Page 274 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 274

Marriott Global Income Fund

Marriott Global Income Fund

Marriott Global Income Fund

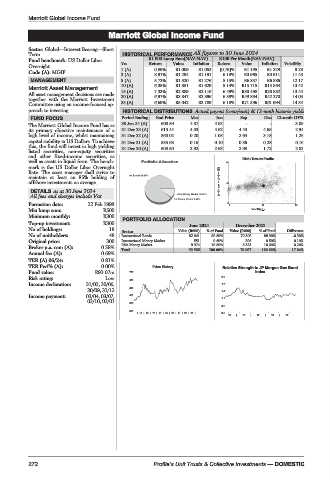

Sector: Global—Interest Bearing—Short

Term HISTORICAL PERFORMANCE All figures to 30 June 2024

Fund benchmark: US Dollar Libor R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Overnight Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): MGIF 1 (A) 0.89% R1 009 R1 052 (0.76)% R1 195 R1 229 9.23

3 (A) 8.97% R1 294 R1 191 6.18% R3 965 R3 911 11.43

MANAGEMENT 5 (A) 5.72% R1 320 R1 276 5.15% R6 857 R6 886 12.17

Marriott Asset Management 10 (A) 6.35% R1 851 R1 629 5.14% R15 715 R15 564 13.42

All asset management decisions are made 15 (A) 7.33% R2 889 R2 116 6.49% R30 498 R26 882 13.44

together with the Marriott Investment 20 (A) 6.97% R3 847 R2 896 6.59% R49 834 R42 270 14.05

Committee using an income-focused ap- 25 (A) 6.69% R5 042 R3 789 6.18% R71 596 R61 994 14.34

proach to investing. HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

FUND FOCUS Period Ending End Price Mar Jun Sep Dec 12-mnth DY%

The Marriott Global Income Fund has as 30 Jun 24 (A) 600.59 4.87 4.62 - - 3.09

its primary objective maintenance of a 31 Dec 23 (A) 613.44 4.33 4.62 4.43 4.65 2.94

high level of income, whilst maintaining 31 Dec 22 (A) 563.02 0.20 1.05 2.64 3.18 1.26

capital stability in US Dollars. To achieve 31 Dec 21 (A) 535.68 0.16 0.10 0.36 0.28 0.16

this, the fund will invest in high yielding 31 Dec 20 (A) 508.50 2.92 2.63 2.98 1.72 2.02

listed securities, non-equity securities

and other fixed-income securities, as

well as assets in liquid form. The bench- 20 Risk / Return Profile

mark is the US Dollar Libor Overnight

Rate. The asset manager shall strive to

maintain at least an 85% holding of

offshore investments on average. 3yr Compound return(%) 10

DETAILS as at 30 June 2024

All fees and charges include Vat

Formation date: 22 Feb 1999 0 0 11 22

Min lump sum: R500 Volatility p.a.

Minimum monthly: R300 PORTFOLIO ALLOCATION

Top-up investment: R300 June 2024 December 2023

No of holdings: 18

Sector Value (R000) % of Fund Value (R000) % of Fund Difference

No of unitholders: 48 International Bonds 82 041 88.60% 70 308 88.90% -0.30%

Original price: 300 International Money Market 551 0.60% 396 0.50% 0.10%

9 974

10.80%

8 383

10.60%

0.20%

Broker p.a. com (A): 0.58% RSA Money Market 92 566 100.00% 79 087 100.00% 17.04%

Total

Annual fee (A): 0.69%

TER (A) 06/24: 0.81%

TER Perf% (A): 0.00% Price History Relative Strength to JP Morgan Gov Bond

Fund value: R93.07m 700 index

Risk rating: Low 620 2.0

Income declaration: 31/03, 30/06, 1.7

30/09, 31/12 540 1.4

Income payment: 03/04, 03/07, 460

03/10, 03/01 380 1.1

0.8

300

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 0.5

15 | 16 | 17 | 18 | 19 |

272 Profile’s Unit Trusts & Collective Investments — DOMESTIC