Page 300 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 300

PSG Money Market Fund

PSG Money Market Fund

PSG Money Market Fund

Sector: South African—Interest Bearing— FUND FOCUS

Money Market The PSG Money Market Fund’s objective is to provide capital security, a steady income

Fund benchmark: South African - and easy access to your money. The fund invests in selected money market instruments

Interest Bearing - Money Market Mean issued by government, parastatals, corporates and banks with a maturity term of less

Code (A): PSGM than 13 months. The fund operates within the constraints of Regulation 28 of the

Pension Funds Act.

MANAGEMENT

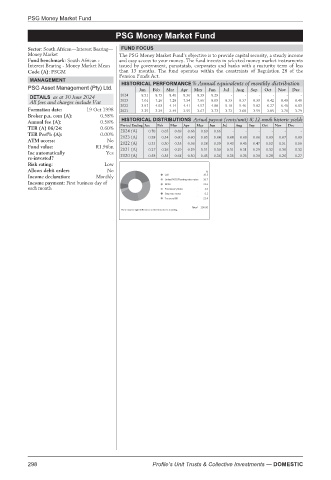

HISTORICAL PERFORMANCE % Annual equivalents of monthly distribution

PSG Asset Management (Pty) Ltd. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

DETAILS as at 30 June 2024 2024 8.51 8.75 8.40 8.36 8.39 8.29 - - - - - -

All fees and charges include Vat 2023 7.01 7.26 7.28 7.54 7.66 8.09 8.33 8.37 8.39 8.42 8.49 8.48

2022 3.97 4.03 4.14 4.41 4.57 4.80 5.18 5.46 5.82 6.27 6.40 6.83

Formation date: 19 Oct 1998 2021 3.25 3.39 3.49 3.55 3.67 3.73 3.73 3.68 3.59 3.85 3.70 3.79

Broker p.a. com (A): 0.58%

Annual fee (A): 0.58% HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

Period Ending Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

TER (A) 06/24: 0.60% 2024 (A)

TER Perf% (A): 0.00% 2023 (A) 0.70 0.65 0.69 0.66 0.69 0.66 0.68 - 0.69 - 0.66 - 0.69 - 0.67 - 0.69 -

0.60

0.58

0.54

0.64

0.60

0.63

ATM access: No 2022 (A) 0.33 0.30 0.35 0.36 0.38 0.39 0.43 0.45 0.47 0.52 0.51 0.56

Fund value: R1.96bn

2021 (A) 0.27 0.26 0.29 0.29 0.31 0.30 0.31 0.31 0.29 0.32 0.30 0.32

Inc automatically Yes

re-invested? 2020 (A) 0.58 0.55 0.64 0.50 0.45 0.36 0.35 0.35 0.30 0.28 0.26 0.27

Risk rating: Low

Allows debit orders No

Income declaration: Monthly Call

Income payment: First business day of NCDs

each month

Total

298 Profile’s Unit Trusts & Collective Investments — DOMESTIC