Page 179 - Profile's Unit Trusts & Collective Investments - September 2025

P. 179

Fund manager interviews Chapter 9

Inflation-linked securities, on the other hand, are designed to protect against inflation by adjusting

their principal and interest payments based on inflation rates. This feature ensures that the real

value of the investment is preserved, making them an excellent choice for long-term investors

concerned about rising prices. As inflationary pressures continue to impact the global economy,

these securities become increasingly valuable, offering both income and protection.

In conclusion, incorporating nominal government bonds and inflation-linked securities into a

diversified portfolio can provide a balanced approach to managing risk and maximising returns. By

leveraging the inherent strengths of these asset classes, investors can achieve a robust and resilient

investment strategy that stands the test of time.

Give your views regarding interest rate trends and the yield curve over the next 1 to 2 years.

What interest rates can investors expect? Do you anticipate further repo rate cuts?

Although we continue to experience relatively high real interest rates in South Africa, the central

bank’s ability to make adjustments will heavily depend on the trajectory of inflation. The longer end of

the yield curve is more influenced by international rates and supply and demand dynamics. While low

inflation currently provides support, any increase in this low inflation environment could adversely

affect the longer end of the curve. Additionally, offshore rates and rising overall government debt

may exert further pressure on the longer end.

In the context of the current economic landscape, it is essential to consider various factors that

could impact interest rates and the yield curve. The central bank’s decisions will be closely tied

to inflation trends, and any shifts in inflation could prompt adjustments in monetary policy. This

dynamic highlights the importance of staying vigilant and adaptable in our strategies.

Furthermore, the interplay between international rates and domestic supply and demand cannot

be ignored. Global economic conditions and foreign interest rates will continue to shape the longer

end of the yield curve. As these factors evolve, they will influence the cost of borrowing and the

returns on fixed-income assets.

Moreover, the rising overall government debt adds another layer of complexity. Increased debt

levels can lead to higher yields as investors demand greater compensation for the perceived risk.

This scenario underscores the need for a comprehensive and proactive approach to managing our

investments, ensuring that we are well-positioned to navigate the challenges and opportunities that

lie ahead.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

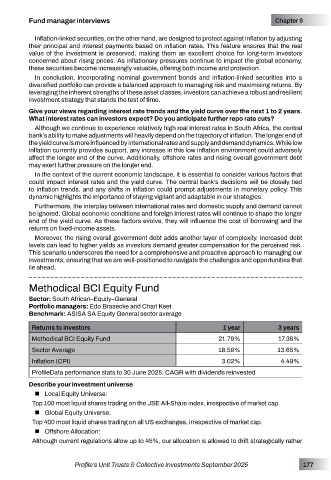

Methodical BCI Equity Fund

Sector: South African–Equity–General

Portfolio managers: Edo Brasecke and Charl Keet

Benchmark: ASISA SA Equity General sector average

Returns to investors 1 year 3 years

Methodical BCI Equity Fund 21.79% 17.36%

Sector Average 18.59% 13.65%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

Local Equity Universe:

Top 100 most liquid shares trading on the JSE All-Share index, irrespective of market cap.

Global Equity Universe:

Top 400 most liquid shares trading on all US exchanges, irrespective of market cap.

Offshore Allocation:

Although current regulations allow up to 45%, our allocation is allowed to drift strategically rather

Profile’s Unit Trusts & Collective Investments September 2025 177