Page 265 - Profile's Unit Trusts & Collective Investments - September 2025

P. 265

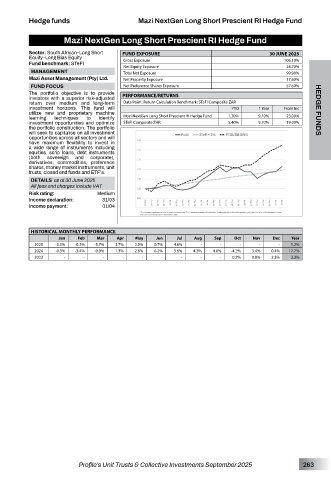

Hedge funds Mazi NextGen Long Short Prescient RI Hedge Fund

Mazi NextGen Long Short Prescient RI Hedge Fund

Sector: South African–Long Short FUND EXPOSURE 30 JUNE 2025

Equity–Long Bias Equity Gross Exposure 106.10%

Fund benchmark: STeFI

Net Equity Exposure 24.70%

MANAGEMENT Total Net Exposure 99.90%

Mazi Asset Management (Pty) Ltd. Net Property Exposure 17.60%

FUND FOCUS Net Preference Shares Exposure 57.60%

The portfolio objective is to provide

investors with a superior risk-adjusted PERFORMANCE/RETURNS

return over medium and long-term Data Point: Return Calculation Benchmark: STeFI Composite ZAR

investment horizons. This fund will YTD 1 Year From Inc

utilize new and proprietary machine HEDGE FUNDS

learning techniques to identify Mazi NextGen Long Short Prescient RI Hedge Fund 1.20% 9.10% 23.00%

investment opportunities and optimize STeFI Composite ZAR 5.40% 9.70% 19.00%

the portfolio construction. The portfolio

will seek to capitalise on all investment

opportunities across all sectors and will

have maximum flexibility to invest in

a wide range of instruments including

equities, scrip loans, debt instruments

(both sovereign and corporate),

derivatives, commodities, preference

shares, money market instruments, unit

trusts, closed end funds and ETF’s.

DETAILS as at 30 June 2025

All fees and charges include VAT

Risk rating: Medium

Income declaration: 31/03

Income payment: 01/04

HISTORICAL MONTHLY PERFORMANCE

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2025 -3.3% -0.2% -5.7% 3.7% 2.0% 0.7% 4.6% - - - - - 1.2%

2024 -0.3% -3.4% -0.9% 1.3% 2.6% 6.2% 3.6% 4.3% 4.0% -4.2% 3.4% 0.4% 17.7%

2023 - - - - - - - - - 0.2% 0.8% 2.3% 3.3%

Profile’s Unit Trusts & Collective Investments September 2025 263