Page 189 - Profile's Unit Trusts & Collective Investments - September 2025

P. 189

Fund manager interviews Chapter 9

performance in the medium term. Nevertheless, a sustained rally in commodity markets could

provide a positive counterbalance, potentially supporting the performance of South African equities.

Are equity markets in general overpriced? Do you anticipate a significant correction?

The current market appears slightly overvalued, with the recent rally primarily driven by the

resources sector, particularly precious metals. Share price increases have been underpinned by

robust company-specific fundamentals. However, we are concerned about the potential impact of

tariffs in the short to medium term, which could adversely affect specific sectors of the South African

domestic market.

As a passive fund, what advantages, in your view, does the underlying index you track offer

investors?

The FTSE/JSE Top 40 Index offers several key advantages over other local equity indices:

Broad representation: Representing over 80% of the JSE’s total market capitalisation, the

index serves as a reliable proxy for the broader market while maintaining low management

and trading costs.

High liquidity: The index exclusively comprises highly liquid stocks, ensuring ease of trading

while remaining broadly representative.

Sectoral diversification: The index spans major local sectors, including resources, financials,

and industrials, reducing the risk of significant losses due to downturns in any single industry.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

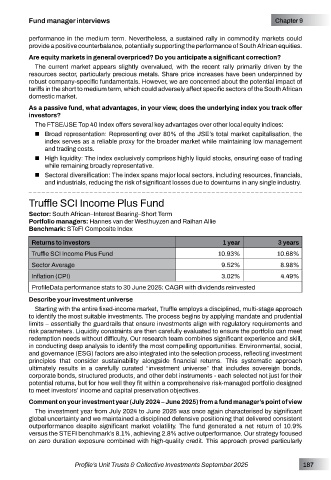

Truffle SCI Income Plus Fund

Sector: South African–Interest Bearing–Short Term

Portfolio managers: Hannes van der Westhuyzen and Raihan Allie

Benchmark: STeFI Composite Index

Returns to investors 1 year 3 years

Truffle SCI Income Plus Fund 10.93% 10.68%

Sector Average 9.52% 8.98%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

Starting with the entire fixed-income market, Truffle employs a disciplined, multi-stage approach

to identify the most suitable investments. The process begins by applying mandate and prudential

limits – essentially the guardrails that ensure investments align with regulatory requirements and

risk parameters. Liquidity constraints are then carefully evaluated to ensure the portfolio can meet

redemption needs without difficulty. Our research team combines significant experience and skill,

in conducting deep analysis to identify the most compelling opportunities. Environmental, social,

and governance (ESG) factors are also integrated into the selection process, reflecting investment

principles that consider sustainability alongside financial returns. This systematic approach

ultimately results in a carefully curated “investment universe” that includes sovereign bonds,

corporate bonds, structured products, and other debt instruments - each selected not just for their

potential returns, but for how well they fit within a comprehensive risk-managed portfolio designed

to meet investors’ income and capital preservation objectives.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

The investment year from July 2024 to June 2025 was once again characterised by significant

global uncertainty and we maintained a disciplined defensive positioning that delivered consistent

outperformance despite significant market volatility. The fund generated a net return of 10.9%

versus the STEFI benchmark’s 8.1%, achieving 2.8% active outperformance. Our strategy focused

on zero duration exposure combined with high-quality credit. This approach proved particularly

Profile’s Unit Trusts & Collective Investments September 2025 187