Page 279 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 279

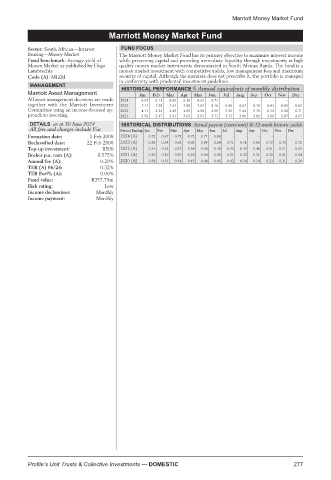

Marriott Money Market Fund

Marriott Money Market Fund

Marriott Money Market Fund

Sector: South African—Interest FUND FOCUS

Bearing—Money Market The Marriott Money Market Fund has its primary objective to maximise interest income

Fund benchmark: Average yield of while preserving capital and providing immediate liquidity through investments in high

Money Market as published by Hugo quality money market instruments denominated in South African Rands. The fund is a

Lambrechts money market investment with competitive yields, low management fees and maximum

Code (A): MIZM security of capital. Although the mandate does not prescribe it, the portfolio is managed

in conformity with prudential investment guidelines.

MANAGEMENT

HISTORICAL PERFORMANCE % Annual equivalents of monthly distribution

Marriott Asset Management

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

All asset management decisions are made 2024 8.87 9.11 8.85 9.18 8.63 8.74 - - - - - -

together with the Marriott Investment 2023 7.11 7.28 7.64 7.88 7.84 8.10 8.66 8.67 8.76 8.84 8.83 8.82

Committee using an income-focused ap- 2022 4.11 4.24 4.46 4.66 4.58 4.96 5.20 5.44 5.71 6.14 6.36 6.71

proach to investing. 2021 3.59 3.47 3.41 3.63 3.61 3.71 3.73 3.90 3.80 3.86 3.87 4.07

DETAILS as at 30 June 2024 HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

All fees and charges include Vat Period Ending Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Formation date: 1 Feb 2008 2024 (A) 0.72 0.67 0.72 0.72 0.71 0.68 - - - - - -

Reclassified date: 22 Feb 2008 2023 (A) 0.58 0.54 0.63 0.63 0.64 0.64 0.71 0.71 0.69 0.72 0.70 0.72

Top-up investment: R500 2022 (A) 0.34 0.32 0.37 0.38 0.38 0.40 0.43 0.45 0.46 0.51 0.51 0.55

Broker p.a. com (A): 0.575% 2021 (A) 0.30 0.26 0.29 0.29 0.30 0.30 0.31 0.33 0.31 0.32 0.31 0.34

Annual fee (A): 0.29% 2020 (A) 0.58 0.53 0.54 0.45 0.48 0.45 0.42 0.34 0.34 0.33 0.31 0.30

TER (A) 06/24: 0.32%

TER Perf% (A): 0.00%

Fund value: R357.79m

Risk rating: Low

Income declaration: Monthly

Income payment: Monthly

Profile’s Unit Trusts & Collective Investments — DOMESTIC 277