Page 171 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 171

Fund Manager Interviews

mispriced, as is the JSE. So, any correction (triggered possibly by the US economy growing at a

higher rate than expected) should be fairly short and hurt the expensive tech shares most.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

South Africa: Nedgroup, Absa and OUTsurance.

Globally: US Bancorp, HSBC and Bawag.

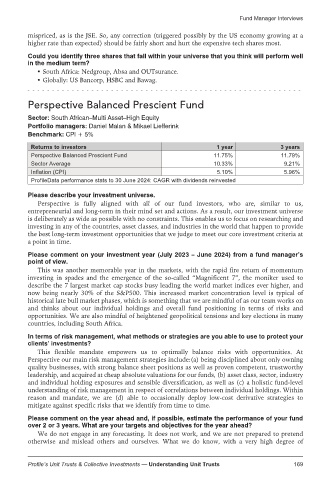

Perspective Balanced Prescient Fund

Sector: South African–Multi Asset–High Equity

Portfolio managers: Daniel Malan & Mikael Liefferink

Benchmark: CPI+5%

Returns to investors 1 year 3 years

Perspective Balanced Prescient Fund 11.75% 11.79%

Sector Average 10.33% 9.21%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

Perspective is fully aligned with all of our fund investors, who are, similar to us,

entrepreneurial and long-term in their mind set and actions. As a result, our investment universe

is deliberately as wide as possible with no constraints. This enables us to focus on researching and

investing in any of the countries, asset classes, and industries in the world that happen to provide

the best long-term investment opportunities that we judge to meet our core investment criteria at

a point in time.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

This was another memorable year in the markets, with the rapid fire return of momentum

investing in spades and the emergence of the so-called “Magnificent 7”, the moniker used to

describe the 7 largest market cap stocks busy leading the world market indices ever higher, and

now being nearly 30% of the S&P500. This increased market concentration level is typical of

historical late bull market phases, which is something that we are mindful of as our team works on

and thinks about our individual holdings and overall fund positioning in terms of risks and

opportunities. We are also mindful of heightened geopolitical tensions and key elections in many

countries, including South Africa.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

This flexible mandate empowers us to optimally balance risks with opportunities. At

Perspective our main risk management strategies include:(a) being disciplined about only owning

quality businesses, with strong balance sheet positions as well as proven competent, trustworthy

leadership, and acquired at cheap absolute valuations for our funds, (b) asset class, sector, industry

and individual holding exposures and sensible diversification, as well as (c) a holistic fund-level

understanding of risk management in respect of correlations between individual holdings. Within

reason and mandate, we are (d) able to occasionally deploy low-cost derivative strategies to

mitigate against specific risks that we identify from time to time.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

We do not engage in any forecasting. It does not work, and we are not prepared to pretend

otherwise and mislead others and ourselves. What we do know, with a very high degree of

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 169