Page 177 - Profile's Unit Trusts & Collective Investments - September 2025

P. 177

Fund manager interviews Chapter 9

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

Stride Inc. (LRN US): Online K12 schooling & vocation training in the USA

Nu Holdings (NU US): Digital banking disruptor in Latin America

Interactive Brokers (IBKR US): Online stockbroking worldwide

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

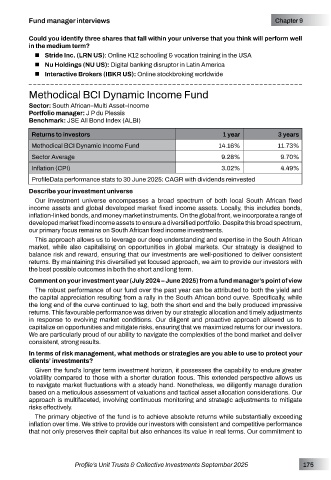

Methodical BCI Dynamic Income Fund

Sector: South African–Multi Asset–Income

Portfolio manager: J P du Plessis

Benchmark: JSE All Bond Index (ALBI)

Returns to investors 1 year 3 years

Methodical BCI Dynamic Income Fund 14.16% 11.73%

Sector Average 9.28% 9.70%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

Our investment universe encompasses a broad spectrum of both local South African fixed

income assets and global developed market fixed income assets. Locally, this includes bonds,

inflation-linked bonds, and money market instruments. On the global front, we incorporate a range of

developed market fixed income assets to ensure a diversified portfolio. Despite this broad spectrum,

our primary focus remains on South African fixed income investments.

This approach allows us to leverage our deep understanding and expertise in the South African

market, while also capitalising on opportunities in global markets. Our strategy is designed to

balance risk and reward, ensuring that our investments are well-positioned to deliver consistent

returns. By maintaining this diversified yet focused approach, we aim to provide our investors with

the best possible outcomes in both the short and long term.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The robust performance of our fund over the past year can be attributed to both the yield and

the capital appreciation resulting from a rally in the South African bond curve. Specifically, while

the long end of the curve continued to lag, both the short end and the belly produced impressive

returns. This favourable performance was driven by our strategic allocation and timely adjustments

in response to evolving market conditions. Our diligent and proactive approach allowed us to

capitalize on opportunities and mitigate risks, ensuring that we maximized returns for our investors.

We are particularly proud of our ability to navigate the complexities of the bond market and deliver

consistent, strong results.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Given the fund’s longer term investment horizon, it possesses the capability to endure greater

volatility compared to those with a shorter duration focus. This extended perspective allows us

to navigate market fluctuations with a steady hand. Nonetheless, we diligently manage duration

based on a meticulous assessment of valuations and tactical asset allocation considerations. Our

approach is multifaceted, involving continuous monitoring and strategic adjustments to mitigate

risks effectively.

The primary objective of the fund is to achieve absolute returns while substantially exceeding

inflation over time. We strive to provide our investors with consistent and competitive performance

that not only preserves their capital but also enhances its value in real terms. Our commitment to

Profile’s Unit Trusts & Collective Investments September 2025 175