Page 274 - Profile's Unit Trusts & Collective Investments - September 2025

P. 274

Argon BCI Bond Fund Domestic funds

Argon BCI Bond Fund

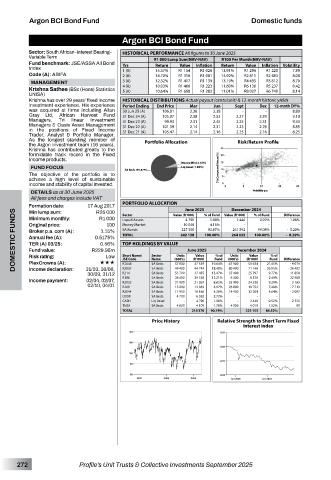

Sector: South African–Interest Bearing– HISTORICAL PERFORMANCE All figures to 30 June 2025

Variable Term R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: JSE/ASSA All Bond

Value

Value

Index Yrs Return R1 154 Inflation Return R1 294 Inflation Volatility

15.37%

R1 220

13.91%

1 (A)

7.89

R1 028

Code (A): ABIFA 2 (A) 14.70% R1 316 R1 081 14.92% R2 811 R2 483 8.08

MANAGEMENT 3 (A) 12.32% R1 417 R1 139 13.19% R4 435 R3 812 8.70

Krishna Sathee (BSc (Hons) Statistics 4 (A) 10.03% R1 466 R1 223 11.60% R6 130 R5 237 8.42

8.14

5 (A)

11.01%

R6 740

R1 658

R1 283

R8 027

10.64%

UNISA)

Krishna has over 29 years’ fixed income HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

investment experience. His experience Period Ending End Price Mar Jun Sept Dec 12-mnth DY%

was acquired at firms including Allan 30 Jun 25 (A) 106.81 2.36 2.38 - - 8.80

Gray Ltd, African Harvest Fund 31 Dec 24 (A) 105.07 2.38 2.52 2.27 2.39 9.10

Managers, Tri linear Investment 31 Dec 23 (A) 99.93 2.31 2.45 2.25 2.31 9.33

Managers & Oasis Asset Management 31 Dec 22 (A) 101.39 2.14 2.31 2.23 2.29 8.85

in the positions of Fixed Income 31 Dec 21 (A) 105.47 2.14 2.16 2.25 2.16 8.25

Trader, Analyst & Portfolio Manager.

As the longest standing member of Portfolio Allocation Risk/Return Profile

the Argon investment team (16 years),

Krishna has contributed greatly to the

formidable track record in the Fixed

Income products.

FUND FOCUS

The objective of the portfolio is to

achieve a high level of sustainable

income and stability of capital invested.

DETAILS as at 30 June 2025

All fees and charges include VAT

Formation date: 17 Aug 2017 PORTFOLIO ALLOCATION June 2025 % of Fund Value (R ‘000) % of Fund Difference

December 2024

Min lump sum:

R25 000

DOMESTIC FUNDS Original price: R229.95m Money Market Sector Units 10 048 Value 100.00% Units December 2024 - % of - 8.29% -

Value (R ‘000)

Sector

R1 000

Minimum monthly:

1.06%

2 440

4 790

0.92%

1.98%

Liquid Assets

100

-

4.15%

227 300

1.15%

261 592

99.08%

93.87%

SA Bonds

Broker p.a. com (A):

- 5.20%

242 138

100.00%

TOTAL

264 032

0.5175%

Annual fee (A):

0.56%

TER (A) 03/25:

TOP HOLDINGS BY VALUE

Fund value:

June 2025

Low

Risk rating:

Value

Short Name/

% of

Fund

Fund

PlexCrowns (A):

«««

56 634

67 900

- 9 076

57 000

R2048

SA Bnds

47 559

Income declaration:

31/03, 30/06,

80 400

44 744

- 26 402

SA Bnds

R2037

49 400

26.95%

71 146

18.48%

30/09, 31/12 JSE Code Name (000’s) (R ‘000) 19.64% (000’s) (R ‘000) 21.45% Difference

25 797

R214

37 400

11 658

53 700

15.47%

37 455

9.77%

SA Bnds

6 570

6 300

SA Bnds

Income payment: 02/04, 02/07, R186 SA Bnds 28 400 29 558 12.21% 25 900 24 530 2.49% 22 988

9.29%

- 3 163

R2032

21 900

8.82%

21 367

02/10, 04/01 R209 SA Bnds 15 800 12 039 4.97% 26 800 19 752 7.48% - 7 713

R2044 SA Bnds 11 950 10 166 4.20% 14 450 12 264 4.64% - 2 097

I2038 SA Bnds 4 700 6 582 2.72% - - - -

CASH Liq Asset - 4 790 1.98% - 2 440 0.92% 2 350

TN30 SA Bnds 4 000 4 109 1.70% 4 000 4 019 1.52% 90

TOTAL 218 370 90.19% 223 153 84.52%

Price History Relative Strength to Short Term Fixed

Interest index

272 Profile’s Unit Trusts & Collective Investments September 2025