Page 251 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 251

Argon BCI Bond Fund

Argon BCI Bond Fund

Argon BCI Bond Fund

Sector: South African—Interest Bearing—

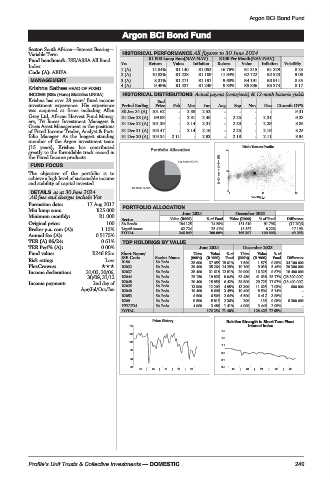

Variable Term HISTORICAL PERFORMANCE All figures to 30 June 2024

Fund benchmark: JSE/ASSA All Bond R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Index Yrs Return Value Inflation Return Value Inflation Volatility

Code (A): ABIFA 1 (A) 14.04% R1 140 R1 052 16.76% R1 315 R1 229 8.25

2 (A) 10.83% R1 228 R1 109 11.94% R2 722 R2 523 9.06

MANAGEMENT 3 (A) 8.31% R1 271 R1 191 9.68% R4 191 R3 911 8.55

4 (A) 9.49% R1 437 R1 249 9.33% R5 836 R5 374 8.17

Krishna Sathee HEAD OF FIXED

INCOME (BSc (Hons) Statistics UNISA) HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-mnth historic yields

Krishna has over 28 years’ fixed income End

investment experience. His experience Period Ending Price Feb Mar Jun Aug Sep Nov Dec 12-mnth DY%

was acquired at firms including Allan 30 Jun 24 (A) 101.62 - 2.38 2.52 - - - - 9.31

Gray Ltd, African Harvest Fund Manag- 31 Dec 23 (A) 99.93 - 2.31 2.45 - 2.25 - 2.31 9.33

ers, Tri linear Investment Managers &

Oasis Asset Management in the positions 31 Dec 22 (A) 101.39 - 2.14 2.31 - 2.23 - 2.29 8.85

of Fixed Income Trader, Analyst & Port- 31 Dec 21 (A) 105.47 - 2.14 2.16 - 2.25 - 2.16 8.25

folio Manager. As the longest standing 31 Dec 20 (A) 104.34 2.11 - 2.93 - 2.18 - 2.11 8.94

member of the Argon investment team

(15 years), Krishna has contributed Risk / Return Profile

greatly to the formidable track record in 20

the Fixed Income products.

FUND FOCUS

The objective of the portfolio is to 3yr Compound return(%) 10

achieve a high level of sustainable income

and stability of capital invested.

DETAILS as at 30 June 2024 0 0 11 22

All fees and charges include Vat Volatility p.a.

Formation date: 17 Aug 2017

PORTFOLIO ALLOCATION

Min lump sum: R25 000 June 2024 December 2023

Minimum monthly: R1 000 Sector Value (R000) % of Fund Value (R000) % of Fund Difference

Original price: 100 SA Bonds 184 125 74.59% 151 810 91.79% (17.20)%

Broker p.a. com (A): 1.15% Liquid Assets 62 724 25.41% 13 587 8.22% 17.19%

Annual fee (A): 0.5175% TOTAL 246 849 100.00% 165 397 100.00% 49.25%

TER (A) 06/24: 0.61% TOP HOLDINGS BY VALUE

TER Perf% (A): 0.00% June 2024 December 2023

Fund value: R246.85m Short Name/ Units Value %of Units Value %of

JSE Code Sector Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

Risk rating: Low

R186 SA Bnds 35 600 37 055 15.01% 1 500 1 575 0.95% 34 100 000

PlexCrowns: R2032 SA Bnds 39 400 35 264 14.29% 10 100 9 038 5.46% 29 300 000

Income declaration: 31/03, 30/06, R2037 SA Bnds 38 400 31 618 12.81% 20 000 16 325 9.87% 18 400 000

30/09, 31/12 R2044 SA Bnds 25 150 19 836 8.04% 53 450 41 638 25.17% (28 300 000)

Income payment: 2nd day of R2048 SA Bnds 20 400 15 856 6.42% 38 800 29 725 17.97% (18 400 000)

Apr/Jul/Oct/Jan R2035 SA Bnds 13 900 12 209 4.95% 13 300 11 625 7.03% 600 000

R2040 SA Bnds 10 400 8 606 3.49% 10 400 8 504 5.14% -

R2053 SA Bnds 6 500 6 509 2.64% 6 500 6 417 3.88% -

R209 SA Bnds 8 500 5 815 2.36% 200 135 0.08% 8 300 000

HWAY34 SA Bnds 4 000 3 486 1.41% 4 000 3 446 2.08% -

TOTAL 176 254 71.40% 128 429 77.65%

Price History Relative Strength to Short Term Fixed

110 Interest index

1.5

106

1.3

102

1.1

98

0.9

94 0.7

90 0.5

19 | 20 | 21 | 22 | 23 19 | 20 | 21 | 22 | 23

Profile’s Unit Trusts & Collective Investments — DOMESTIC 249