Page 174 - Profile's Unit Trusts & Collective Investments - September 2025

P. 174

Chapter 9 Fund manager interviews

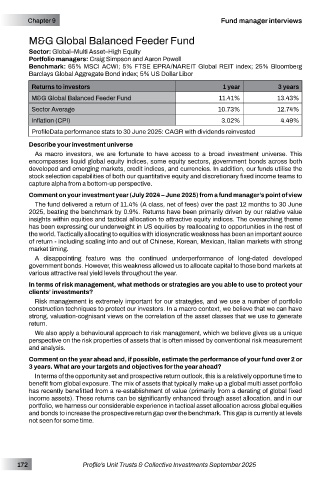

M&G Global Balanced Feeder Fund

Sector: Global–Multi Asset–High Equity

Portfolio managers: Craig Simpson and Aaron Powell

Benchmark: 65% MSCI ACWI; 5% FTSE EPRA/NAREIT Global REIT index; 25% Bloomberg

Barclays Global Aggregate Bond index; 5% US Dollar Libor

Returns to investors 1 year 3 years

M&G Global Balanced Feeder Fund 11.41% 13.43%

Sector Average 10.73% 12.74%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

As macro investors, we are fortunate to have access to a broad investment universe. This

encompasses liquid global equity indices, some equity sectors, government bonds across both

developed and emerging markets, credit indices, and currencies. In addition, our funds utilise the

stock selection capabilities of both our quantitative equity and discretionary fixed income teams to

capture alpha from a bottom-up perspective.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The fund delivered a return of 11.4% (A class, net of fees) over the past 12 months to 30 June

2025, beating the benchmark by 0.9%. Returns have been primarily driven by our relative value

insights within equities and tactical allocation to attractive equity indices. The overarching theme

has been expressing our underweight in US equities by reallocating to opportunities in the rest of

the world. Tactically allocating to equities with idiosyncratic weakness has been an important source

of return - including scaling into and out of Chinese, Korean, Mexican, Italian markets with strong

market timing.

A disappointing feature was the continued underperformance of long-dated developed

government bonds. However, this weakness allowed us to allocate capital to those bond markets at

various attractive real yield levels throughout the year.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Risk management is extremely important for our strategies, and we use a number of portfolio

construction techniques to protect our investors. In a macro context, we believe that we can have

strong, valuation-cognisant views on the correlation of the asset classes that we use to generate

return.

We also apply a behavioural approach to risk management, which we believe gives us a unique

perspective on the risk properties of assets that is often missed by conventional risk measurement

and analysis.

Comment on the year ahead and, if possible, estimate the performance of your fund over 2 or

3 years. What are your targets and objectives for the year ahead?

In terms of the opportunity set and prospective return outlook, this is a relatively opportune time to

benefit from global exposure. The mix of assets that typically make up a global multi asset portfolio

has recently benefitted from a re-establishment of value (primarily from a derating of global fixed

income assets). These returns can be significantly enhanced through asset allocation, and in our

portfolio, we harness our considerable experience in tactical asset allocation across global equities

and bonds to increase the prospective return gap over the benchmark. This gap is currently at levels

not seen for some time.

172 Profile’s Unit Trusts & Collective Investments September 2025