Page 276 - Profile's Unit Trusts & Collective Investments - September 2025

P. 276

Camissa Asset Management (Pty) Ltd. Domestic funds

Camissa Asset Management (Pty) Ltd.

Reg. No. 2010/009289/06

HEAD OFFICE DIRECTORS

5th Floor MontClare Place, Cnr Campground and R G Greaver (CEO)

Main Roads, Claremont, 7708 B Ngonyama

PO Box 1016, Cape Town, 8000 P Radebe

Tel: 021-673-6300 T Scott

Fax: 086-673-9294 K Shongwe

Tollfree: 0800-864-418 G J Wood

Email: info@camissa-am.com

Website: https://camissa-am.com

TRUSTEE

Standard Bank

AUDITOR

PricewaterhouseCoopers

DOMESTIC FUNDS

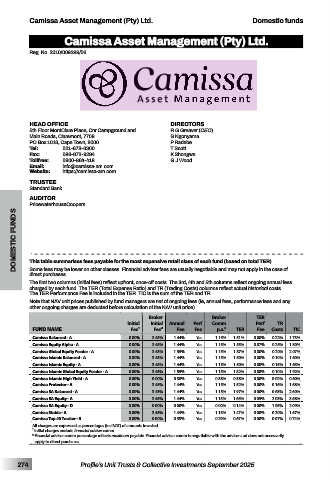

This table summarises fees payable for the most expensive retail class of each fund (based on total TER).

Some fees may be lower on other classes. Financial adviser fees are usually negotiable and may not apply in the case of

direct purchases.

The first two columns (initial fees) reflect upfront, once-off costs. The 3rd, 4th and 5th columns reflect ongoing annual fees

charged by each fund. The TER (Total Expense Ratio) and TR (Trading Costs) columns reflect actual historical costs.

The TER Performance Fee is included in the TER. TIC is the sum of the TER and TR.

Note that NAV unit prices published by fund managers are net of ongoing fees (ie, annual fees, performance fees and any

other ongoing charges are deducted before calculation of the NAV unit price).

Broker Broker TER

Initial Initial Annual Perf Comm Perf TR

FUND NAME Fee1 Fee2 Fee Fee p.a.2 TER Fee Costs TIC

Camissa Balanced - A 0.00% 3.45% 1.44% Yes 1.15% 1.51% 0.00% 0.22% 1.73%

Camissa Equity Alpha - A 0.00% 3.45% 1.44% Yes 1.15% 1.55% 0.07% 0.25% 1.80%

Camissa Global Equity Feeder - A 0.00% 3.45% 1.55% Yes 1.15% 1.87% 0.00% 0.20% 2.07%

Camissa Islamic Balanced - A 0.00% 3.45% 1.44% Yes 1.15% 1.50% 0.00% 0.10% 1.60%

Camissa Islamic Equity - A 0.00% 3.45% 1.44% Yes 1.15% 1.50% 0.00% 0.15% 1.65%

Camissa Islamic Global Equity Feeder - A 0.00% 3.45% 1.55% Yes 1.15% 1.82% 0.00% 0.10% 1.92%

Camissa Islamic High Yield - A 0.00% 0.00% 0.58% Yes 0.58% 0.58% 0.00% 0.02% 0.60%

Camissa Protector - A 0.00% 3.45% 1.44% Yes 1.15% 1.52% 0.00% 0.16% 1.68%

Camissa SA Balanced - A 0.00% 3.45% 1.44% Yes 1.15% 1.97% 0.00% 0.63% 2.60%

Camissa SA Equity - A 0.00% 3.45% 1.44% Yes 1.15% 1.65% 0.05% 2.03% 3.68%

Camissa SA Equity - D 0.00% 0.00% 0.00% Yes 0.00% 0.14% 0.00% 1.95% 2.09%

Camissa Stable - A 0.00% 3.45% 1.44% Yes 1.15% 1.47% 0.00% 0.20% 1.67%

Camissa Top 40 Tracker - R 0.00% 0.00% 0.58% Yes 0.29% 0.67% 0.00% 0.07% 0.74%

All charges are expressed as percentages (incl VAT) of amounts invested.

1 Initial charges exclude financial adviser comm.

2 Financial adviser comm percentage reflects maximum payable. Financial adviser comm is negotiable with the adviser and does not necessarily

apply to direct purchases.

274 Profile’s Unit Trusts & Collective Investments September 2025