Page 284 - Profile's Unit Trusts & Collective Investments - March 2025

P. 284

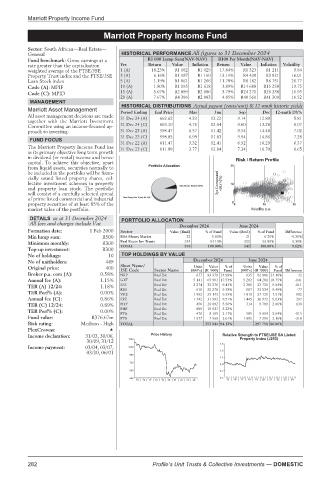

Marriott Property Income Fund

Marriott Property Income Fund

Marriott Property Income Fund

Sector: South African—Real Estate—

General HISTORICAL PERFORMANCE All figures to 31 December 2024

Fund benchmark: Grow earnings at a R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

rate greater than the capitalisation Yrs Return Value Inflation Return Value Inflation Volatility

weighted average of the FTSE/JSE 1 (A) 18.23% R1 182 R1 029 17.84% R1 323 R1 211 9.84

Property Trust index and the FTSE/JSE 3 (A) 6.16% R1 197 R1 160 13.11% R4 430 R3 821 16.01

Loan Stock index 5 (A) 1.19% R1 061 R1 266 11.70% R8 182 R6 751 26.77

Code (A): MPIF 10 (A) 1.80% R1 195 R1 618 3.89% R14 688 R15 258 19.75

15 (A) 5.07% R2 099 R2 086 3.79% R24 271 R26 338 16.95

Code (C): MPID

20 (A) 7.67% R4 386 R2 883 4.85% R40 561 R41 309 16.52

MANAGEMENT

HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

Marriott Asset Management Period Ending End Price Mar Jun Sep Dec 12-mnth DY%

All asset management decisions are made 31 Dec 24 (A) 662.62 4.33 12.22 9.14 12.80 5.81

together with the Marriott Investment

Committee using an income-focused ap- 31 Dec 24 (C) 663.10 4.75 12.64 9.60 13.28 6.07

proach to investing. 31 Dec 23 (A) 598.47 6.57 11.42 9.54 14.48 7.02

31 Dec 23 (C) 598.85 6.99 11.83 9.94 14.86 7.28

FUND FOCUS

31 Dec 22 (A) 611.47 3.32 12.41 6.92 16.29 6.37

The Marriott Property Income Fund has 31 Dec 22 (C) 611.88 3.77 12.84 7.34 16.70 6.65

as its primary objective long term growth

in dividend (or rental) income and hence Risk / Return Profile

capital. To achieve this objective, apart

from liquid assets, securities normally to 25

be included in the portfolio will be finan-

cially sound listed property shares, col-

lective investment schemes in property 3yr Compound return(%) 12

and property loan stock. The portfolio

will consist of a carefully selected spread

of prime listed commercial and industrial

property securities of at least 85% of the 0 0 10 20

market value of the portfolio. Volatility p.a.

DETAILS as at 31 December 2024 PORTFOLIO ALLOCATION

All fees and charges include Vat

December 2024 June 2024

Formation date: 1 Feb 2000 Sector Value (Rmil) % of Fund Value (Rmil) % of Fund Difference

Min lump sum: R500 RSA Money Market 22 5.90% 21 6.20% -0.30%

Minimum monthly: R300 Real Estate Inv Trusts 354 94.10% 322 93.80% 0.30%

Top-up investment: R300 TOTAL 376 100.00% 343 100.00% 9.62%

No of holdings: 10 TOP HOLDINGS BY VALUE

No of unitholders: 449 December 2024 June 2024

Short Name/

Units

Value

%of

Units

Value

%of

Original price: 400 JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Broker p.a. com (A): 0.58% NRP Real Est 677 93 979 24.99% 635 82 886 24.18% 42

Annual fee (A): 1.15% GRT Real Est 5 141 65 903 17.53% 5 282 64 281 18.75% -141

TER (A) 12/24: 1.18% SSS Real Est 2 274 35 376 9.41% 2 385 33 730 9.84% -111

RES Real Est 610 35 278 9.38% 687 32 534 9.49% -77

TER Perf% (A): 0.00% VKE Real Est 1 992 35 143 9.35% 1 810 27 121 7.91% 182

Annual fee (C): 0.86% SRE Real Est 1 742 31 992 8.51% 1 445 30 972 9.03% 297

TER (C) 12/24: 0.89% HYP Real Est 450 20 892 5.56% 314 9 789 2.86% 136

TER Perf% (C): 0.00% PHP Real Est 889 19 647 5.23%

FTA Real Est 470 8 165 2.17% 585 9 054 2.64% -115

Fund value: R376.67m FTB Real Est 1 577 7 568 2.01% 1 895 7 391 2.16% -318

Risk rating: Medium - High TOTAL 353 944 94.13% 297 758 86.86%

PlexCrowns:

Income declaration: 31/03, 30/06, Price History Relative Strength to FTSE/JSE SA Listed

30/09, 31/12 1200 Property Index (J253)

1.5

Income payment: 03/04, 03/07, 1040

03/10, 06/01 1.3

880

1.1

720

0.9

560 0.7

400 0.5

15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24

282 Profile’s Unit Trusts & Collective Investments — DOMESTIC