Page 170 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 170

CHAPTER 9

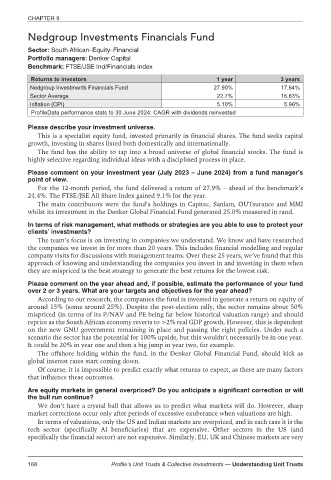

Nedgroup Investments Financials Fund

Sector: South African–Equity–Financial

Portfolio managers: Denker Capital

Benchmark: FTSE/JSE Ind/Financials index

Returns to investors 1 year 3 years

Nedgroup Investments Financials Fund 27.90% 17.64%

Sector Average 22.7% 16.83%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

This is a specialist equity fund, invested primarily in financial shares. The fund seeks capital

growth, investing in shares listed both domestically and internationally.

The fund has the ability to tap into a broad universe of global financial stocks. The fund is

highly selective regarding individual ideas with a disciplined process in place.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

For the 12-month period, the fund delivered a return of 27.9% – ahead of the benchmark’s

24.4%. The FTSE/JSE All Share Index gained 9.1% for the year.

The main contributors were the fund’s holdings in Capitec, Sanlam, OUTsurance and MMI

whilst its investment in the Denker Global Financial Fund generated 25.0% measured in rand.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

The team’s focus is on investing in companies we understand. We know and have researched

the companies we invest in for more than 20 years. This includes financial modelling and regular

company visits for discussions with management teams. Over these 25 years, we’ve found that this

approach of knowing and understanding the companies you invest in and investing in them when

they are mispriced is the best strategy to generate the best returns for the lowest risk.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

According to our research, the companies the fund is invested in generate a return on equity of

around 15% (some around 25%). Despite the post-election rally, the sector remains about 50%

mispriced (in terms of its P/NAV and PE being far below historical valuation range) and should

reprice as the South African economy reverts to >2% real GDP growth. However, this is dependent

on the new GNU government remaining in place and passing the right policies. Under such a

scenario the sector has the potential for 100% upside, but this wouldn’t necessarily be in one year.

It could be 20% in year one and then a big jump in year two, for example.

The offshore holding within the fund, in the Denker Global Financial Fund, should kick as

global interest rates start coming down.

Of course, it is impossible to predict exactly what returns to expect, as there are many factors

that influence these outcomes.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

We don’t have a crystal ball that allows us to predict what markets will do. However, sharp

market corrections occur only after periods of excessive exuberance when valuations are high.

In terms of valuations, only the US and Indian markets are overpriced, and in each case it is the

tech sector (specifically AI beneficiaries) that are expensive. Other sectors in the US (and

specifically the financial sector) are not expensive. Similarly, EU, UK and Chinese markets are very

168 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts