Page 261 - Profile's Unit Trusts & Collective Investments - September 2025

P. 261

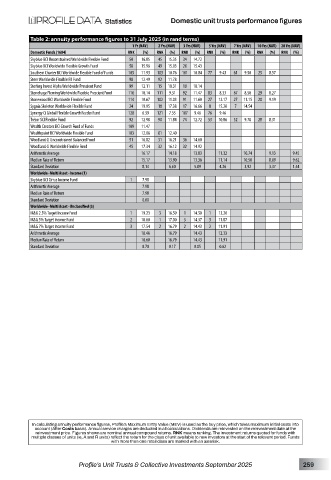

Domestic unit trusts performance figures

Table 2: annuity performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Skyblue BCI Unconstrained Worldwide Flexible Fund 50 16.85 45 15.35 34 14.72

Skyblue BCI Worldwide Flexible Growth Fund 58 15.96 49 15.03 26 15.43

Southern Charter BCI Worldwide Flexible Fund of Funds 105 11.93 103 10.76 101 10.84 77 9.43 61 9.50 25 8.57

Steer Worldwide Flexible FR Fund 98 12.49 92 11.78

Sterling Invest Alpha Worldwide Prescient Fund 99 12.11 15 18.31 10 18.14

Stonehage Fleming Worldwide Flexible Prescient Fund 116 10.14 111 9.31 92 11.47 83 8.33 67 8.50 29 8.27

Stonewood BCI Worldwide Flexible Fund 114 10.67 102 11.03 91 11.60 27 12.17 27 11.15 20 9.19

Sygnia Skeleton Worldwide Flexible Fund 24 19.95 18 17.38 17 16.66 8 15.20 7 14.54

Synergy Ci Global Flexible Growth Feeder Fund 128 6.39 121 7.35 107 9.46 76 9.46

Trésor SCI Flexible Fund 92 12.98 90 11.84 74 12.72 53 10.86 52 9.78 28 8.31

Wealth Creators BCI Growth Fund of Funds 109 11.47

Wealthpoint BCI Worldwide Flexible Fund 103 12.06 81 12.40

Woodland Ci Unconstrained Balanced Fund 51 16.82 31 16.21 36 14.60

Woodland Ci Worldwide Flexible Fund 45 17.34 32 16.12 32 14.92

Arithmetic Average 16.17 14.18 13.83 11.32 10.74 9.13 9.45

Median Rate of Return 15.17 13.90 13.36 11.14 10.50 8.89 9.62

Standard Deviation 8.14 6.60 5.89 4.26 3.92 3.37 1.44

Worldwide–Multi Asset–Income (1)

Skyblue BCI Cirrus Income Fund 1 7.98

Arithmetic Average 7.98

Median Rate of Return 7.98

Standard Deviation 0.00

Worldwide–Multi Asset–Unclassified (3)

M&G 2.5% Target Income Fund 1 19.23 3 16.59 1 14.50 1 13.20

M&G 5% Target Income Fund 2 18.60 1 17.00 3 14.37 3 11.87

M&G 7% Target Income Fund 3 17.54 2 16.79 2 14.43 2 11.91

Arithmetic Average 18.46 16.79 14.43 12.33

Median Rate of Return 18.60 16.79 14.43 11.91

Standard Deviation 0.70 0.17 0.05 0.62

In calculating annuity performance figures, Profile’s Maximum Entry Value (MEV) is used as the buy price, which takes maximum initial costs into

account (After Costs basis). Annual service charges are deducted in all calculations. Dividends are reinvested on the reinvestment date at the

reinvestment price. Figures shown are nominal annual compound returns. RNK means ranking. The investment returns quoted for funds with

multiple classes of units (ie, A and R units) reflect the return for the class of unit available to new investors at the start of the relevant period. Funds

with more than one retail class are marked with an asterisk.

Profile’s Unit Trusts & Collective Investments September 2025 259