Page 172 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 172

CHAPTER 9

conviction, is that our funds own a diversified collection of top quality, proven long-term

sustainable businesses, with amazing owners and leaders, strong balance sheets, and that are

currently priced cheaply in the markets. As a result, we are confident to state clearly that our funds

offer significant absolute and relative long-term investment value to its aligned long-term fund

investors. Our investment objective is for the fund to deliver a long-term total return over full

market cycles to its long-term fund investors after all costs and inflation of 5% per annum or

better.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull-run continue?

Our bottom-up valuation informed work leads us to believe that leading global market indices

are overvalued at present, and that geopolitical risks are elevated, in our humble estimation. We

have absolutely no idea about the short-term direction of market indices, and we do not believe

that anyone else does either regardless of what they may think and say. We do know that we will

act accordingly depending on whatever unfolds in the future – whether the indices go up, sideways,

or down.

Which asset classes do you expect will give the best total rates of return over the next few

years?

We believe our selected fund equities will continue delivering the best total long-term rates of

return to our long-term fund investors, closely followed by our selected property equities.

Could you identify three shares that fall within your universe that you think will perform well

in the medium term?

We never know in advance which of the shares we own will do the best over any future time

frame, and we are not willing to pretend otherwise or mislead ourselves or anyone else. We would

caution the reader not to read into our public disclosures of individual fund holdings, as we are

completely focused on construction a sufficiently diversified portfolio of balanced opportunities

and risks.

As per our June 2024 fund MDD, which is public knowledge, our three largest fund exposures

to individual shares at that point in time were to Growthpoint, Emira and Remgro.

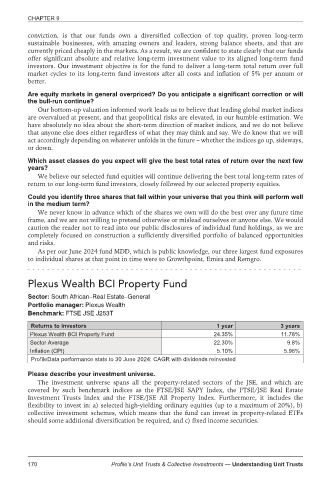

Plexus Wealth BCI Property Fund

Sector: South African–Real Estate–General

Portfolio manager: Plexus Wealth

Benchmark: FTSE JSE J253T

Returns to investors 1 year 3 years

Plexus Wealth BCI Property Fund 24.35% 11.78%

Sector Average 22.30% 9.8%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The investment universe spans all the property-related sectors of the JSE, and which are

covered by such benchmark indices as the FTSE/JSE SAPY Index, the FTSE/JSE Real Estate

Investment Trusts Index and the FTSE/JSE All Property Index. Furthermore, it includes the

flexibility to invest in: a) selected high-yielding ordinary equities (up to a maximum of 20%), b)

collective investment schemes, which means that the fund can invest in property-related ETFs

should some additional diversification be required, and c) fixed income securities.

170 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts