Page 278 - Profile's Unit Trusts & Collective Investments - March 2025

P. 278

Marriott High Income Fund of Funds

Marriott High Income Fund of Funds

Marriott High Income Fund of Funds

Sector: South African—Multi Asset—

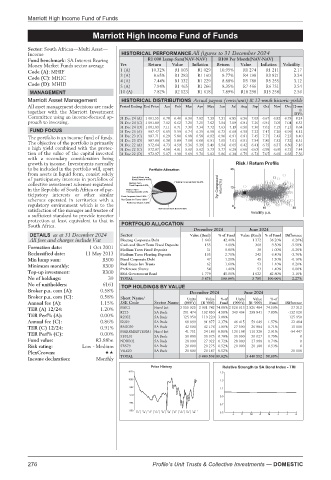

Income HISTORICAL PERFORMANCE All figures to 31 December 2024

Fund benchmark: SA Interest Bearing R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Money Market Funds sector average Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): MHIF 1 (A) 10.32% R1 103 R1 029 10.95% R1 274 R1 211 2.17

Code (C): MHIC 3 (A) 8.65% R1 283 R1 160 9.77% R4 198 R3 821 3.34

3.12

R1 332

8.88%

R5 780

R5 255

7.44%

R1 229

4 (A)

Code (D): MHID 5 (A) 7.94% R1 465 R1 266 8.35% R7 466 R6 751 3.54

MANAGEMENT 10 (A) 7.82% R2 123 R1 618 7.89% R18 298 R15 258 2.56

Marriott Asset Management HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

All asset management decisions are made Period Ending End Price Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 12-mn

th

together with the Marriott Investment DY%

Committee using an income-focused ap- 31 Dec 24 (A) 1 001.55 6.78 6.40 6.96 7.02 7.39 7.31 6.85 6.56 7.03 6.67 6.82 6.79 8.24

proach to investing. 31 Dec 24 (C) 1 001.80 7.02 6.62 7.20 7.25 7.62 7.54 7.09 6.81 7.26 6.91 7.05 7.04 8.53

31 Dec 24 (D) 1 001.89 7.11 6.71 7.30 7.34 7.72 7.63 7.19 6.90 7.36 7.01 7.15 7.13 8.64

FUND FOCUS 31 Dec 23 (A) 987.47 6.05 5.59 6.74 6.35 6.58 6.73 6.68 6.58 7.22 7.47 7.20 6.99 8.12

The portfolio is an income fund of funds. 31 Dec 23 (C) 987.71 6.29 5.80 6.98 6.58 6.82 6.96 6.91 6.81 7.45 7.71 7.43 7.23 8.40

The objective of the portfolio is primarily 31 Dec 23 (D) 987.80 6.38 5.89 7.08 6.68 6.91 7.05 7.01 6.91 7.54 7.80 7.52 7.32 8.51

7.16

972.64

6.50

6.05

6.75

6.41

6.42

31 Dec 22 (A)

5.39

5.36

5.49

6.37

5.54

4.73

4.59

a high yield combined with the protec- 31 Dec 22 (C) 972.87 4.98 4.81 5.60 5.62 5.73 5.77 6.28 6.66 6.63 6.98 6.60 6.73 7.44

tion of the value of the capital invested 31 Dec 22 (D) 972.97 5.07 4.90 5.69 5.71 5.82 5.86 6.38 6.75 6.73 7.07 6.69 6.83 7.56

with a secondary consideration being

growth in income. Investments normally Risk / Return Profile

to be included in the portfolio will, apart 25

from assets in liquid form, consist solely

of participatory interests in portfolios of

collective investment schemes registered 3yr Compound return(%)

in the Republic of South Africa or of par- 12

ticipatory interests or other similar

schemes operated in territories with a

regulatory environment which is to the 0

10

satisfaction of the manager and trustee of 0 Volatility p.a. 20

a sufficient standard to provide investor

protection at least equivalent to that in

South Africa. PORTFOLIO ALLOCATION

December 2024 June 2024

DETAILS as at 31 December 2024 Sector Value (Rmil) % of Fund Value (Rmil) % of Fund Difference

All fees and charges include Vat Floating Corporate Debt 1 643 42.40% 1 372 36.20% 6.20%

Cash and Short Term Fixed Deposits 155 4.00% 360 9.50% -5.50%

Formation date: 1 Oct 2001 Medium Term Fixed Deposits 31 0.80% 38 1.00% -0.20%

Reclassified date: 11 May 2013 Medium Term Floating Deposits 105 2.70% 242 6.40% -3.70%

Min lump sum: R500 Fixed Corporate Debt 47 1.20% 49 1.30% -0.10%

Minimum monthly: R300 Real Estate Inv Trusts 62 1.60% 53 1.40% 0.20%

Preference Shares 54 1.40% 53 1.40% 0.00%

Top-up investment: R300 RSA Government Bond 1 779 45.90% 1 622 42.80% 3.10%

No of holdings: 39 TOTAL 3 875 100.00% 3 789 100.00% 2.27%

No of unitholders: 6161 TOP HOLDINGS BY VALUE

Broker p.a. com (A): 0.58% December 2024 June 2024

Broker p.a. com (C): 0.58% Short Name/ Units Value %of Units Value %of

Annual fee (A): 1.15% JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

27 312

TER (A) 12/24: 1.20% MRCI Fixed Int 2 555 925 2 901 742 74.88% 2 528 613 2 826 484 74.59% -132 020

R213

192 850

4.98%

7.89%

298 841

343 494

211 474

SA Bnds

TER Perf% (A): 0.00% R2032 SA Bnds 125 950 119 220 3.08% 125 950

Annual fee (C): 0.86% I2029 SA Bnds 68 899 91 877 2.37% 46 415 59 649 1.57% 22 484

TER (C) 12/24: 0.91% RN2030 SA Bnds 42 500 42 176 1.09% 27 500 26 984 0.71% 15 000

MARRMEDTERMI Fixed Int 41 751 34 186 0.88% 136 198 110 320 2.91% -94 447

TER Perf% (C): 0.00% SBSL01 SA Bnds 30 000 30 073 0.78% 30 000 30 027 0.79% 0

Fund value: R3.88bn NDBB02 SA Bnds 28 000 27 922 0.72% 28 000 27 988 0.74% 0

Risk rating: Low - Medium SBS79 SA Bnds 20 000 20 275 0.52% 20 000 20 188 0.53% 0

PlexCrowns: VKE20 SA Bnds 20 000 20 187 0.52% 20 000

Income declaration: Monthly TOTAL 3 480 508 89.82% 3 440 592 90.80%

Price History Relative Strength to SA Bond Index - TRI

1020 1.5

1006 1.3

992

1.1

978

0.9

964

0.7

950

15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 0.5

J F M A M J J A

276 Profile’s Unit Trusts & Collective Investments — DOMESTIC