Page 179 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 179

Fund Manager Interviews

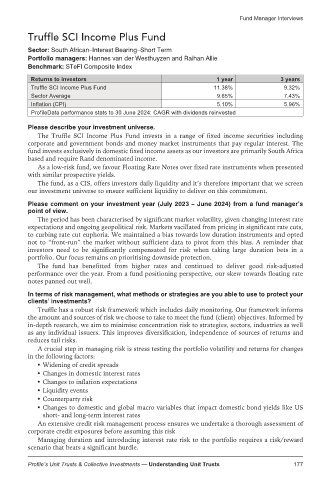

Truffle SCI Income Plus Fund

Sector: South African–Interest Bearing–Short Term

Portfolio managers: Hannes van der Westhuyzen and Raihan Allie

Benchmark: STeFI Composite Index

Returns to investors 1 year 3 years

Truffle SCI Income Plus Fund 11.38% 9.32%

Sector Average 9.65% 7.43%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The Truffle SCI Income Plus Fund invests in a range of fixed income securities including

corporate and government bonds and money market instruments that pay regular interest. The

fund invests exclusively in domestic fixed income assets as our investors are primarily South Africa

based and require Rand denominated income.

As a low-risk fund, we favour Floating Rate Notes over fixed rate instruments when presented

with similar prospective yields.

The fund, as a CIS, offers investors daily liquidity and it’s therefore important that we screen

our investment universe to ensure sufficient liquidity to deliver on this commitment.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

The period has been characterised by significant market volatility, given changing interest rate

expectations and ongoing geopolitical risk. Markets vacillated from pricing in significant rate cuts,

to curbing rate cut euphoria. We maintained a bias towards low duration instruments and opted

not to “front-run” the market without sufficient data to pivot from this bias. A reminder that

investors need to be significantly compensated for risk when taking large duration bets in a

portfolio. Our focus remains on prioritising downside protection.

The fund has benefitted from higher rates and continued to deliver good risk-adjusted

performance over the year. From a fund positioning perspective, our skew towards floating rate

notes panned out well.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Truffle has a robust risk framework which includes daily monitoring. Our framework informs

the amount and sources of risk we choose to take to meet the fund (client) objectives. Informed by

in-depth research, we aim to minimise concentration risk to strategies, sectors, industries as well

as any individual issuers. This improves diversification, independence of sources of returns and

reduces tail risks.

A crucial step in managing risk is stress testing the portfolio volatility and returns for changes

in the following factors:

Widening of credit spreads

Changes in domestic interest rates

Changes to inflation expectations

Liquidity events

Counterparty risk

Changes to domestic and global macro variables that impact domestic bond yields like US

short- and long-term interest rates

An extensive credit risk management process ensures we undertake a thorough assessment of

corporate credit exposures before assuming this risk

Managing duration and introducing interest rate risk to the portfolio requires a risk/reward

scenario that beats a significant hurdle.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 177