Page 174 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 174

CHAPTER 9

In the short term, we believe much of the good news has been priced into stocks, with yields

compressing sharply. However, lower interest rates, coupled with firmer GDP growth and an

absence of load-shedding and other constraints, marks a significant improvement from the

operating conditions that the sector has endured for the past 6 years. Furthermore, the rally in

share prices provides companies with the opportunity to raise capital far more effectively,

underpinning acquisitive growth for the first time in years. On that basis, we think the sector has

further to run, but appreciate that a period of consolidation is necessary after recent gains.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

Three REITS that we like include:

Fairvest: Local fund with no offshore exposure and focussed exclusively on retail assets that

will benefit from both lower interest rates and stronger GDP growth.

Spear: This is a small fund with assets only in the Western Cape. Given the semigration

trend and better municipal management, we expect that province to outperform. Spear is a

small, nimble company that is well-positioned to benefit from this trend.

Equites: Their restructuring is largely complete with a new base set from which to grow.

Excellent portfolio of logistics properties with long leases and certainty of income makes

Equities a low risk option.

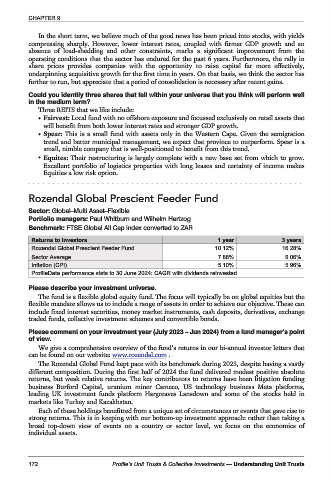

Rozendal Global Prescient Feeder Fund

Sector: Global–Multi Asset–Flexible

Portfolio managers: Paul Whitburn and Wilhelm Hertzog

Benchmark: FTSE Global All Cap index converted to ZAR

Returns to investors 1 year 3 years

Rozendal Global Prescient Feeder Fund 10.12% 16.28%

Sector Average 7.88% 9.06%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The fund is a flexible global equity fund. The focus will typically be on global equities but the

flexible mandate allows us to include a range of assets in order to achieve our objective. These can

include fixed interest securities, money market instruments, cash deposits, derivatives, exchange

traded funds, collective investment schemes and convertible bonds.

Please comment on your investment year (July 2023 – Jun 2024) from a fund manager’s point

of view.

We give a comprehensive overview of the fund’s returns in our bi-annual investor letters that

can be found on our website: www.rozendal.com .

The Rozendal Global Fund kept pace with its benchmark during 2023, despite having a vastly

different composition. During the first half of 2024 the fund delivered modest positive absolute

returns, but weak relative returns. The key contributors to returns have been litigation funding

business Burford Capital, uranium miner Cameco, US technology business Meta platforms,

leading UK investment funds platform Hargreaves Lansdown and some of the stocks held in

markets like Turkey and Kazakhstan.

Each of these holdings benefitted from a unique set of circumstances or events that gave rise to

strong returns. This is in keeping with our bottom-up investment approach: rather than taking a

broad top-down view of events on a country or sector level, we focus on the economics of

individual assets.

172 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts