Page 280 - Profile's Unit Trusts & Collective Investments - September 2025

P. 280

Camissa Islamic Balanced Fund Domestic funds

Camissa Islamic Balanced Fund

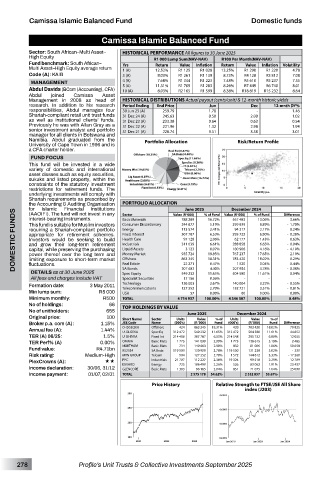

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

High Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: South African– Yrs Return Value Inflation Return Value Inflation Volatility

Multi Asset–High Equity average return 1 (A) 12.52% R1 125 R1 028 13.25% R1 290 R1 220 4.78

Code (A): KAIB 3 (A) 8.03% R1 261 R1 139 8.73% R4 128 R3 812 7.08

4 (A) 7.68% R1 344 R1 223 7.48% R5 610 R5 237 7.55

MANAGEMENT 5 (A) 11.31% R1 709 R1 283 8.26% R7 449 R6 740 8.01

Abdul Davids (BCom (Accounting), CFA) 10 (A) 8.03% R2 165 R1 599 8.38% R18 819 R15 232 8.64

Abdul joined Camissa Asset

Management in 2008 as head of HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

research. In addition to his research Period Ending End Price Jun Dec 12-mnth DY%

responsibilities, Abdul manages four 30 Jun 25 (A) 259.79 1.78 - 1.46

Shariah-compliant retail unit trust funds 31 Dec 24 (A) 245.63 0.50 2.00 1.02

as well as institutional clients’ funds. 31 Dec 23 (A) 233.38 0.64 0.63 0.54

Previously he was with Allan Gray as a 31 Dec 22 (A) 221.96 1.32 2.98 1.94

senior investment analyst and portfolio 31 Dec 21 (A) 228.74 3.51 3.38 3.01

manager for all clients in Botswana and

Namibia. Abdul graduated from the Portfolio Allocation Risk/Return Profile

University of Cape Town in 1996 and is

a CFA charter holder.

FUND FOCUS

This fund will be invested in a wide

variety of domestic and international

asset classes such as equity securities,

sukuks and listed property, within the

constraints of the statutory investment

restrictions for retirement funds. The

underlying investments will comply with

Shariah requirements as prescribed by

the Accounting & Auditing Organisation PORTFOLIO ALLOCATION 788 289 % of Fund Value (R ‘000) % of Fund Difference

Institutions

Financial

for

Islamic

June 2025

December 2024

DOMESTIC FUNDS This fund is suitable for Muslim investors Consumer Discretionary 244 877 19.85% 299 639 17.65% - 1.70%

(AAOIFI). The fund will not invest in any

Value (R ‘000)

Sector

interest-bearing instruments.

567 483

16.72%

Basic Materials

13.06%

3.66%

6.89%

5.19%

requiring a Shariah-compliant portfolio

2.41%

Energy

113 574

2.17%

0.24%

94 217

appropriate for retirement schemes.

295 732

307 787

Fixed Interest

6.80%

6.53%

- 0.28%

Investors would be seeking to build

0.63%

97 128

2.06%

1.43%

Health Care

62 177

and grow their long-term retirement

6.65%

6.61%

- 0.04%

311 639

288 858

Industrials

capital, while preserving the purchasing

180 906

0.07%

4.16%

3 123

Liquid Assets

- 4.10%

power thereof over the long term and

935 724

2.19%

Money Market

767 237

limiting exposure to short-term market

863 245

Offshore

18.02%

18.31%

0.29%

783 420

fluctuations.

1 520

22 271

0.47%

0.04%

0.44%

SA Bonds

4.78%

4.40%

DETAILS as at 30 June 2025

0.04%

549 232

504 580

Spec Equity

All fees and charges include VAT Real Estate 207 482 11.65% 207 954 - 11.61% - - 0.38% -

17 156

Specialist Securities

0.36%

Formation date: 3 May 2011 Technology 126 003 2.67% 140 004 3.22% - 0.55%

Telecommunications

2.70%

127 352

152 721

3.51%

- 0.81%

Min lump sum: R5 000 USA 57 0.00% 60 0.00% 0.00%

Minimum monthly: R500 TOTAL 4 714 937 100.00% 4 346 507 100.00% 8.48%

No of holdings: 66

No of unitholders: 655 TOP HOLDINGS BY VALUE June 2025 December 2024

Original price: 100 Short Name/ Sector Units Value % of Units Value % of

Broker p.a. com (A): 1.15% JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

420

424

Annual fee (A): 1.44% O-ISGEQKA Offshore 312 472 863 245 18.31% 312 472 783 420 18.02% 79 825

504 580

44 652

11.61%

11.65%

Spec Eq

549 232

U-GLISEKA

TER (A) 06/25: 1.5% U-ISHIYKA Fixed Int 214 486 307 787 6.53% 214 548 295 732 6.80% 12 055

TER Perf% (A) 0.00% OMNIA Basic Mats 1 775 141 099 2.99% 1 775 138 615 3.19% 2 485

81 006

832

734

Fund value: R4.71bn NORTHAM Basic Mats 119 500 140 663 2.98% 119 500 131 238 1.86% 59 658

SA Bnds

130 909

- 330

3.02%

RS2034

2.78%

Risk rating: Medium-High MTN GROUP Telcom 904 127 352 2.70% 1 572 144 612 3.33% - 17 260

PlexCrowns (A): «« PPC Industrials 21 707 112 227 2.38% 19 324 99 518 2.29% 12 709

1.91%

725

106 499

Energy

EXXARO

23 437

2.26%

526

83 062

Income declaration: 30/06, 31/12 GLENCORE Basic Mats 1 383 96 165 2.04% 851 71 075 1.64% 25 090

Income payment: 01/07, 02/01 TOTAL 2 575 178 54.62% 2 332 857 53.67%

Price History Relative Strength to FTSE/JSE All Share

index (J203)

278 Profile’s Unit Trusts & Collective Investments September 2025