Page 167 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 167

Fund Manager Interviews

Merchant West SCI Global Property Income Fund

Sector: Global–Real estate–General

Portfolio managers: Richard Henwood and Ian Anderson

Benchmark: GPR 250 REIT Index TR

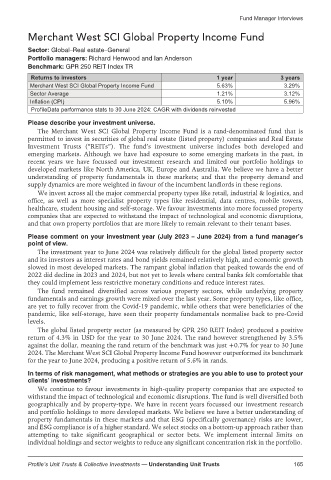

Returns to investors 1 year 3 years

Merchant West SCI Global Property Income Fund 5.63% 3.29%

Sector Average 1.21% 3.12%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The Merchant West SCI Global Property Income Fund is a rand-denominated fund that is

permitted to invest in securities of global real estate (listed property) companies and Real Estate

Investment Trusts (“REITs”). The fund’s investment universe includes both developed and

emerging markets. Although we have had exposure to some emerging markets in the past, in

recent years we have focussed our investment research and limited our portfolio holdings to

developed markets like North America, UK, Europe and Australia. We believe we have a better

understanding of property fundamentals in these markets; and that the property demand and

supply dynamics are more weighted in favour of the incumbent landlords in these regions.

We invest across all the major commercial property types like retail, industrial & logistics, and

office, as well as more specialist property types like residential, data centres, mobile towers,

healthcare, student housing and self-storage. We favour investments into more focussed property

companies that are expected to withstand the impact of technological and economic disruptions,

and that own property portfolios that are more likely to remain relevant to their tenant bases.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

The investment year to June 2024 was relatively difficult for the global listed property sector

and its investors as interest rates and bond yields remained relatively high, and economic growth

slowed in most developed markets. The rampant global inflation that peaked towards the end of

2022 did decline in 2023 and 2024, but not yet to levels where central banks felt comfortable that

they could implement less restrictive monetary conditions and reduce interest rates.

The fund remained diversified across various property sectors, while underlying property

fundamentals and earnings growth were mixed over the last year. Some property types, like office,

are yet to fully recover from the Covid-19 pandemic, while others that were beneficiaries of the

pandemic, like self-storage, have seen their property fundamentals normalise back to pre-Covid

levels.

The global listed property sector (as measured by GPR 250 REIT Index) produced a positive

return of 4.3% in USD for the year to 30 June 2024. The rand however strengthened by 3.5%

against the dollar, meaning the rand return of the benchmark was just +0.7% for year to 30 June

2024. The Merchant West SCI Global Property Income Fund however outperformed its benchmark

for the year to June 2024, producing a positive return of 5.6% in rands.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

We continue to favour investments in high-quality property companies that are expected to

withstand the impact of technological and economic disruptions. The fund is well diversified both

geographically and by property-type. We have in recent years focussed our investment research

and portfolio holdings to more developed markets. We believe we have a better understanding of

property fundamentals in these markets and that ESG (specifically governance) risks are lower,

and ESG compliance is of a higher standard. We select stocks on a bottom-up approach rather than

attempting to take significant geographical or sector bets. We implement internal limits on

individual holdings and sector weights to reduce any significant concentration risk in the portfolio.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 165