Page 188 - Profile's Unit Trusts & Collective Investments - September 2025

P. 188

Chapter 9 Fund manager interviews

From a purchasing power perspective, the rand’s fair value probably is closer to ZAR/USD16 but

getting back to that level would require a lot of positive local economic and international geopolitical

developments. Longer term, the rand is still likely to weaken according to the long term interest rate

differentials between South Africa and developed markets. Based on the current differential in ten-

year government bond yields, the implied depreciation of the rand to the US dollar is still around 5%

per annum over the next 10 years, but that appears excessive and suggests that local bonds are

under-priced.

Give your views regarding interest rate trends and the yield curve over the next 1 to 2 years.

What interest rates can investors expect? Do you anticipate further repo cuts?

We expect interest rates to ease lower in the US over the next 18 months, by around 125 to 150bp

as inflation stabilises and policy makers’ focus shifts back to stimulating economic growth. Europe

is likely to be on hold for the foreseeable future, whereas the UK has a need but not much scope to

cut given their high and sticky inflation. We don’t expect to return to the zero or ultra-low interest

rates in developed markets seen over the last decade however. The outlier is Japan, which is on a

(very) gradual hiking path, and still has to fully normalise its rates. Locally, the SARB is unlikely to

ease further in this stage, given its ambition to shift its inflation target to the lower end of the 3% to

6% range.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Sygnia Top 40 Index Fund

Sector: South African–Equity–SA Equity

Portfolio managers: Anton Swanepoel and Wessel Brand

Benchmark: FTSE/JSE Top 40 Index

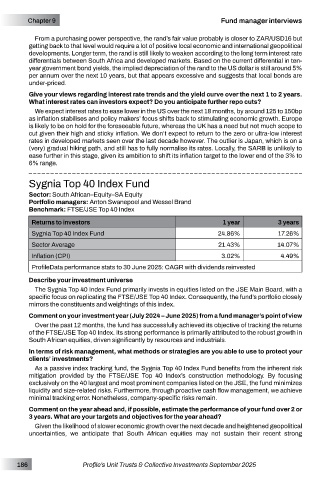

Returns to investors 1 year 3 years

Sygnia Top 40 Index Fund 24.86% 17.26%

Sector Average 21.43% 14.07%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The Sygnia Top 40 Index Fund primarily invests in equities listed on the JSE Main Board, with a

specific focus on replicating the FTSE/JSE Top 40 Index. Consequently, the fund’s portfolio closely

mirrors the constituents and weightings of this index.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

Over the past 12 months, the fund has successfully achieved its objective of tracking the returns

of the FTSE/JSE Top 40 Index. Its strong performance is primarily attributed to the robust growth in

South African equities, driven significantly by resources and industrials.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

As a passive index tracking fund, the Sygnia Top 40 Index Fund benefits from the inherent risk

mitigation provided by the FTSE/JSE Top 40 Index’s construction methodology. By focusing

exclusively on the 40 largest and most prominent companies listed on the JSE, the fund minimizes

liquidity and size-related risks. Furthermore, through proactive cash flow management, we achieve

minimal tracking error. Nonetheless, company-specific risks remain.

Comment on the year ahead and, if possible, estimate the performance of your fund over 2 or

3 years. What are your targets and objectives for the year ahead?

Given the likelihood of slower economic growth over the next decade and heightened geopolitical

uncertainties, we anticipate that South African equities may not sustain their recent strong

186 Profile’s Unit Trusts & Collective Investments September 2025