Page 289 - Profile's Unit Trusts & Collective Investments - March 2025

P. 289

Mazi BCI Global Equity Feeder Fund

Mazi BCI Global Equity Feeder Fund

Mazi BCI Global Equity Feeder Fund

Sector: Global—Equity—General

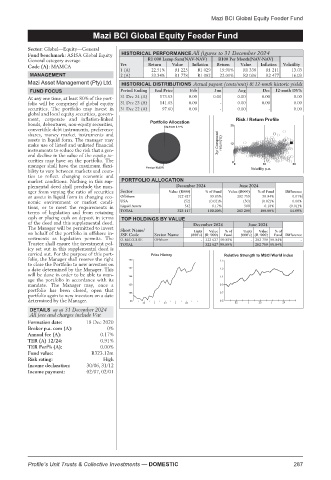

Fund benchmark: ASISA Global Equity HISTORICAL PERFORMANCE All figures to 31 December 2024

General category average R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Code (A): MAMCA Yrs Return Value Inflation Return Value Inflation Volatility

1 (A) 22.51% R1 225 R1 029 19.91% R1 338 R1 211 13.03

MANAGEMENT 2 (A) 33.34% R1 778 R1 082 22.01% R3 036 R2 477 16.03

Mazi Asset Management (Pty) Ltd. HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

FUND FOCUS Period Ending End Price Feb Jun Aug Dec 12-mnth DY%

At any one time, at least 80% of the port- 31 Dec 24 (A) 173.53 0.00 0.00 0.00 0.00 0.00

folio will be comprised of global equity 31 Dec 23 (A) 141.65 0.00 - 0.00 0.00 0.00

securities. The portfolio may invest in 31 Dec 22 (A) 97.60 0.00 - 0.00 - 0.00

global and local equity securities, govern-

ment, corporate and inflation-linked Risk / Return Profile

bonds, debentures, non-equity securities, 25

convertible debt instruments, preference

shares, money market instruments and

assets in liquid form. The manager may

make use of listed and unlisted financial 3yr Compound return(%) 12

instruments to reduce the risk that a gen-

eral decline in the value of the equity se-

curities may have on the portfolio. The 0

manager shall have the maximum flexi- 0 10 20

bility to vary between markets and coun- Volatility p.a.

ties to reflect changing economic and

market conditions. Nothing in this sup- PORTFOLIO ALLOCATION

plemental deed shall preclude the man- December 2024 June 2024

ager from varying the ratio of securities Sector Value (R000) % of Fund Value (R000) % of Fund Difference

or assets in liquid form in changing eco- Offshore 322 627 99.85% 282 759 99.84% 0.01%

nomic environment or market condi- USA (52) (0.02)% (50) (0.02)% 0.00%

tions, or to meet the requirements in Liquid Assets 542 0.17% 500 0.18% (0.01)%

terms of legislation and from retaining TOTAL 323 117 100.00% 283 209 100.00% 14.09%

cash or placing cash on deposit in terms TOP HOLDINGS BY VALUE

of the deed and this supplemental deed. December 2024 June 2024

The Manager will be permitted to invest Short Name/

Value

Units

Value

%of

%of

Units

on behalf of the portfolio in offshore in- JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

vestments as legislation permits. The O-MAZGLBE Offshore - 322 627 99.85% - 282 759 99.84% -

Trustee shall ensure the investment pol- TOTAL 322 627 99.85% 282 759 99.84%

icy set out in this supplemental deed is

carried out. For the purpose of this port- Price History Relative Strength to MSCI World index

folio, the Manager shall reserve the right 180 1.5

to close the Portfolio to new investors on

a date determined by the Manager. This 162 1.3

will be done in order to be able to man- 144 1.1

age the portfolio in accordance with its

mandate. The Manager may, once a 126 0.9

portfolio has been closed, open that

portfolio again to new investors on a date 108 0.7

determined by the Manager. 90 0.5

22 | 23 | 24 22 | 23 | 24

DETAILS as at 31 December 2024

All fees and charges include Vat

Formation date: 18 Dec 2020

Broker p.a. com (A): 0%

Annual fee (A): 0.17%

TER (A) 12/24: 0.91%

TER Perf% (A): 0.00%

Fund value: R323.12m

Risk rating: High

Income declaration: 30/06, 31/12

Income payment: 02/07, 02/01

Profile’s Unit Trusts & Collective Investments — DOMESTIC 287