Page 268 - Profile's Unit Trusts & Collective Investments - March 2025

P. 268

Camissa Top 40 Tracker Fund

Camissa Top 40 Tracker Fund

Camissa Top 40 Tracker Fund

Sector: South African—Equity—Large

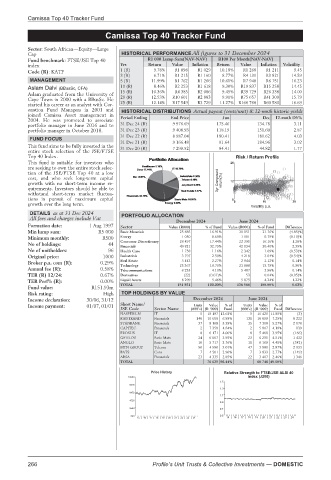

Cap HISTORICAL PERFORMANCE All figures to 31 December 2024

Fund benchmark: FTSE/JSE Top 40 R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

index Yrs Return Value Inflation Return Value Inflation Volatility

Code (R): KATF 1 (R) 9.78% R1 098 R1 029 10.18% R1 268 R1 211 9.45

3 (R) 6.71% R1 215 R1 160 8.77% R4 131 R3 821 14.59

MANAGEMENT 5 (R) 11.99% R1 762 R1 266 10.61% R7 940 R6 751 16.23

10 (R) 8.46% R2 253 R1 618 9.30% R19 837 R15 258 14.45

Aslam Dalvi (BBusSc, CFA) 15 (R) 10.36% R4 385 R2 086 9.45% R39 729 R26 338 14.00

Aslam graduated from the University of

Cape Town in 2000 with a BBusSc. He 20 (R) 12.53% R10 601 R2 883 9.91% R75 657 R41 309 15.79

started his career as an analyst with Cor- 25 (R) 12.14% R17 549 R3 729 11.27% R166 760 R60 580 16.69

onation Fund Managers in 2001 and HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

joined Camissa Asset management in Period Ending End Price Jun Dec 12-mnth DY%

2004. He was promoted to associate

portfolio manager in June 2016 and to 31 Dec 24 (R) 9 976.69 175.46 134.78 3.11

portfolio manager in October 2018. 31 Dec 23 (R) 9 408.93 118.19 151.60 2.87

31 Dec 22 (R) 8 987.04 180.41 181.62 4.03

FUND FOCUS

31 Dec 21 (R) 9 166.48 91.64 184.96 3.02

This fund aims to be fully invested in the 31 Dec 20 (R) 7 299.52 84.41 44.82 1.77

entire stock selection of the JSE/FTSE

Top 40 Index. Risk / Return Profile

This fund is suitable for investors who 25

are seeking to own the entire stock selec-

tion of the JSE/FTSE Top 40 at a low

cost, and who seek long-term capital 3yr Compound return(%)

growth with no short-term income re- 12

quirements. Investors should be able to

withstand short-term market fluctua-

tions in pursuit of maximum capital 0

10

growth over the long term. 0 Volatility p.a. 20

DETAILS as at 31 Dec 2024 PORTFOLIO ALLOCATION

All fees and charges include Vat

December 2024 June 2024

Formation date: 1 Aug 1997 Sector Value (R000) % of Fund Value (R000) % of Fund Difference

Min lump sum: R5 000 Basic Materials 25 685 16.91% 30 151 21.76% (4.85)%

Minimum monthly: R500 Energy 1 050 0.69% 1 101 0.79% (0.10)%

No of holdings: 44 Consumer Discretionary 26 497 17.44% 22 395 16.16% 1.28%

Financials 49 821 32.79% 42 134 30.40% 2.39%

No of unitholders: 96 Health Care 1 758 1.16% 2 342 1.69% (0.53)%

Original price: 1000 Industrials 3 797 2.50% 4 218 3.04% (0.54)%

2.12%

2 944

3 443

2.27%

Broker p.a. com (R): 0.29% Real Estate 25 367 16.70% 21 888 15.79% 0.14%

Technology

0.90%

Annual fee (R): 0.58% Telecommunications 6 235 4.10% 5 487 3.96% 0.14%

TER (R) 12/24: 0.67% Derivatives (22) (0.01)% 53 0.04% (0.05)%

TER Perf% (R): 0.00% Liquid Assets 8 299 5.46% 5 875 4.24% 1.22%

Fund value: R151.93m TOTAL 151 931 100.00% 138 588 100.00% 9.63%

Risk rating: High TOP HOLDINGS BY VALUE

Income declaration: 30/06, 31/12 December 2024 June 2024

Short Name/

Income payment: 01/07, 01/01 Units Value %of Units Value %of

JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

NASPERS-N IT 5 19 197 12.64% 5 16 420 11.85% (3)

FIRSTRAND Financials 140 10 600 6.98% 131 10 099 7.29% 8 222

STANBANK Financials 37 8 168 5.38% 35 7 308 5.27% 2 170

CAPITEC Financials 2 7 359 4.84% 2 5 807 4.19% 139

PROSUS IT 8 6 171 4.06% 8 5 468 3.95% (166)

GFIELDS Basic Mats 24 6 007 3.95% 23 6 255 4.51% 1 432

ANGLO Basic Mats 10 5 717 3.76% 11 6 169 4.45% (342)

MTN GROUP Telcom 50 4 580 3.01% 47 3 980 2.87% 2 933

BATS Cons 7 4 501 2.96% 7 3 833 2.77% (149)

ABSA Financials 23 4 335 2.85% 22 3 407 2.46% 1 346

TOTAL 76 635 50.44% 68 746 49.60%

Price History Relative Strength to FTSE/JSE ALSI 40

10360 index (J200)

1.5

8416

1.3

6472

1.1

4528

0.9

2584 0.7

640 0.5 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24

15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24

266 Profile’s Unit Trusts & Collective Investments — DOMESTIC