Page 260 - Profile's Unit Trusts & Collective Investments - September 2025

P. 260

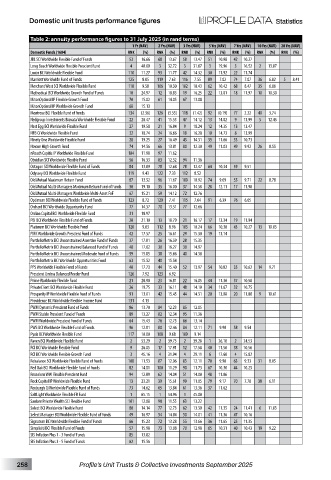

Domestic unit trusts performance figures

Table 2: annuity performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

JBL SCI Worldwide Flexible Fund of Funds 53 16.66 68 13.67 58 13.47 51 10.98 42 10.27

Long Beach Worldwide Flexible Prescient Fund 4 40.00 3 32.72 3 31.67 3 19.96 3 16.52 2 13.87

Lunar BCI Worldwide Flexible Fund 110 11.27 93 11.77 42 14.32 30 11.92 22 11.74

Marriott Worldwide Fund of Funds 125 8.05 119 7.63 116 7.55 89 7.02 74 7.07 36 6.82 5 8.41

Merchant West SCI Worldwide Flexible Fund 118 9.58 106 10.30 102 10.43 62 10.42 68 8.47 35 6.86

Methodical BCI Worldwide Growth Fund of Funds 10 24.97 12 18.83 19 16.25 22 13.01 18 11.97 10 10.30

MitonOptimal IP Flexible Growth Fund 70 15.02 61 14.05 67 13.08

MitonOptimal IP Worldwide Growth Fund 68 15.13

Montrose BCI Flexible Fund of Funds 134 (2.36) 126 (3.33) 118 (1.42) 92 (0.19) 77 2.22 40 3.74

Nedgroup Investments Bravata Worldwide Flexible Fund 22 20.47 41 15.53 47 14.12 13 14.02 9 13.99 5 12.45

Nest Egg BCI Worldwide Flexible Fund 27 19.58 21 16.84 9 18.24 12 14.35 13 13.47

NFB Ci Worldwide Flexible Fund 32 18.74 24 16.66 18 16.28 10 14.73 8 13.99

Ninety One Worldwide Flexible Fund 28 19.25 27 16.49 43 14.31 35 11.66 33 10.73

Novare High Growth Fund 74 14.56 66 13.81 80 12.30 49 11.03 49 9.92 26 8.55

nReach Capitis IP Worldwide Flexible Fund 104 11.98 97 11.62

Obsidian SCI Worldwide Flexible Fund 56 16.33 83 12.32 94 11.36

Octagon SCI Worldwide Flexible Fund of Funds 84 13.89 78 12.68 78 12.47 64 10.34 59 9.51

Odyssey BCI Worldwide Flexible Fund 119 9.43 122 7.33 112 8.52

Old Mutual Maximum Return Fund 87 13.52 96 11.67 100 10.92 74 9.69 55 9.71 22 8.78

Old Mutual Multi-Managers Maximum Return Fund of Funds 30 19.10 35 16.00 37 14.58 28 12.11 17 11.98

Old Mutual Multi-Managers Worldwide Multi-Asset FoF 67 15.21 59 14.12 72 12.76

Optimum BCI Worldwide Flexible Fund of Funds 123 8.72 120 7.41 115 7.64 91 6.39 76 6.05

Orchard BCI Worldwide Opportunity Fund 77 14.37 70 13.51 77 12.66

Ordian Capital BCI Worldwide Flexible Fund 31 18.97

PBi BCI Worldwide Flexible Fund of Funds 20 21.10 13 18.79 21 16.17 17 13.34 19 11.94

Platinum BCI Worldwide Flexible Fund 120 9.03 112 8.96 103 10.24 66 10.30 43 10.27 13 10.03

PMK Worldwide Growth Prescient Fund of Funds 42 17.57 25 16.61 29 15.30 19 13.14

PortfolioMetrix BCI Unconstrained Assertive Fund of Funds 37 17.81 26 16.59 28 15.35

PortfolioMetrix BCI Unconstrained Balanced Fund of Funds 48 17.02 30 16.27 30 14.97

PortfolioMetrix BCI Unconstrained Moderate Fund of Funds 59 15.85 38 15.66 40 14.38

PortfolioMetrix BCI Worldwide Opportunities Fund 63 15.52 40 15.54

PPS Worldwide Flexible Fund of Funds 40 17.73 44 15.40 52 13.97 54 10.82 35 10.62 14 9.71

Prescient Umbra Balanced Feeder Fund 126 7.92 123 6.92

Prime Worldwide Flexible Fund 21 20.90 23 16.81 22 16.05 44 11.30 37 10.58

PrivateClient BCI Worldwide Flexible Fund 26 19.75 33 16.11 48 14.10 34 11.67 32 10.75

Prosperity IP Worldwide Flexible Fund of Funds 91 13.01 42 15.45 44 14.31 20 13.08 20 11.80 9 10.61

Providence BCI Worldwide Flexible Income Fund 131 4.13

PWM Dynamic Prescient Fund of Funds 86 13.70 84 12.23 85 12.05

PWM Stable Prescient Fund of Funds 89 13.27 82 12.34 95 11.36

PWM Worldwide Prescient Fund of Funds 64 15.43 76 12.73 66 13.14

PWS BCI Worldwide Flexible Fund of Funds 96 12.81 80 12.46 84 12.11 71 9.90 58 9.54

Pyxis BCI Worldwide Flexible Fund 117 10.00 108 9.68 109 9.14

Raven BCI Worldwide Flexible Fund 2 53.29 2 39.75 2 39.28 1 26.10 2 24.53

RCI BCI Worldwide Flexible Fund 9 26.05 17 17.91 12 17.58 40 11.50 38 10.56

RCI BCI Worldwide Flexible Growth Fund 3 45.16 4 31.94 4 29.11 6 17.60 4 15.82

Rebalance SCI Worldwide Flexible Fund of Funds 108 11.53 87 12.06 83 12.11 70 9.90 63 9.33 31 8.05

Red Oak BCI Worldwide Flexible Fund of Funds 82 14.01 100 11.29 90 11.73 67 10.30 44 10.25

Rexsolom WW Flexible Prescient Fund 94 12.89 62 14.04 51 14.00 48 11.06

Rock Capital IP Worldwide Flexible Fund 13 23.21 39 15.61 99 11.05 79 9.17 70 7.78 38 6.11

Roxburgh Ci Worldwide Flexible Fund of Funds 73 14.62 65 13.84 61 13.36 37 11.62

SaltLight Worldwide Flexible FR Fund 1 65.15 1 54.96 1 45.00

Sanlam Private Wealth SCI Flexible Fund 101 12.08 98 11.55 63 13.22

Select BCI Worldwide Flexible Fund 80 14.14 77 12.73 62 13.30 42 11.35 24 11.41 6 11.83

Select Manager BCI Worldwide Flexible Fund of Funds 49 16.97 54 14.84 50 14.01 41 11.36 47 10.16

Signature BCI Worldwide Flexible Fund of Funds 66 15.23 72 13.28 55 13.66 36 11.65 25 11.35

Simplisiti BCI Flexible Fund of Funds 57 15.98 73 13.08 70 12.98 65 10.31 40 10.43 19 9.22

SIS Inflation Plus 1 - 3 Fund of Funds 85 13.82

SIS Inflation Plus 3 - 5 Fund of Funds 62 15.56

258 Profile’s Unit Trusts & Collective Investments September 2025