Page 298 - Profile's Unit Trusts & Collective Investments - September 2025

P. 298

Marriott Income Fund Domestic funds

Marriott Income Fund

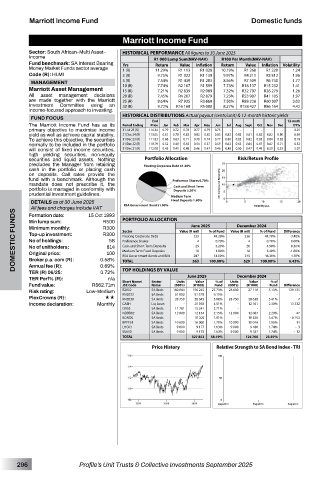

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Income R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: SA Interest Bearing Yrs Return Value Inflation Return Value Inflation Volatility

Money Market Funds sector average 1 (R) 11.29% R1 113 R1 028 10.19% R1 268 R1 220 1.24

Code (R): HLMI 3 (R) 9.75% R1 322 R1 139 9.97% R4 211 R3 812 1.96

5 (R) 7.54% R1 439 R1 283 8.56% R7 509 R6 740 1.77

MANAGEMENT 10 (R) 7.74% R2 107 R1 599 7.73% R18 137 R15 232 1.41

Marriott Asset Management 15 (R) 7.21% R2 839 R2 089 7.32% R32 797 R26 279 1.26

All asset management decisions 20 (R) 7.45% R4 207 R2 879 7.23% R53 907 R41 105 1.97

are made together with the Marriott 25 (R) 8.64% R7 935 R3 669 7.50% R88 226 R60 307 3.02

Investment Committee using an 30 (R) 9.72% R16 168 R5 080 8.27% R158 427 R86 164 4.42

income-focused approach to investing.

HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

FUND FOCUS End 12-mnth

The Marriott Income Fund has as its Period Ending Price Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec DY%

primary objective to maximise income 31 Jul 25 (R) 114.34 0.79 0.72 0.78 0.77 0.79 0.75 - - - - - - 8.25

yield as well as achieve capital stability. 31 Dec 24 (R) 113.05 0.81 0.78 0.83 0.82 0.85 0.83 0.83 0.83 0.81 0.82 0.82 0.80 8.69

To achieve this objective, the securities 31 Dec 23 (R) 111.83 0.68 0.63 0.71 0.70 0.74 0.77 0.80 0.82 0.82 0.83 0.84 0.82 8.19

normally to be included in the portfolio 31 Dec 22 (R) 110.79 0.52 0.48 0.55 0.54 0.57 0.59 0.63 0.65 0.64 0.67 0.67 0.71 6.52

will consist of fixed income securities, 31 Dec 21 (R) 112.08 0.45 0.41 0.48 0.46 0.47 0.46 0.48 0.50 0.47 0.49 0.50 0.53 5.07

high yielding securities, non-equity

securities and liquid assets. Nothing Portfolio Allocation Risk/Return Profile

precludes the Manager from retaining

cash in the portfolio or placing cash

on deposits. Call rates provide the

fund with a benchmark. Although the

mandate does not prescribe it, the

portfolio is managed in conformity with

prudential investment guidelines.

DETAILS as at 30 June 2025

All fees and charges include VAT R500 PORTFOLIO ALLOCATION

DOMESTIC FUNDS Minimum monthly: 0.58% Sector Value (R mil) 4 % of Fund Value (R mil) 4 % of Fund Difference

Formation date:

15 Oct 1993

Min lump sum:

December 2024

June 2025

R300

R300

Top-up investment:

-3.40%

Floating Corporate Debt

41.30%

233

236

44.70%

58

No of holdings:

0.00%

0.70%

Preference Shares

0.70%

No of unitholders:

814

29

0.30%

5.20%

Cash and Short Term Deposits

26

4.90%

18

10

1.80%

3.40%

Medium Term Fixed Deposits

-1.60%

100

Original price:

RSA Government Bonds and Bills

245

287

46.30%

4.70%

51.00%

Broker p.a. com (R):

100.00%

563

529

Annual fee (R):

TOP HOLDINGS BY VALUE

TER (R) 06/25:

0.72%

TER Perf% (R): 0.69% TOTAL Sector Units June 2025 100.00% Units December 2024 % of 6.43%

n/a

Value

Short Name/

Value

% of

Fund value: R562.71m JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Risk rating: Low-Medium R2032 SA Bnds 160 084 156 245 27.73% 28 630 - 27 110 - 5.13% - 129 135 -

51 000

RN2032

SA Bnds

9.15%

51 578

PlexCrowns (R): «« RN2030 SA Bnds 28 750 28 645 5.08% 28 750 28 638 5.41% 7

Income declaration: Monthly CASH Liq Asset - 25 392 4.51% - 12 161 2.30% 13 232

I2033 SA Bnds 11 781 15 241 2.71% - - - -

NDBB02 SA Bnds 12 000 12 134 2.15% 12 000 12 087 2.29% 47

BONDS SA Bnds - 10 205 1.81% - 18 358 3.47% - 8 153

BPPF51 SA Bnds 10 000 10 060 1.79% 10 000 10 046 1.90% 14

LHC03 SA Bnds 9 000 9 177 1.63% 9 000 9 180 1.74% - 3

SSA10 SA Bnds 9 000 9 175 1.63% 9 000 9 187 1.74% - 12

TOTAL 327 852 58.19% 126 766 23.97%

Price History Relative Strength to SA Bond Index - TRI

296 Profile’s Unit Trusts & Collective Investments September 2025