Page 292 - Profile's Unit Trusts & Collective Investments - March 2025

P. 292

Novare Balanced Fund

Novare Balanced Fund

Novare Balanced Fund

Sector: South African—Multi Asset—

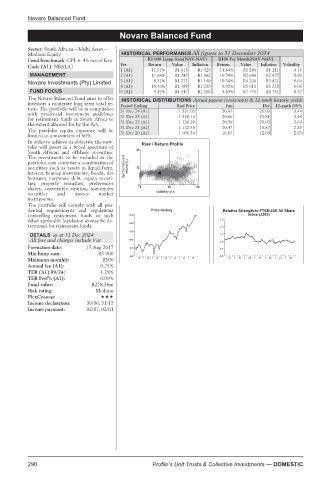

Medium Equity HISTORICAL PERFORMANCE All figures to 31 December 2024

Fund benchmark: CPI + 4% net of fees R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Code (A1): NBALA1 Yrs Return Value Inflation Return Value Inflation Volatility

1 (A1) 11.51% R1 115 R1 029 11.84% R1 280 R1 211 4.16

MANAGEMENT 2 (A1) 11.68% R1 247 R1 082 10.74% R2 688 R2 477 5.93

Novare Investments (Pty) Limited 3 (A1) 8.32% R1 271 R1 160 10.34% R4 236 R3 821 6.64

4 (A1) 10.46% R1 489 R1 229 9.92% R5 911 R5 255 6.06

FUND FOCUS 5 (A1) 9.12% R1 547 R1 266 9.83% R7 771 R6 751 8.52

The Novare Balanced Fund aims to offer HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

investors a moderate long term total re- Period Ending End Price Jun Dec 12-mnth DY%

turn. The portfolio will be in compliance 31 Dec 24 (A1) 1 321.03 20.47 25.03 3.44

with prudential investment guidelines

for retirement funds in South Africa to 31 Dec 23 (A1) 1 226.14 20.66 21.81 3.46

the extent allowed for by the Act. 31 Dec 22 (A1) 1 136.30 20.36 21.03 3.64

31 Dec 21 (A1) 1 152.55 10.47 15.87 2.29

The portfolio equity exposure will be 31 Dec 20 (A1) 1 006.34 16.87 12.60 2.93

limited to a maximum of 60%.

In order to achieve its objective the port- Risk / Return Profile

folio will invest in a broad spectrum of

South African and offshore securities. 25

The investments to be included in the

portfolio may comprise a combination of

securities such as assets in liquid form, 3yr Compound return(%) 12

interest bearing instruments, bonds, de-

bentures, corporate debt, equity securi-

ties, property securities, preferences 0

shares, convertible equities, non-equity 0 10 20

securities and money market Volatility p.a.

instruments.

The portfolio will comply with all pru-

dential requirements and regulations Price History Relative Strength to FTSE/JSE All Share

controlling retirement funds or such 1330 index (J203)

other applicable legislation as may be de- 1.5

termined for retirement funds. 1240 1.3

1150

DETAILS as at 31 Dec 2024 1.1

All fees and charges include Vat 1060 0.9

Formation date: 15 Aug 2017 970 0.7

Min lump sum: R5 000

880 0.5

Minimum monthly: R500 18 | 19 | 20 | 21 | 22 | 23 | 24 18 | 19 | 20 | 21 | 22 | 23 | 24

Annual fee (A1): 0.75%

TER (A1) 09/24: 1.28%

TER Perf% (A1): 0.00%

Fund value: R218.36m

Risk rating: Medium

PlexCrowns:

Income declaration: 30/06, 31/12

Income payment: 02/07, 02/01

290 Profile’s Unit Trusts & Collective Investments — DOMESTIC