Page 168 - Profile's Unit Trusts & Collective Investments - September 2025

P. 168

Chapter 9 Fund manager interviews

Are equity markets in general overpriced? Do you anticipate a significant correction?

On the back of the significant recovery from the 8 April 2025 low (and as at mid-August 2025)

equity markets are no longer inexpensively priced. A correction could occur (and could be healthy)

but at current levels of +/- 10% expected return per annum for the next 3 years, both SA and global

equity still offer decent returns in rand terms over the medium return.

Which asset classes do you expect will give the best total rates of return over the next few years?

Based on our fundamental analysis and valuation work, and despite the recent rally, global equity

still stands out from an expected return perspective. Within the asset class, European and emerging

market equities could continue to benefit from an environment within which the US dollar is under

pressure.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

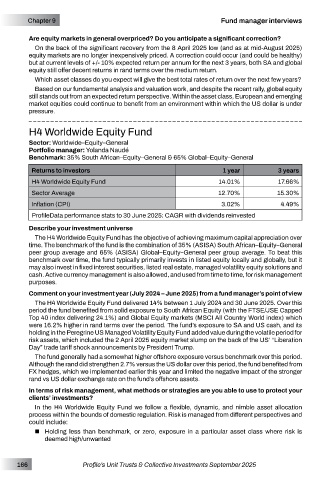

H4 Worldwide Equity Fund

Sector: Worldwide–Equity–General

Portfolio manager: Yolanda Naudé

Benchmark: 35% South African–Equity–General & 65% Global–Equity–General

Returns to investors 1 year 3 years

H4 Worldwide Equity Fund 14.01% 17.66%

Sector Average 12.70% 15.30%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The H4 Worldwide Equity Fund has the objective of achieving maximum capital appreciation over

time. The benchmark of the fund is the combination of 35% (ASISA) South African–Equity–General

peer group average and 65% (ASISA) Global–Equity–General peer group average. To beat this

benchmark over time, the fund typically primarily invests in listed equity locally and globally, but it

may also invest in fixed interest securities, listed real estate, managed volatility equity solutions and

cash. Active currency management is also allowed, and used from time to time, for risk management

purposes.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The H4 Worldwide Equity Fund delivered 14% between 1 July 2024 and 30 June 2025. Over this

period the fund benefited from solid exposure to South African Equity (with the FTSE/JSE Capped

Top 40 index delivering 24.1%) and Global Equity markets (MSCI All Country World index) which

were 16.2% higher in rand terms over the period. The fund’s exposure to SA and US cash, and its

holding in the Peregrine US Managed Volatility Equity Fund added value during the volatile period for

risk assets, which included the 2 April 2025 equity market slump on the back of the US’ “Liberation

Day” trade tariff shock announcements by President Trump.

The fund generally had a somewhat higher offshore exposure versus benchmark over this period.

Although the rand did strengthen 2.7% versus the US dollar over this period, the fund benefited from

FX hedges, which we implemented earlier this year and limited the negative impact of the stronger

rand vs US dollar exchange rate on the fund’s offshore assets.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

In the H4 Worldwide Equity Fund we follow a flexible, dynamic, and nimble asset allocation

process within the bounds of domestic regulation. Risk is managed from different perspectives and

could include:

Holding less than benchmark, or zero, exposure in a particular asset class where risk is

deemed high/unwanted

166 Profile’s Unit Trusts & Collective Investments September 2025