Page 262 - Profile's Unit Trusts & Collective Investments - September 2025

P. 262

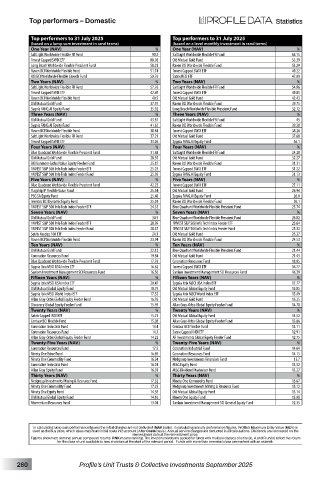

Top performers – Domestic

Top performers to 31 July 2025 Top performers to 31 July 2025

(based on a lump sum investment in rand terms) (based on a level monthly investment in rand terms)

One Year (NAV) % One Year (NAV) %

SaltLight Worldwide Flexible FR Fund 90.5 SaltLight Worldwide Flexible FR Fund 65.15

1nvest Capped SWIX ETF 88.98 Old Mutual Gold Fund 53.39

Long Beach Worldwide Flexible Prescient Fund 58.23 Raven BCI Worldwide Flexible Fund 53.29

Raven BCI Worldwide Flexible Fund 51.74 1nvest Capped SWIX ETF 49.22

RCI BCI Worldwide Flexible Growth Fund 50.76 Satrix RESI ETF 47.09

Two Years (NAV) % Two Years (NAV) %

SaltLight Worldwide Flexible FR Fund 57.76 SaltLight Worldwide Flexible FR Fund 54.96

1nvest Capped SWIX ETF 42.45 1nvest Capped SWIX ETF 49.05

Raven BCI Worldwide Flexible Fund 40.9 Old Mutual Gold Fund 42.43

Old Mutual Gold Fund 37.97 Raven BCI Worldwide Flexible Fund 39.75

Sygnia FANG.AI Equity Fund 35.92 Long Beach Worldwide Flexible Prescient Fund 32.72

Three Years (NAV) % Three Years (NAV) %

Old Mutual Gold Fund 43.87 SaltLight Worldwide Flexible FR Fund 45

Sygnia FANG.AI Equity Fund 41.62 Raven BCI Worldwide Flexible Fund 39.28

Raven BCI Worldwide Flexible Fund 38.84 1nvest Capped SWIX ETF 38.26

SaltLight Worldwide Flexible FR Fund 37.21 Old Mutual Gold Fund 37.68

1nvest Capped SWIX ETF 33.26 Sygnia FANG.AI Equity Fund 36.1

Four Years (NAV) % Four Years (NAV) %

Blue Quadrant Worldwide Flexible Prescient Fund 31.68 SaltLight Worldwide Flexible FR Fund 34.28

Old Mutual Gold Fund 28.55 Old Mutual Gold Fund 32.27

BCI Ranmore Global Value Equity Feeder Fund 25.87 Raven BCI Worldwide Flexible Fund 31.31

1NVEST S&P 500 Info Tech Index Feeder ETF 25.25 1nvest Capped SWIX ETF 31.22

1NVEST S&P 500 Info Tech Index Feeder Fund 25.05 Sygnia FANG.AI Equity Fund 31.13

Five Years (NAV) % Five Years (NAV) %

Blue Quadrant Worldwide Flexible Prescient Fund 42.22 1nvest Capped SWIX ETF 27.11

Flagship IP Flexible Value Fund 25.54 Old Mutual Gold Fund 26.94

PSG SA Equity Fund 25.48 Sygnia FANG.AI Equity Fund 26.8

Investec BCI Dynamic Equity Fund 25.01 Raven BCI Worldwide Flexible Fund 26.1

1NVEST S&P 500 Info Tech Index Feeder ETF 24.32 Blue Quadrant Worldwide Flexible Prescient Fund 25.74

Seven Years (NAV) % Seven Years (NAV) %

Old Mutual Gold Fund 30.9 Blue Quadrant Worldwide Flexible Prescient Fund 26.82

1NVEST S&P 500 Info Tech Index Feeder ETF 28.99 1NVEST S&P 500 Info Tech Index Feeder ETF 25.64

