Page 275 - Profile's Unit Trusts & Collective Investments - September 2025

P. 275

Domestic funds Argon BCI Flexible Income Fund

Argon BCI Flexible Income Fund

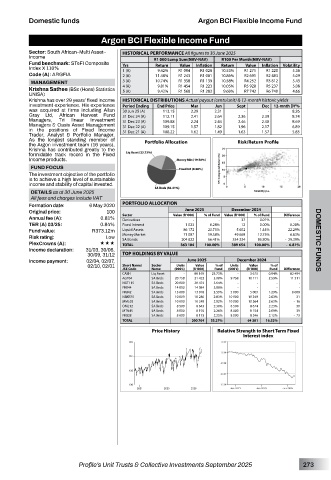

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Income R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: STeFI Composite

Value

Value

Index X 110% Yrs Return R1 094 Inflation Return R1 271 Inflation Volatility

5.36

9.42%

1 (A)

10.53%

R1 028

R1 220

Code (A): ARGFIA 2 (A) 11.48% R1 243 R1 081 10.86% R2 691 R2 483 5.09

MANAGEMENT 3 (A) 10.74% R1 358 R1 139 10.58% R4 252 R3 812 5.43

Krishna Sathee (BSc (Hons) Statistics 4 (A) 9.81% R1 454 R1 223 10.05% R5 928 R5 237 5.08

R1 283

4.66

R6 740

9.42%

R1 568

5 (A)

R7 742

9.69%

UNISA)

Krishna has over 29 years’ fixed income HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

investment experience. His experience Period Ending End Price Mar Jun Sept Dec 12-mnth DY%

was acquired at firms including Allan 30 Jun 25 (A) 113.15 2.29 2.31 - - 8.26

Gray Ltd, African Harvest Fund 31 Dec 24 (A) 112.11 2.41 2.64 2.36 2.39 8.74

Managers, Tri linear Investment 31 Dec 23 (A) 109.88 2.24 2.44 2.46 2.40 8.69

Managers & Oasis Asset Management 31 Dec 22 (A) 109.15 1.57 1.82 1.96 2.17 6.89

in the positions of Fixed Income 31 Dec 21 (A) 108.22 1.62 1.49 1.63 1.57 5.83

Trader, Analyst & Portfolio Manager.

As the longest standing member of Portfolio Allocation Risk/Return Profile

the Argon investment team (16 years),

Krishna has contributed greatly to the

formidable track record in the Fixed

Income products.

FUND FOCUS

The investment objective of the portfolio

is to achieve a high level of sustainable

income and stability of capital invested.

DETAILS as at 30 June 2025

All fees and charges include VAT

Formation date: 6 May 2020 PORTFOLIO ALLOCATION

Original price: 100 June 2025 December 2024

Annual fee (A): 0.81% Sector Value (R ‘000) - % of Fund - Value (R ‘000) % of Fund Difference -

37

0.01%

Derivatives

TER (A) 03/25: 0.84% Fixed Interest 1 023 0.28% 12 0.00% 0.28%

Fund value: R373.12m Liquid Assets 86 172 23.73% 5 602 1.44% 22.29%

49 668

6.83%

71 087

Risk rating: Low Money Market 204 822 19.58% 334 334 12.75% - 29.39%

56.41%

SA Bonds

85.80%

PlexCrowns (A): ««« TOTAL 363 104 100.00% 389 654 100.00% - 6.81% DOMESTIC FUNDS

Income declaration: 31/03, 30/06,

30/09, 31/12 TOP HOLDINGS BY VALUE

Income payment: 02/04, 02/07, June 2025 December 2024

02/10, 02/01 Short Name/ Sector Units Value % of Units Value % of

JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

CASH Liq Asset - 86 169 23.73% - 3 675 0.94% 82 494

AGT04 SA Bnds 20 758 21 422 5.90% 9 758 10 111 2.59% 11 311

NGT115 SA Bnds 20 000 20 474 5.64% - - - -

FRB44 SA Bnds 14 000 14 084 3.88% - - - -

FRB42 SA Bnds 13 000 13 018 3.59% 5 000 5 009 1.29% 8 009

NBKB75 SA Bnds 10 000 10 280 2.83% 10 000 10 249 2.63% 31

MML03 SA Bnds 10 000 10 248 2.82% 10 000 10 264 2.63% - 16

OML12 SA Bnds 8 500 8 643 2.38% 8 500 8 674 2.23% - 30

MTN45 SA Bnds 8 000 8 193 2.26% 8 000 8 154 2.09% 39

FRB28 SA Bnds 8 000 8 173 2.25% 8 000 8 246 2.12% - 73

TOTAL 200 704 55.27% 64 381 16.52%

Price History Relative Strength to Short Term Fixed

Interest index

115 0.02

0.00

110

-0.02

105

-0.04

100 -0.06

2021 2023 2025 Jan 2021 Jan 2023 Jan 2025

Profile’s Unit Trusts & Collective Investments September 2025 273