Page 272 - Profile's Unit Trusts & Collective Investments - March 2025

P. 272

Marriott Balanced Fund of Funds

Marriott Balanced Fund of Funds

Marriott Balanced Fund of Funds

Sector: South African—Multi Asset—

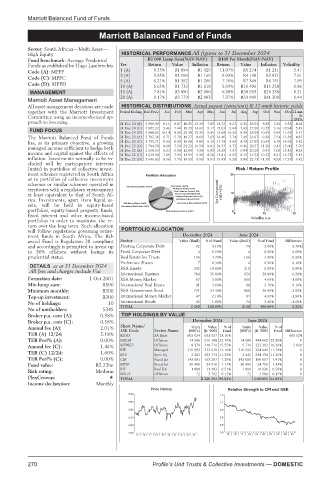

High Equity HISTORICAL PERFORMANCE All figures to 31 December 2024

Fund benchmark: Average Prudential R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Funds as published by Hugo Lambrechts Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): MPFF 1 (A) 9.35% R1 094 R1 029 11.07% R1 274 R1 211 5.47

Code (C): MPFC 3 (A) 5.95% R1 189 R1 160 9.03% R4 148 R3 821 7.91

R1 352

R1 266

5 (A)

R7 349

7.76%

6.21%

7.99

R6 751

Code (D): MPFD 10 (A) 5.65% R1 733 R1 618 5.93% R16 406 R15 258 6.86

MANAGEMENT 15 (A) 7.81% R3 090 R2 086 6.68% R30 993 R26 338 6.21

20 (A) 9.17% R5 779 R2 883 7.37% R54 849 R41 309 6.44

Marriott Asset Management

All asset management decisions are made HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

together with the Marriott Investment Period Ending End Price Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 12-mn

Committee using an income-focused ap- th

proach to investing. 31 Dec 24 (A) 2 905.90 8.11 6.17 18.35 13.34 7.85 13.72 8.27 6.30 26.53 8.85 7.81 9.52 DY%

4.64

31 Dec 24 (C) 2 907.32 9.46 7.44 19.70 14.61 9.17 15.03 9.64 7.69 27.90 10.25 9.16 10.94 5.19

FUND FOCUS

31 Dec 24 (D) 2 908.02 10.14 8.08 20.38 15.25 9.84 15.68 10.32 8.39 28.58 10.95 9.84 11.64 5.47

The Marriott Balanced Fund of Funds 31 Dec 23 (A) 2 792.36 6.71 5.79 18.27 8.60 7.82 16.46 7.74 7.45 26.67 9.36 7.54 13.58 4.87

has, as its primary objective, a growing 31 Dec 23 (C) 2 793.71 8.03 6.99 19.58 9.89 9.15 17.74 9.06 8.79 27.93 10.63 8.79 14.93 5.42

managed income sufficient to hedge both 31 Dec 23 (D) 2 794.38 8.68 7.59 20.23 10.54 9.81 18.37 9.72 9.46 28.57 11.26 9.41 15.60 5.70

income and capital against the effects of 31 Dec 22 (A) 2 638.69 6.53 5.98 12.64 7.98 6.95 13.59 7.37 6.84 20.29 9.47 7.05 15.43 4.55

9.26

7.89

7.19 13.94

8.65

8.15 21.52 10.73

8.26 14.81

31 Dec 22 (C) 2 639.98

5.13

8.31 16.72

inflation. Investments normally to be in- 31 Dec 22 (D) 2 640.63 8.56 7.79 14.59 9.90 8.91 15.43 9.28 8.80 22.13 11.35 8.93 17.37 5.42

cluded will be participatory interests

(units) in portfolios of collective invest- Risk / Return Profile

ment schemes registered in South Africa 25

or in portfolios of collective investment

schemes or similar schemes operated in

territories with a regulatory environment

at least equivalent to that of South Af- 3yr Compound return(%) 12

rica. Investments, apart from liquid as-

sets, will be held in equity-based

portfolios, equity-based property funds, 0

fixed interest and other income-based 0 10 20

portfolios in order to maximise the re- Volatility p.a.

turn over the long term. Such allocation

will follow regulations governing retire- PORTFOLIO ALLOCATION

ment funds in South Africa. The Bal- December 2024 June 2024

anced Fund is Regulation 28 compliant Sector Value (Rmil) % of Fund Value (Rmil) % of Fund Difference

and accordingly is permitted to invest up Floating Corporate Debt 92 4.10% 74 3.40% 0.70%

to 30% offshore without losings its Fixed Corporate Debt 4 0.20% 4 0.20% 0.00%

prudential status. Real Estate Inv Trusts 105 4.70% 106 4.90% -0.20%

Preference Shares 7 0.30% 4 0.20% 0.10%

DETAILS as at 31 December 2024 RSA Equity 242 10.80% 215 9.90% 0.90%

All fees and charges include Vat

International Equities 784 35.00% 624 28.80% 6.20%

Formation date: 1 Oct 2001 RSA Money Market 67 3.00% 100 4.60% -1.60%

Min lump sum: R500 International Real Estate 81 3.60% 80 3.70% -0.10%

Minimum monthly: R300 RSA Government Bond 771 34.40% 800 36.90% -2.50%

Top-up investment: R300 International Money Market 47 2.10% 87 4.00% -1.90%

No of holdings: 10 International Bonds 40 1.80% 74 3.40% -1.60%

No of unitholders: 5345 TOTAL 2 240 100.00% 2168 100.00% 3.32%

Broker p.a. com (A): 0.58% TOP HOLDINGS BY VALUE

Broker p.a. com (C): 0.58% December 2024 June 2024

Short Name/

Annual fee (A): 2.01% Units Value %of Units Value %of

JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

TER (A) 12/24: 2.18% R2035 SA Bnds 665 024 631 537 28.16% 665 024

TER Perf% (A): 0.00% MIIGF Offshore 14 586 510 188 22.75% 14 586 484 662 22.35% 0

Annual fee (C): 1.44% MFWEF Offshore 8 379 348 719 15.55% 5 710 222 392 10.26% 2 669

EIF Managed 310 992 272 678 12.16% 310 992 254 640 11.74% 0

TER (C) 12/24: 1.60% DIV Spec Eq 2 442 253 774 11.32% 2 442 244 131 11.26% 0

TER Perf% (C): 0.00% CIF Fixed Int 143 681 163 207 7.28% 143 681 160 607 7.41% 0

Fund value: R2.23bn MTIF Fixed Int 30 496 24 916 1.11% 30 496 24 702 1.14% 0

Risk rating: Medium PIF Real Est 1 800 11 483 0.51% 1 800 10 936 0.50% 0 0

0.17%

0.17%

MIGA

72

3 581

3 792

Offshore

72

PlexCrowns: TOTAL 2 220 293 99.02% 1405651 64.83%

Income declaration: Monthly

Price History Relative Strength to CPI excl OER

3000

1.2

2840 1.1

2680 0.9

2520 0.8

2360 0.6

2200 0.5 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24

15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24

270 Profile’s Unit Trusts & Collective Investments — DOMESTIC