Page 175 - Profile's Unit Trusts & Collective Investments - September 2025

P. 175

Fund manager interviews Chapter 9

Are equity markets in general overpriced? Do you anticipate a significant correction?

Global equity markets do appear richly valued on a market capitalisation-weighted basis.

Importantly, this is not occurring against a backdrop of depressed earnings or profit expectations,

making it increasingly difficult to achieve attractive returns from global index exposures. Fortunately,

we do not solely invest in the global index, and while the headline pricing levels are optically

demanding, this belies considerable opportunities at the country and regional level. As macro

allocators, we are positioned to take advantage of these.

Which asset classes do you expect will give the best total rates of return over the next

few years?

Developed market government bonds.

Offshore investments are heavily influenced by the rand. Give your view on the rand over the

next 1, 3 and 5 years.

The South African rand is only one side of the currency exposure – which global currency

exposures are held should also be vital for the rand-based investor. Currently, the rand is moderately

attractive by historical standards against the US dollar, having performed well against a benign

inflation backdrop.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

As macro investors, we currently see Turkish, Chinese and Indonesian equities as medium

term opportunities. While some of this view is more tactical in terms of the entry points into these

trades, each of these markets has features that allow us to enter into attractive index-level positions

at valuations that are historically favourable.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

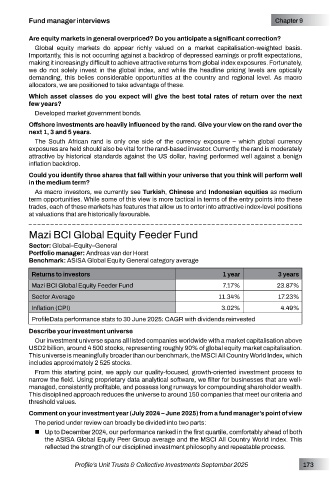

Mazi BCI Global Equity Feeder Fund

Sector: Global–Equity–General

Portfolio manager: Andreas van der Horst

Benchmark: ASISA Global Equity General category average

Returns to investors 1 year 3 years

Mazi BCI Global Equity Feeder Fund 7.17% 23.87%

Sector Average 11.34% 17.23%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

Our investment universe spans all listed companies worldwide with a market capitalisation above

USD2 billion, around 4 500 stocks, representing roughly 90% of global equity market capitalisation.

This universe is meaningfully broader than our benchmark, the MSCI All Country World Index, which

includes approximately 2 525 stocks.

From this starting point, we apply our quality-focused, growth-oriented investment process to

narrow the field. Using proprietary data analytical software, we filter for businesses that are well-

managed, consistently profitable, and possess long runways for compounding shareholder wealth.

This disciplined approach reduces the universe to around 150 companies that meet our criteria and

threshold values.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The period under review can broadly be divided into two parts:

Up to December 2024, our performance ranked in the first quartile, comfortably ahead of both

the ASISA Global Equity Peer Group average and the MSCI All Country World Index. This

reflected the strength of our disciplined investment philosophy and repeatable process.

Profile’s Unit Trusts & Collective Investments September 2025 173