Page 273 - Profile's Unit Trusts & Collective Investments - September 2025

P. 273

Domestic funds Argon BCI Absolute Return Fund

Argon BCI Absolute Return Fund

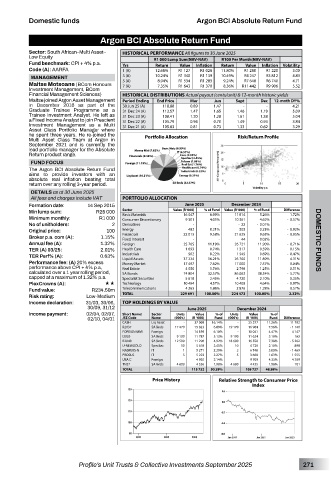

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Low Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: CPI + 4% p.a. Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): AARFA 1 (A) 12.68% R1 127 R1 028 11.80% R1 280 R1 220 3.00

3 (A) 10.24% R1 340 R1 139 10.49% R4 247 R3 812 4.83

MANAGEMENT

R7 648

Maitse Motsoane (BCom Honours 5 (A) 8.94% R1 534 R1 283 9.24% R11 442 R6 740 4.71

8.36%

5.52

7.35%

7 (A)

R9 906

R1 643

R1 370

Investment Management, BCom

Financial Management Sciences) HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

Maitse joined Argon Asset Management Period Ending End Price Mar Jun Sept Dec 12-mnth DY%

in December 2016 as part of the 30 Jun 25 (A) 118.88 0.89 1.47 - - 4.21

Graduate Trainee Programme as a 31 Dec 24 (A) 113.57 1.47 1.65 1.46 1.19 5.09

Trainee Investment Analyst. He left as 31 Dec 23 (A) 108.41 1.20 1.28 1.61 1.38 5.04

a Fixed Income Analyst to join Prescient 31 Dec 22 (A) 105.79 0.94 0.70 1.49 0.93 3.84

Investment Management as a Multi 31 Dec 21 (A) 105.63 0.81 0.73 1.33 0.62 3.29

Asset Class Portfolio Manager where

he spent three years. He re-joined the Portfolio Allocation Risk/Return Profile

Multi Asset Class Team at Argon in

September 2021 and is currently the

lead portfolio manager for the Absolute

Return product range.

FUND FOCUS

The Argon BCI Absolute Return Fund

aims to provide investors with an

absolute real inflation beating total

return over any rolling 3-year period.

DETAILS as at 30 June 2025

All fees and charges include VAT PORTFOLIO ALLOCATION

Formation date: 14 Sep 2015 June 2025 December 2024

Min lump sum: R25 000 Sector Value (R ‘000) % of Fund Value (R ‘000) % of Fund Difference

6.99%

Basic Materials

11 814

5.26%

16 047

1.72%

Minimum monthly: R1 000 Consumer Discretionary 9 301 4.05% 10 361 4.62% - 0.57%

No of unitholders: 2 Derivatives - - - 22 - 0.01% -

Original price: 100 Energy 482 0.21% 505 0.23% - 0.02%

Broker p.a. com (A): 1.15% Financials 22 013 - 9.58% - 21 625 9.63% - 0.05% -

Fixed Interest

0.02%

44

Annual fee (A): 1.32% Foreign 25 705 11.19% 26 721 11.90% - 0.71% DOMESTIC FUNDS

TER (A) 03/25: 2.01% Health Care 1 693 0.74% 1 317 0.59% 0.15%

0.69%

502

0.22%

1 545

TER Perf% (A): 0.63% Industrials 37 224 16.21% 26 700 11.89% - 0.47%

Liquid Assets

4.31%

Performance fee: (A) 20% excess Money Market 17 497 7.62% 17 000 7.57% 0.04%

performance above CPI + 4% p.a, Real Estate 4 050 1.76% 2 798 1.25% 0.51%

calculated over a 1 year rolling period, SA Bonds 74 804 32.57% 86 062 38.34% - 5.77%

capped at a maximum of 1.32% p.a. Specialist Securities 5 618 2.45% 4 720 2.10% 0.35%

PlexCrowns (A): «« Technology 10 494 4.57% 10 408 4.64% - 0.07%

Fund value: R234.50m Telecommunications 4 263 1.86% 2 876 1.28% 0.57%

Risk rating: Low-Medium TOTAL 229 691 100.00% 224 473 100.00% 2.32%

Income declaration: 31/03, 30/06, TOP HOLDINGS BY VALUE

30/09, 31/12 June 2025 December 2024

Income payment: 02/04, 02/07, Short Name/ Sector Units Value % of Units Value % of

02/10, 04/01 JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

CASH Liq Asset - 37 069 16.14% - 25 277 11.26% 11 792

R2037 SA Bnds 17 470 15 823 6.89% 19 170 16 964 7.56% - 1 140

FOREIGN MMI Foreign - 14 189 6.18% - 10 041 4.47% 4 147

I2033 SA Bnds 9 100 11 787 5.13% 9 100 11 624 5.18% 163

R2040 SA Bnds 12 500 11 296 4.92% 18 600 16 558 7.38% - 5 262

U-NEWGOLD SpecSec 10 5 618 2.45% 10 4 720 2.10% 898

NASPERS-N IT 1 5 271 2.29% 2 6 740 3.00% - 1 469

PROSUS IT 5 5 223 2.27% 5 3 668 1.63% 1 555

USA C Foreign - 4 920 2.14% - 9 709 4.33% - 4 789

TN27 SA Bnds 4 600 4 536 1.98% 4 600 4 435 1.98% 101

TOTAL 115 732 50.39% 109 737 48.88%

Price History Relative Strength to Consumer Price

Index

Profile’s Unit Trusts & Collective Investments September 2025 271