SA Equity - A 0.00% 1.27% Yes 1.50% 0.19% 0.28% 1.78%

Coronation SA Income - A 0.00% 0.75% Yes 0.80% 0.00% 0.00% 0.80%

Coronation Smaller Companies - R 0.00% 1.15% Yes 1.18% 0.00% 0.14% 1.32%

Coronation Strategic Income - A 0.00% 0.86% Yes 0.87% 0.00% 0.00% 0.87%

Coronation Top 20 - A 0.00% 1.15% Yes 1.40% 0.22% 0.27% 1.67%

All charges are expressed as percentages (incl VAT) of amounts invested.

1 Initial charges exclude financial adviser comm.

Profile’s Unit Trusts & Collective Investments September 2025 287