Page 186 - Profile's Unit Trusts & Collective Investments - September 2025

P. 186

Chapter 9 Fund manager interviews

every two Millennial and Gen Z on the planet. Could Pop Mart become an IP powerhouse with

a conveyor belt of viral sensations? Maybe. But with a market cap (USD54bn) already sitting

at the top of the listed toy company peer group, we believe the downside is far more compelling

than the upside.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

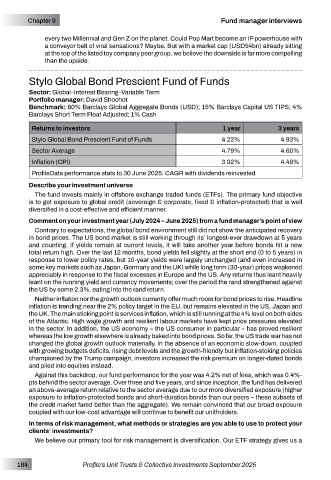

Stylo Global Bond Prescient Fund of Funds

Sector: Global–Interest Bearing–Variable Term

Portfolio manager: David Shochot

Benchmark: 80% Barclays Global Aggregate Bonds (USD); 15% Barclays Capital US TIPS; 4%

Barclays Short Term Float Adjusted; 1% Cash

Returns to investors 1 year 3 years

Stylo Global Bond Prescient Fund of Funds 4.22% 4.93%

Sector Average 4.79% 4.60%

Inflation (CPI) 3.02% 4.49%

ProfileData performance stats to 30 June 2025: CAGR with dividends reinvested

Describe your investment universe

The fund invests mainly in offshore exchange traded funds (ETFs). The primary fund objective

is to get exposure to global credit (sovereign & corporate, fixed & inflation-protected) that is well

diversified in a cost-effective and efficient manner.

Comment on your investment year (July 2024 – June 2025) from a fund manager’s point of view

Contrary to expectations, the global bond environment still did not show the anticipated recovery

in bond prices. The US bond market is still working through its’ longest-ever drawdown at 5 years

and counting. If yields remain at current levels, it will take another year before bonds hit a new

total return high. Over the last 12 months, bond yields fell slightly at the short end (0 to 5 years) in

response to lower policy rates, but 10-year yields were largely unchanged (and even increased in

some key markets such as Japan, Germany and the UK) while long term (30-year) prices weakened

appreciably in response to the fiscal excesses in Europe and the US. Any returns thus leant heavily

leant on the running yield and currency movements; over the period the rand strengthened against

the US by some 2.3%, eating into the rand return.

Neither inflation nor the growth outlook currently offer much room for bond prices to rise. Headline

inflation is trending near the 2% policy target in the EU, but remains elevated in the US, Japan and

the UK. The main sticking point is services inflation, which is still running at the 4% level on both sides

of the Atlantic. High wage growth and resilient labour markets have kept price pressures elevated

in the sector. In addition, the US economy – the US consumer in particular – has proved resilient

whereas the low growth elsewhere is already baked into bond prices. So far, the US trade war has not

changed the global growth outlook materially. In the absence of an economic slow-down, coupled

with growing budgets deficits, rising debt levels and the growth-friendly but inflation-stoking policies

championed by the Trump campaign, investors increased the risk premium on longer-dated bonds

and piled into equities instead.

Against this backdrop, our fund performance for the year was 4.2% net of fees, which was 0.4%-

pts behind the sector average. Over three and five years, and since inception, the fund has delivered

an above-average return relative to the sector average due to our more diversified exposure (higher

exposure to inflation-protected bonds and short-duration bonds than our peers – these subsets of

the credit market fared better than the aggregate). We remain convinced that our broad exposure

coupled with our low-cost advantage will continue to benefit our unitholders.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

We believe our primary tool for risk management is diversification. Our ETF strategy gives us a

184 Profile’s Unit Trusts & Collective Investments September 2025