Page 286 - Profile's Unit Trusts & Collective Investments - September 2025

P. 286

Camissa SA Equity Fund Domestic funds

Camissa SA Equity Fund

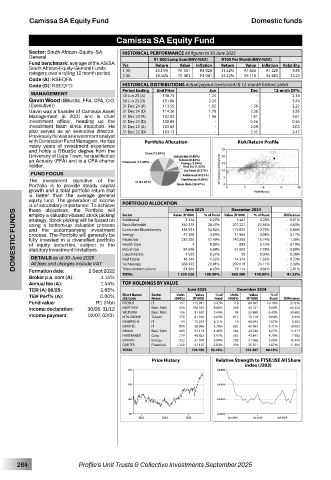

Sector: South African–Equity–SA HISTORICAL PERFORMANCE All figures to 30 June 2025

General R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: average of the ASISA

South African-Equity-General Funds Yrs Return Value Inflation Return Value Inflation Volatility

9.85

category over a rolling 12 month period 1 (A) 33.13% R1 331 R1 028 31.52% R1 426 R1 220 13.22

2 (A)

R1 401

R1 081

R3 118

24.42%

R2 483

18.36%

Code (A): KSEQFA

Code (D): KSEQFD HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

Period Ending End Price Jun Dec 12-mnth DY%

MANAGEMENT 30 Jun 25 (A) 130.73 1.24 - 2.14

Gavin Wood (BBusSc, FFA, CFA, CIO 30 Jun 25 (D) 131.86 2.24 - 3.49

(Executive)) 31 Dec 24 (A) 113.55 1.02 1.56 2.27

Gavin was a founder of Camissa Asset 31 Dec 24 (D) 114.36 1.70 2.36 3.55

Management in 2001 and is chief 31 Dec 23 (A) 102.02 1.06 1.61 2.61

investment officer, heading up the 31 Dec 23 (D) 100.89 - 0.56 0.56

investment team since inception. He 31 Dec 22 (A) 102.65 - 2.09 2.03

also serves as an executive director. 31 Dec 22 (D) 103.13 - 2.55 2.47

Previously he was an investment analyst

with Coronation Fund Managers. He has Portfolio Allocation Risk/Return Profile

many years of investment experience

and holds a BBusSc degree from the

University of Cape Town, he qualified as

an Actuary (FFA) and is a CFA charter

holder.

FUND FOCUS

The investment objective of the

Portfolio is to provide steady capital

growth and a total portfolio return that

is better than the average general

equity fund. The generation of income

is of secondary importance. To achieve PORTFOLIO ALLOCATION June 2025 % of Fund Value (R ‘000) % of Fund Difference

December 2024

these objectives, the Portfolio will

DOMESTIC FUNDS using a bottom-up valuation process Basic Materials 350 279 1 28.47% 207 227 23.84% - 0.86%

employ a valuation-based stock picking

Sector

Value (R ‘000)

strategy. Stock picking will be based on

- 0.01%

Additional

0.28%

2 447

0.27%

3 324

4.63%

and the accompanying investment

13.78%

119 800

158 951

Consumer Discretionary

12.92%

process. The Portfolio will generally be

3.68%

0.17%

47 308

3.84%

31 966

Energy

fully invested in a diversified portfolio

1.36%

215 225

Financials

16.14%

140 262

17.49%

of equity securities, subject to the

- 0.10%

Health Care

855

0.10%

0.00%

statutory investment limitations.

6.88%

67 600

- 0.89%

7.78%

Industrials

84 696

Liquid Assets

0.36%

0.00%

38

0.37%

4 535

DETAILS as at 30 June 2025

1.65%

- 0.33%

1.32%

14 374

16 244

Real Estate

All fees and charges include VAT

209 618

268 393

24.11%

21.81%

8.64%

75 114

Telecommunications

6.63%

- 2.01%

81 564

Formation date:

41.55%

TOTAL

1.15%

Broker p.a. com (A): 2 Sept 2022 Technology 1 230 520 100.00% 869 300 100.00% - 2.30%

Annual fee (A): 1.44% TOP HOLDINGS BY VALUE

TER (A) 06/25: 1.65% June 2025 December 2024

Value

Value

Units

% of

% of

Units

TER Perf% (A): 0.00% Short Name/ Sector (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Name

JSE Code

Fund value: R1.24bn PROSUS IT 117 115 941 9.42% 118 88 305 10.16% 27 636

Income declaration: 30/06, 31/12 NORTHAM Basic Mats 556 106 545 8.66% 453 44 121 5.08% 62 424

98

Income payment: 02/07, 02/01 VALTERRA Basic Mats 116 91 550 7.44% 817 55 868 6.43% 35 682

6.63%

579

8.64%

MTN GROUP

75 114

81 564

Telcom

6 450

NASPERS-N IT 14 75 224 6.11% 16 66 642 7.67% 8 582

DATATEC IT 904 58 966 4.79% 821 40 963 4.71% 18 003

OMNIA Basic Mats 693 55 113 4.48% 564 44 036 5.07% 11 077

FAMBRANDS Cons 779 48 823 3.97% 592 40 841 4.70% 7 982

EXXARO Energy 322 47 308 3.84% 202 31 966 3.68% 15 343

QUILTER Financials 1 240 47 155 3.83% 994 35 351 4.07% 11 804

TOTAL 728 190 59.18% 523 207 60.19%

Price History Relative Strength to FTSE/JSE All Share

index (J203)

284 Profile’s Unit Trusts & Collective Investments September 2025