Page 290 - Profile's Unit Trusts & Collective Investments - March 2025

P. 290

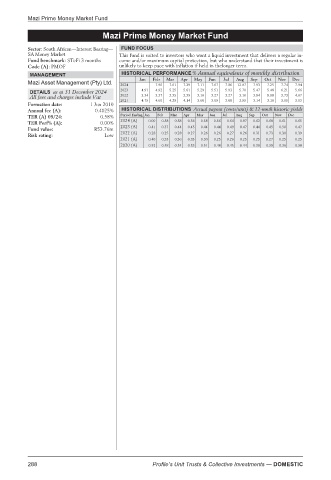

Mazi Prime Money Market Fund

Mazi Prime Money Market Fund

Mazi Prime Money Market Fund

Sector: South African—Interest Bearing— FUND FOCUS

SA Money Market This fund is suited to investors who want a liquid investment that delivers a regular in-

Fund benchmark: STeFi 3 months come and/or maximum capital protection, but who understand that their investment is

Code (A): PMOF unlikely to keep pace with inflation if held in thelonger term.

HISTORICAL PERFORMANCE % Annual equivalents of monthly distribution

MANAGEMENT

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Mazi Asset Management (Pty) Ltd. 2024 - 7.90 7.01 7.29 7.11 7.07 7.86 12.07 7.93 7.25 7.74 7.94

DETAILS as at 31 December 2024 2023 4.91 4.92 5.25 5.61 5.29 5.51 5.93 5.70 5.47 5.48 6.21 5.66

All fees and charges include Vat 2022 3.34 3.37 3.35 3.39 3.16 3.27 3.27 3.16 3.84 8.88 3.73 4.67

2021 4.79 4.60 4.29 4.14 3.60 3.09 3.08 2.99 3.14 3.18 3.05 3.03

Formation date: 1 Jun 2010

Annual fee (A): 0.4025% HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

TER (A) 09/24: 0.58% Period Ending Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

TER Perf% (A): 0.00% 2024 (A) 0.00 0.58 0.58 0.58 0.58 0.56 0.64 0.97 0.63 0.60 0.61 0.65

Fund value: R53.76m 2023 (A) 0.41 0.37 0.44 0.45 0.44 0.44 0.49 0.47 0.44 0.45 0.50 0.47

2022 (A) 0.28 0.25 0.28 0.27 0.26 0.26 0.27 0.26 0.31 0.73 0.30 0.39

Risk rating: Low

2021 (A) 0.40 0.35 0.36 0.33 0.30 0.25 0.26 0.25 0.25 0.27 0.25 0.25

2020 (A) 0.52 0.48 0.54 0.53 0.51 0.48 0.45 0.44 0.38 0.39 0.36 0.38

288 Profile’s Unit Trusts & Collective Investments — DOMESTIC