Page 256 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 256

Camissa Global Equity Feeder

Camissa Global Equity Feeder Fund Class A

Camissa Global Equity Feeder

Sector: Global—Equity—General

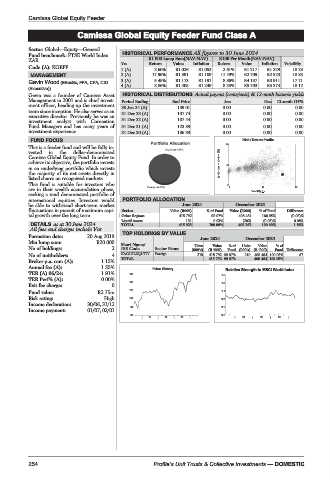

Fund benchmark: FTSE World Index HISTORICAL PERFORMANCE All figures to 30 June 2024

ZAR R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Code (A): KGEFF Yrs Return Value Inflation Return Value Inflation Volatility

1 (A) 2.60% R1 026 R1 052 2.61% R1 217 R1 229 18.23

MANAGEMENT 2 (A) 17.96% R1 391 R1 109 11.49% R2 709 R2 523 18.85

3 (A) 5.45% R1 173 R1 191 8.86% R4 137 R3 911 17.71

Gavin Wood (BBusSc, FFA, CFA, CIO

4 (A) 8.86% R1 405 R1 249 8.25% R5 703 R5 374 18.12

(Executive))

Gavin was a founder of Camissa Asset HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

Management in 2001 and is chief invest- Period Ending End Price Jun Dec 12-mnth DY%

ment officer, heading up the investment 30 Jun 24 (A) 139.01 0.00 0.00 0.00

team since inception. He also serves as an

executive director. Previously he was an 31 Dec 23 (A) 137.74 0.00 0.00 0.00

investment analyst with Coronation 31 Dec 22 (A) 107.44 0.00 0.00 0.00

Fund Managers and has many years of 31 Dec 21 (A) 123.89 0.00 0.00 0.00

investment experience. 31 Dec 20 (A) 106.39 0.00 0.00 0.00

FUND FOCUS Risk / Return Profile

This is a feeder fund and will be fully in- 20

vested in the dollar-denominated

Camissa Global Equity Fund. In order to

achieve its objective, the portfolio invests 3yr Compound return(%)

in an underlying portfolio which invests 10

the majority of its net assets directly in

listed shares on recognized markets.

This fund is suitable for investors who 0

11

are in their wealth accumulation phase, 0 Volatility p.a. 22

seeking a rand denominated portfolio of

international equities. Investors would PORTFOLIO ALLOCATION

be able to withstand short-term market June 2024 December 2023

fluctuations in pursuit of maximum capi- Sector Value (R000) % of Fund Value (R000) % of Fund Difference

tal growth over the long term. Other Regions 415 792 99.97% 408 464 100.05% (0.08)%

Liquid Assets 131 0.03% (203) (0.05)% 0.08%

DETAILS as at 30 June 2024 TOTAL 415 923 100.00% 408 262 100.00% 1.88%

All fees and charges include Vat

TOP HOLDINGS BY VALUE

Formation date: 20 Aug 2019 June 2024 December 2023

Min lump sum: R20 000 Short Name/ Units Value %of Units Value %of

No of holdings: 2 JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

No of unitholders: 4 KAGLBLEQUITY Foreign 219 415 792 99.97% 219 408 464 100.05% 67

TOTAL 415 792 99.97% 408 464 100.05%

Broker p.a. com (A): 1.15%

Annual fee (A): 1.55% Price History Relative Strength to MSCI World index

TER (A) 06/24: 1.91% 150 1.5

TER Perf% (A): 0.00%

136 1.3

Exit fee charge: 0

Fund value: R2.75m 122 1.1

Risk rating: High 108 0.9

Income declaration: 30/06, 31/12

94 0.7

Income payment: 01/07, 02/01

80 0.5

| 21 | 22 | 23 | | 21 | 22 | 23 |

254 Profile’s Unit Trusts & Collective Investments — DOMESTIC