Page 170 - Profile's Unit Trusts & Collective Investments - September 2025

P. 170

Chapter 9 Fund manager interviews

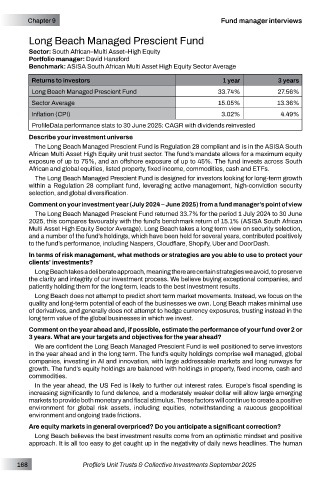

Long Beach Managed Prescient Fund

Sector: South African–Multi Asset–High Equity

Portfolio manager: David Hansford

Benchmark: ASISA South African Multi Asset High Equity Sector Average

Returns to investors 1 year 3 years

Long Beach Managed Prescient Fund 33.74% 27.56%

Sector Average 15.05% 13.36%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The Long Beach Managed Prescient Fund is Regulation 28 compliant and is in the ASISA South

African Multi Asset High Equity unit trust sector. The fund’s mandate allows for a maximum equity

exposure of up to 75%, and an offshore exposure of up to 45%. The fund invests across South

African and global equities, listed property, fixed income, commodities, cash and ETFs.

The Long Beach Managed Prescient Fund is designed for investors looking for long-term growth

within a Regulation 28 compliant fund, leveraging active management, high-conviction security

selection, and global diversification.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The Long Beach Managed Prescient Fund returned 33.7% for the period 1 July 2024 to 30 June

2025, this compares favourably with the fund’s benchmark return of 15.1% (ASISA South African

Multi Asset High Equity Sector Average). Long Beach takes a long term view on security selection,

and a number of the fund’s holdings, which have been held for several years, contributed positively

to the fund’s performance, including Naspers, Cloudflare, Shopify, Uber and DoorDash.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Long Beach takes a deliberate approach, meaning there are certain strategies we avoid, to preserve

the clarity and integrity of our investment process. We believe buying exceptional companies, and

patiently holding them for the long term, leads to the best investment results.

Long Beach does not attempt to predict short term market movements. Instead, we focus on the

quality and long-term potential of each of the businesses we own. Long Beach makes minimal use

of derivatives, and generally does not attempt to hedge currency exposures, trusting instead in the

long term value of the global businesses in which we invest.

Comment on the year ahead and, if possible, estimate the performance of your fund over 2 or

3 years. What are your targets and objectives for the year ahead?

We are confident the Long Beach Managed Prescient Fund is well positioned to serve investors

in the year ahead and in the long term. The fund’s equity holdings comprise well managed, global

companies, investing in AI and innovation, with large addressable markets and long runways for

growth. The fund’s equity holdings are balanced with holdings in property, fixed income, cash and

commodities.

In the year ahead, the US Fed is likely to further cut interest rates. Europe’s fiscal spending is

increasing significantly to fund defence, and a moderately weaker dollar will allow large emerging

markets to provide both monetary and fiscal stimulus. These factors will continue to create a positive

environment for global risk assets, including equities, notwithstanding a raucous geopolitical

environment and ongoing trade frictions.

Are equity markets in general overpriced? Do you anticipate a significant correction?

Long Beach believes the best investment results come from an optimistic mindset and positive

approach. It is all too easy to get caught up in the negativity of daily news headlines. The human

168 Profile’s Unit Trusts & Collective Investments September 2025