Page 165 - Profile's Unit Trusts & Collective Investments - September 2025

P. 165

Fund manager interviews Chapter 9

Give your views regarding interest rate trends and the yield curve over the next 1 to 2 years.

What interest rates can investors expect? Do you anticipate further repo rate cuts?

The trajectory of global interest rates through 2025 and potentially into 2026 will largely depend

on inflation trends worldwide and whether central banks can successfully bring inflation back to their

target ranges.

Looking ahead to the rest of 2025 and into early 2026, we have pencilled in more interest rate

relief and feel that the risk case is tilted towards more, rather than fewer, rate cuts going forward.

This outlook is dependent on local political stability as well as more market-friendly international

relations. However, we feel that South Africa remains hellbent on triggering the self-destruct button

with the world’s major economies.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

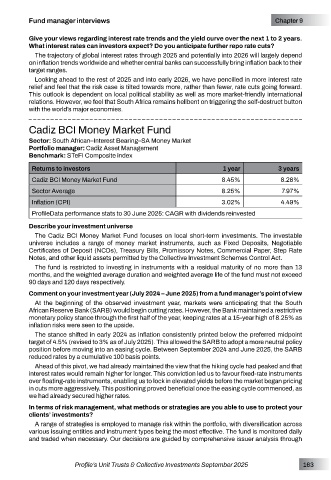

Cadiz BCI Money Market Fund

Sector: South African–Interest Bearing–SA Money Market

Portfolio manager: Cadiz Asset Management

Benchmark: STeFI Composite index

Returns to investors 1 year 3 years

Cadiz BCI Money Market Fund 8.45% 8.28%

Sector Average 8.25% 7.97%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The Cadiz BCI Money Market Fund focuses on local short-term investments. The investable

universe includes a range of money market instruments, such as Fixed Deposits, Negotiable

Certificates of Deposit (NCDs), Treasury Bills, Promissory Notes, Commercial Paper, Step Rate

Notes, and other liquid assets permitted by the Collective Investment Schemes Control Act.

The fund is restricted to investing in instruments with a residual maturity of no more than 13

months, and the weighted average duration and weighted average life of the fund must not exceed

90 days and 120 days respectively.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

At the beginning of the observed investment year, markets were anticipating that the South

African Reserve Bank (SARB) would begin cutting rates. However, the Bank maintained a restrictive

monetary policy stance through the first half of the year, keeping rates at a 15-year high of 8.25% as

inflation risks were seen to the upside.

The stance shifted in early 2024 as inflation consistently printed below the preferred midpoint

target of 4.5% (revised to 3% as of July 2025). This allowed the SARB to adopt a more neutral policy

position before moving into an easing cycle. Between September 2024 and June 2025, the SARB

reduced rates by a cumulative 100 basis points.

Ahead of this pivot, we had already maintained the view that the hiking cycle had peaked and that

interest rates would remain higher for longer. This conviction led us to favour fixed-rate instruments

over floating-rate instruments, enabling us to lock in elevated yields before the market began pricing

in cuts more aggressively. This positioning proved beneficial once the easing cycle commenced, as

we had already secured higher rates.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

A range of strategies is employed to manage risk within the portfolio, with diversification across

various issuing entities and instrument types being the most effective. The fund is monitored daily

and traded when necessary. Our decisions are guided by comprehensive issuer analysis through

Profile’s Unit Trusts & Collective Investments September 2025 163