Page 175 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 175

Fund Manager Interviews

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Our primary risk management tool is to allocate capital only to assets trading below fair value,

and to hold cash when we are unable to find sensible opportunities in risky assets. Sizing positions

with reference to the risk embedded in the underlying asset is a further way in which we manage

risk.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

We do not attempt to forecast market or fund returns over one-year periods. We continue to

find a wide disparity in valuations across different geographies and sectors, and whilst we are not

overly excited about the risk and return prospects of equity markets in aggregate, we do find it

possible to buy assets at attractive valuations that gives us confidence in the longer term returns

the fund should deliver to investors.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull-run continue?

In aggregate, we consider the world equity market to be on the expensive side of fair value. But

this is mainly due to the US market which dominates global indices. Emerging markets however

appear to offer better value compared to most developed markets at the moment.

Which asset classes do you expect will give the best total rates of return over the next few

years?

Global equities – but given valuations currently, we expect divergent outcomes between

different geographies within global equities.

Offshore investments are heavily influenced by the rand. Please give your view on the rand

over the next 1, 3 and 5 years.

As with markets in general, we do not attempt to make short term forecasts of exchange rates.

On a longer-term view, with reference to purchasing power parity, we continue to view the Rand as

priced too cheaply, and hence expect Rand cash investments (i.e. including interest) to be a better

store of value than many other currencies (notably the US dollar).

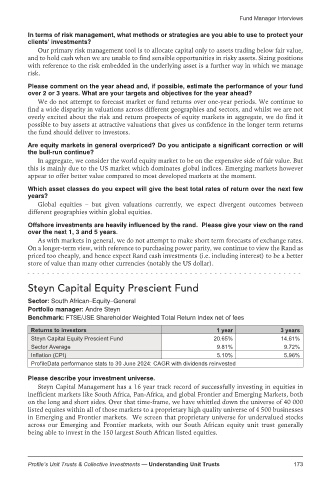

Steyn Capital Equity Prescient Fund

Sector: South African–Equity–General

Portfolio manager: Andre Steyn

Benchmark: FTSE/JSE Shareholder Weighted Total Return Index net of fees

Returns to investors 1 year 3 years

Steyn Capital Equity Prescient Fund 20.65% 14.61%

Sector Average 9.81% 9.72%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

Steyn Capital Management has a 16 year track record of successfully investing in equities in

inefficient markets like South Africa, Pan-Africa, and global Frontier and Emerging Markets, both

on the long and short sides. Over that time-frame, we have whittled down the universe of 40 000

listed equites within all of those markets to a proprietary high quality universe of 4 500 businesses

in Emerging and Frontier markets. We screen that proprietary universe for undervalued stocks

across our Emerging and Frontier markets, with our South African equity unit trust generally

being able to invest in the 150 largest South African listed equities.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 173