Page 163 - Profile's Unit Trusts & Collective Investments - September 2025

P. 163

Fund manager interviews Chapter 9

Our fund is positioned to navigate this environment by focusing on high-quality companies with

strong fundamentals that are trading at a reasonable price.

Which asset classes do you expect will give the best total rates of return over the next

few years?

Global Equities, for the reasons mentioned above.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

Locally, we have strong overweight positions in Prosus Ltd, AngloGold Plc, and Discovery

Group Ltd,

Global portfolio, we have strong overweights in Alphabet, UniCredit, and ASML.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

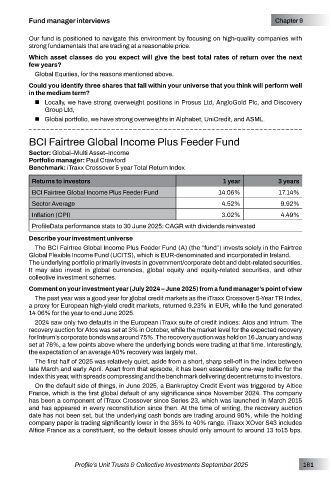

BCI Fairtree Global Income Plus Feeder Fund

Sector: Global–Multi Asset–Income

Portfolio manager: Paul Crawford

Benchmark: iTraxx Crossover 5 year Total Return Index

Returns to investors 1 year 3 years

BCI Fairtree Global Income Plus Feeder Fund 14.06% 17.14%

Sector Average 4.52% 9.92%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The BCI Fairtree Global Income Plus Feeder Fund (A) (the “fund”) invests solely in the Fairtree

Global Flexible Income Fund (UCITS), which is EUR-denominated and incorporated in Ireland.

The underlying portfolio primarily invests in government/corporate debt and debt-related securities.

It may also invest in global currencies, global equity and equity-related securities, and other

collective investment schemes.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The past year was a good year for global credit markets as the iTraxx Crossover 5-Year TR Index,

a proxy for European high-yield credit markets, returned 9.23% in EUR, while the fund generated

14.06% for the year to end June 2025.

2024 saw only two defaults in the European iTraxx suite of credit indices: Atos and Intrum. The

recovery auction for Atos was set at 3% in October, while the market level for the expected recovery

for Intrum’s corporate bonds was around 75%. The recovery auction was held on 16 January and was

set at 76%, a few points above where the underlying bonds were trading at that time. Interestingly,

the expectation of an average 40% recovery was largely met.

The first half of 2025 was relatively quiet, aside from a short, sharp sell-off in the index between

late March and early April. Apart from that episode, it has been essentially one-way traffic for the

index this year, with spreads compressing and the benchmark delivering decent returns to investors.

On the default side of things, in June 2025, a Bankruptcy Credit Event was triggered by Altice

France, which is the first global default of any significance since November 2024. The company

has been a component of iTraxx Crossover since Series 23, which was launched in March 2015

and has appeared in every reconstitution since then. At the time of writing, the recovery auction

date has not been set, but the underlying cash bonds are trading around 90%, while the holding

company paper is trading significantly lower in the 35% to 40% range. iTraxx XOver S43 includes

Altice France as a constituent, so the default losses should only amount to around 13 to15 bps.

Profile’s Unit Trusts & Collective Investments September 2025 161