1NVEST S&P 500 Info Tech Index Feeder Fund 28.37 1NVEST S&P 500 Info Tech Index Feeder Fund 25.32

Satrix Nasdaq 100 ETF 24.1 Old Mutual Gold Fund 25.27

Raven BCI Worldwide Flexible Fund 23.94 Raven BCI Worldwide Flexible Fund 24.53

Ten Years (NAV) % Ten Years (NAV) %

Old Mutual Gold Fund 22.12 Blue Quadrant Worldwide Flexible Prescient Fund 21.44

Coronation Resources Fund 19.84 Old Mutual Gold Fund 21.43

Blue Quadrant Worldwide Flexible Prescient Fund 17.78 Coronation Resources Fund 18.05

Sygnia Itrix MSCI USA Index ETF 16.62 1nvest Capped SWIX ETF 16.77

Sanlam Investment Management SCI Resources Fund 16.56 Sanlam Investment Management SCI Resources Fund 16.39

Fifteen Years (NAV) % Fifteen Years (NAV) %

Sygnia Itrix MSCI USA Index ETF 20.47 Sygnia Itrix MSCI USA Index ETF 17.77

Old Mutual Global Equity Fund 18.79 Old Mutual Global Equity Fund 15.85

Sygnia Itrix MSCI World Index ETF 17.52 Sygnia Itrix MSCI World Index ETF 15.49

Allan Gray-Orbis Global Equity Feeder Fund 16.76 Old Mutual Gold Fund 15.25

Discovery Global Equity Feeder Fund 15.95 Allan Gray-Orbis Global Equity Feeder Fund 14.78

Twenty Years (NAV) % Twenty Years (NAV) %

Satrix Capped INDI ETF 15.21 Old Mutual Global Equity Fund 14.52

Centaur BCI Flexible Fund 15.08 Allan Gray-Orbis Global Equity Feeder Fund 13.86

Coronation Industrial Fund 14.4 Centaur BCI Flexible Fund 13.11

Coronation Resources Fund 14.3 Satrix Capped INDI ETF 12.91

Allan Gray-Orbis Global Equity Feeder Fund 14.22 AF Investments Global Equity Feeder Fund 12.75

Twenty-Five Years (NAV) % Twenty-Five Years (NAV) %

Coronation Resources Fund 17.5 Coronation Industrial Fund 14.64

Ninety One Value Fund 16.89 Coronation Resources Fund 14.15

Ninety One Commodity Fund 16.34 Nedgroup Investments Financials Fund 13.7

Coronation Industrial Fund 16.24 M&G Equity Fund 13.52

Allan Gray Equity Fund 16.01 M&G Dividend Maximiser Fund 13.27

Thirty Years (NAV) % Thirty Years (NAV) %

Nedgroup Investments Mining & Resource Fund 17.32 Ninety One Commodity Fund 15.67

Ninety One Commodity Fund 17.25 Nedgroup Investments Mining & Resource Fund 15.12

Ninety One Equity Fund 14.58 Old Mutual Global Equity Fund 13.14

Old Mutual Global Equity Fund 14.16 Ninety One Equity Fund 13.08

Momentum Resources Fund 13.04 Sanlam Investment Management SCI General Equity Fund 12.35

In calculating lump sum performance figures the initial charges are not deducted (NAV basis). In calculating annuity performance figures, Profile’s Maximum Entry Value (MEV) is

used as the buy price, which takes maximum initial costs into account (After Costs basis). Annual service charges are deducted in all calculations. Dividends are reinvested on the

reinvestment date at the reinvestment price.

Figures shown are nominal annual compound returns. RNK means ranking. The investment returns quoted for funds with multiple classes of units (ie, A and R units) reflect the return

for the class of unit available to new investors at the start of the relevant period. Funds with more than one retail class are marked with an asterisk.

260 Profile’s Unit Trusts & Collective Investments September 2025